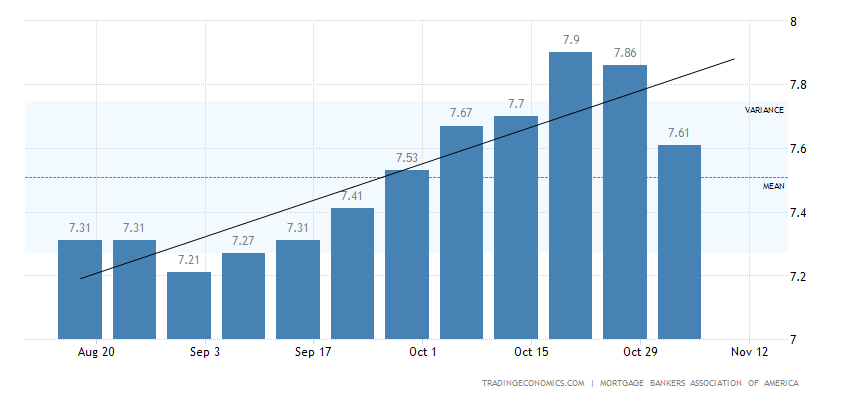

Lately, there’s been quite a tectonic shift in the world of mortgage rates, especially within the borders of the good old USA. The stage is set, and the curtain rises on the grand spectacle of finance! Picture this: the average interest rate on 30-year fixed-rate mortgages, tailored for those conforming loan balances (that’s the ones under $726,200), took a dip for the second week running, falling to a captivating 7.61% in the week that concluded on November 3rd, 2023. Now, you might not be an aficionado of interest rates, but that’s a noticeable change from the 7.86% of the previous week.

This drop is akin to a meteoric descent, the likes of which we haven’t seen in quite some time. Think of it as the equivalent of a magician pulling a rabbit out of his hat, except the rabbit is a lower mortgage rate. Abracadabra!

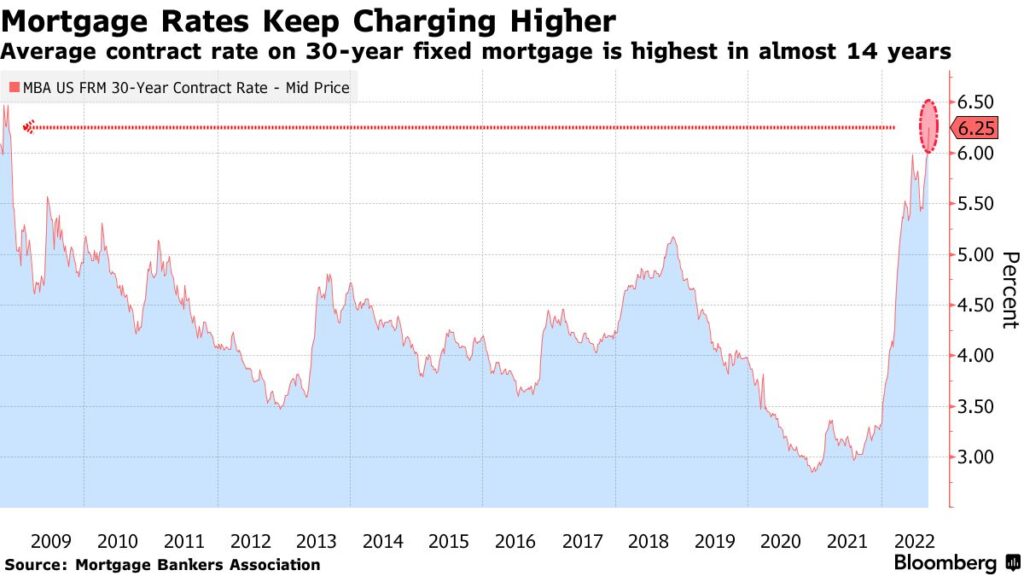

Now, you might be wondering, “What sorcery is behind this sudden drop?” Well, my dear readers, it’s a magical brew concocted by various elements. First, we’ve got changes in Treasury yields – think of those as the mystical runes of the financial world. Then, the Federal Reserve chimed in with a more dovish tone, like a gentle lullaby to calm the markets. Lastly, it turns out that government borrowing needs fell below our expectations, almost like a plot twist in a thrilling novel.

In summary, the mortgage rate landscape has morphed before our very eyes, and while it may not be as flashy as a wizard’s spell, it’s certainly a tale worth following. So, whether you’re a seasoned economist or just someone looking for a place to call home, these numbers hold a story that affects us all. Stay tuned for more twists and turns in the financial saga!

The Impact of Falling Mortgage Rates

The recent decline in mortgage rates is indeed significant. It is the largest drop we’ve witnessed since July 2022, with rates now standing at 7.61% for conforming loan balances. This development can be traced back to a cascade of events, including a shift in Treasury yields and a more accommodative stance from the Federal Reserve.

With the average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $726,200) also decreasing to 7.58% from 7.8%, it’s clear that these rate changes are not limited to a specific market segment. Even 30-year fixed-rate mortgages backed by the FHA saw their rates drop from 7.57% to 7.36%. This widespread phenomenon raises several questions and opportunities for potential homebuyers and existing homeowners looking to refinance.

