Introduction

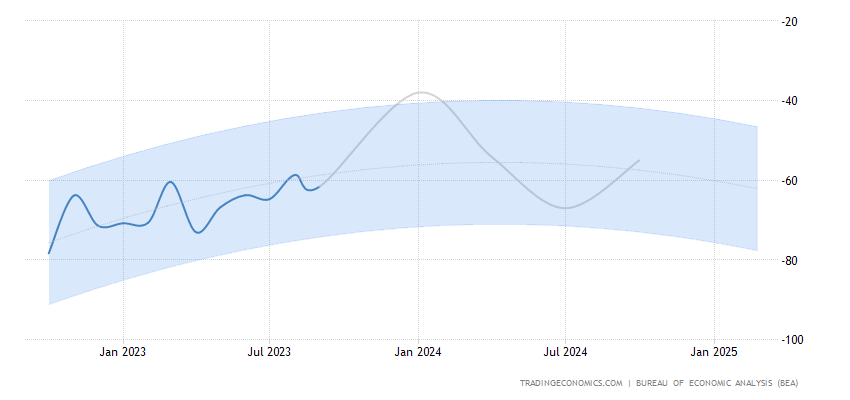

In September 2023, the US found itself grappling with a hefty trade deficit that swelled to a sizable $61.5 billion. This figure was quite the leap from the revised $58.7 billion gap seen just the month before in August. Remarkably, this overachievement raised eyebrows as it outpaced the earlier market predictions of a $59.9 billion deficit. Yet, let’s not lose sight of the bigger picture – this trade deficit is, in fact, the third smallest since 2021.

The sudden surge in this trade imbalance owes its dues to an undeniable surge in imports, which made an impressive 2.7% leap, landing at a staggering $322.7 billion. This happens to be the highest level of imports we’ve seen in the last seven months. The credit for this surge in imports goes to a wide array of sectors that experienced an uptick in sales: cell phones, household goods, passenger cars, crude oil, travel, computer accessories, civilian aircraft, and industrial machinery.

On the flip side, exports did make gains, albeit at a more measured pace, growing by 2.2%. In September, the total exports amassed to $261.1 billion, reaching levels unseen since August 2022. This uptick in exports found its champion in the sales of petroleum products, soybeans, crude oil, corn, travel, and transport.

What’s crucial here is to delve deeper into the driving forces behind these trends and, more importantly, ponder the implications they hold for the United States’ intricate trade landscape.