Understanding the Mortgage Rate Dynamics

To make informed decisions in the current mortgage rate environment, it’s crucial to understand the dynamics at play. The term “Mortgage Rate” is not just a number; it reflects the state of the economy and financial markets.

Mortgage rates are intricately tied to Treasury yields, which are influenced by various economic factors. The recent decline in rates is linked to the Federal Reserve’s dovish tone, where they’ve signaled a willingness to keep interest rates low to support economic growth. Simultaneously, government borrowing needs have fallen below expectations, contributing to the decrease in Treasury yields. These developments have paved the way for the decrease in mortgage rates.

Advice for Homebuyers

For those considering purchasing a home in the current environment, the lowered mortgage rates provide a unique opportunity. The difference between a 7.86% rate and a 7.61% rate on a $500,000 mortgage is roughly $40,000 over the life of the loan. Hence, it’s essential to act promptly while these favorable conditions persist.

Here are some key pieces of advice for potential homebuyers:

- Shop Around: Given the dynamic nature of the mortgage market, it’s advisable to shop around for the best rates. Different lenders may offer varying rates and terms, so don’t settle for the first offer you receive.

- Consider Refinancing: If you are currently a homeowner, this is an opportune time to consider refinancing your existing mortgage. Lower rates can lead to substantial savings over the life of your loan.

- Lock Your Rate: Mortgage rates can fluctuate daily. Once you’ve found a favorable rate, consider locking it in to ensure that it remains unchanged throughout the closing process.

Impact on the Real Estate Market

The drop in mortgage rates has already started to impact the real estate market. As rates decrease, the affordability of homes increases, which can stimulate demand. This increased demand can, in turn, influence home prices. As more buyers enter the market due to lower rates, competition can drive prices up. Therefore, while low mortgage rates are beneficial for buyers in terms of affordability, it may also mean more competition in the housing market.

In addition, the pace of home sales may also increase due to these favorable rates, and this could lead to a more competitive environment for buyers. Sellers may have the upper hand in negotiations. This means that, as a buyer, it’s essential to be well-prepared, have your financing in order, and act swiftly when you find the right property.

Long-Term Considerations

While the current drop in mortgage rates is undeniably beneficial for those in the market for a new home or looking to refinance, it’s important to consider the long-term implications. The financial markets are dynamic, and rates can change rapidly.

It’s advisable to consult with a financial advisor or mortgage expert to assess whether the current rate environment aligns with your long-term financial goals. Mortgage decisions should not be made in isolation; they should be part of a comprehensive financial strategy.

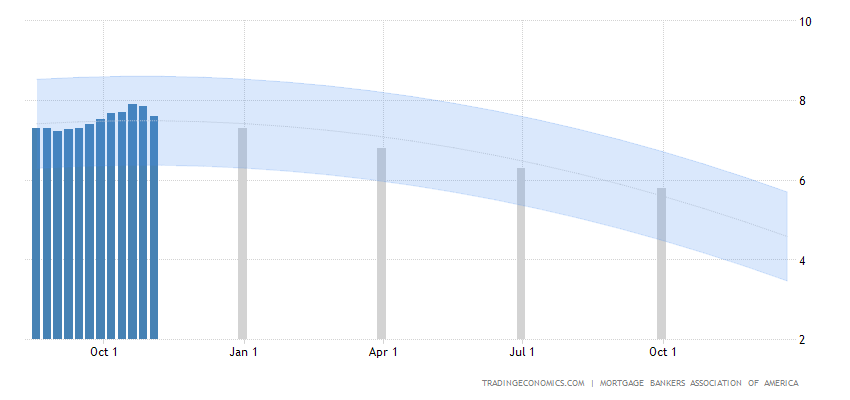

Future Mortgage Rate Projections

Mortgage rates are inherently unpredictable, and predicting their future movement can be challenging. However, it’s essential to keep an eye on economic indicators and government policies that can influence rates.

If the Federal Reserve maintains a dovish stance and economic growth remains steady, we may continue to see relatively low mortgage rates in the near term. However, geopolitical events, inflation, and fiscal policies can introduce uncertainty.

To stay informed about future rate developments, consider subscribing to financial news outlets, consulting with financial experts, and monitoring key indicators, such as Treasury yields and Federal Reserve statements.

Conclusion

In conclusion, the recent decline in mortgage rates, as highlighted by the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, offers a unique opportunity for potential homebuyers and existing homeowners. These rate changes are a reflection of various economic factors, including shifts in Treasury yields, the Federal Reserve’s policy stance, and government borrowing needs.

For those in the market for a new home, it’s advisable to act promptly, shop around for the best rates, and consider locking in a favorable rate. Existing homeowners should also explore the benefits of refinancing in this low-rate environment.

However, it’s important to approach mortgage decisions as part of a broader financial strategy and to remain vigilant about future rate developments. The mortgage market is dynamic, and rates can change rapidly, so staying informed is key to making sound financial decisions in the ever-evolving world of mortgage rates.

One thought on “Your Mortgage Rate Roadmap: Expert Insights and Strategies”