The Trade Deficit Dilemma

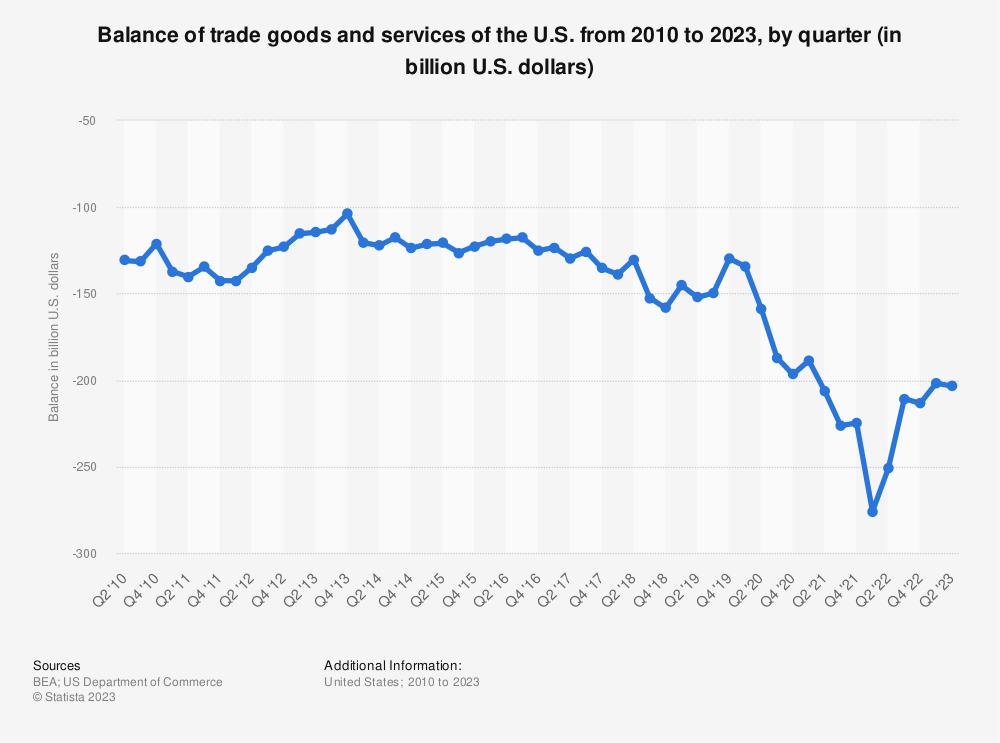

The widening of the deficit raises concerns and presents both challenges and opportunities for the country’s economy. To understand its significance, we must analyze the trade balance and its components more comprehensively.

Import Surge: Drivers and Consequences

The substantial increase in imports, driven by strong demand for a range of products, has both positive and negative implications. While the surge in imports is a sign of a robust domestic economy, it also highlights some vulnerabilities. The demand for cell phones, household goods, passenger cars, and crude oil indicates strong consumer spending and economic growth.

However, an excessive reliance on imports can weaken domestic industries and leave the US vulnerable to supply chain disruptions, as we’ve witnessed in recent times. To address these concerns, policymakers and businesses need to focus on domestic production and innovation to maintain a balanced trade profile.

Export Growth: Implications and Challenges

The growth in exports is a positive development, showcasing the competitiveness of American products on the global stage. This increase in exports has been primarily driven by the sale of petroleum products, soybeans, crude oil, and corn, indicating the resilience of the US agricultural and energy sectors.

Nonetheless, the pace of export growth has been slower than that of imports, which raises concerns about the trade deficit. Addressing this imbalance will require a concerted effort to expand export markets, reduce trade barriers, and enhance the quality of American products to meet global demand.

The Impact of Currency Exchange Rates

Currency exchange rates play a pivotal role in shaping the US trade balance. A stronger US dollar can make American goods more expensive for foreign buyers, potentially dampening exports. Conversely, a weaker dollar can boost exports by making US products more affordable internationally.

Therefore, it is essential to monitor exchange rates and understand their impact on the trade deficit. Investors and businesses should consider hedging strategies to mitigate currency risks in the volatile global market.

Trade Policies and Tariffs: A Balancing Act

Trade policies and tariffs are crucial determinants of the trade deficit. The US has implemented tariffs on various goods, with the intent of protecting domestic industries and addressing trade imbalances. However, it’s essential to strike a balance between protecting domestic industries and ensuring a competitive global trade environment.

The Role of International Relations

The landscape is not only shaped by domestic policies but is also influenced by international relations. Trade agreements and diplomatic efforts can open new markets for American goods and create opportunities for economic growth. Strengthening diplomatic ties and negotiating favorable trade agreements should be a priority for the US to bolster its export potential.

Investor Insights: Navigating the US Trade Landscape

For investors, understanding the dynamics of the deficit is crucial for making informed decisions. The trade deficit can impact various financial markets, including currency exchange, equity markets, and commodity prices. It’s important to diversify investments to mitigate risks associated with trade fluctuations.

Conclusion:

The widening of the deficit in September 2023 highlights the complexities and challenges faced by the nation’s economy. The surge in imports driven by strong consumer demand and the slower pace of export growth emphasize the need for a balanced trade policy.

To navigate the landscape successfully, it’s essential for businesses, policymakers, and investors to closely monitor currency exchange rates, trade policies, and international relations. By striking a balance between imports and exports, the US can strengthen its position in the global marketplace, fostering economic growth and stability.