Introduction: US stock signal

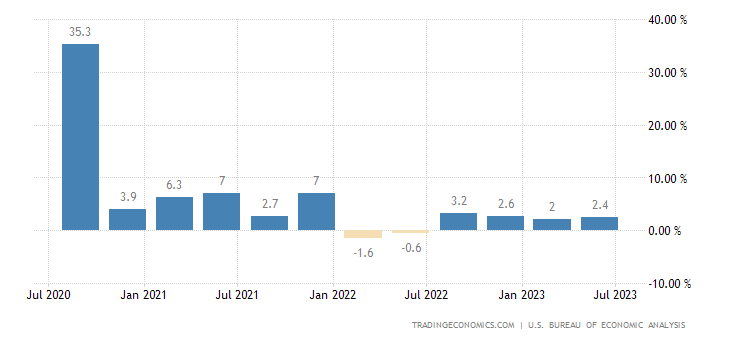

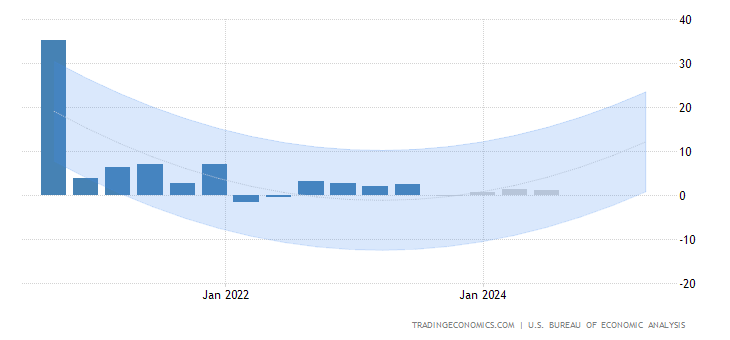

In the second quarter of 2023, the US economy demonstrated impressive resilience, expanding at an annualized rate of 2.4% quarter-on-quarter (QoQ). This growth surpassed market expectations, which had anticipated a more modest 1.8% increase. The advance estimate revealed significant developments in various sectors, painting a mixed picture of the nation’s economic health. As a financial expert, I will delve into the key indicators and their potential impact on the stock market. Notably, the surge in nonresidential fixed investment, a rebound in equipment and intellectual property products, and the stabilization of public expenditure will be explored, along with the challenges posed by a slowdown in consumer spending and the persistent decline in residential investment. By analyzing these factors, we can better understand the current state of the US economy and discern potential signals for investors in the stock market. US stock signal

Nonresidential Fixed Investment Fuels Economic Growth:

Nonresidential fixed investment emerged as a driving force behind the economy’s robust performance in Q2 2023. This crucial indicator saw a sharp acceleration of 7.7%, contrasting sharply with the mere 0.6% growth in the previous quarter. A noteworthy aspect was the impressive rebound in both equipment and intellectual property product investments. The former witnessed a notable increase of 10.8%, recovering from a disappointing -8.9% contraction. Likewise, intellectual property products rebounded to 3.9% growth from 3.1%. These developments indicate growing confidence among businesses, as they ramp up investments to meet the rising demands and capitalize on emerging opportunities.

Public Expenditure Moderates, Trade Balance Weighs Down:

On the flip side, public expenditure experienced a softer growth pace, expanding at 2.6% compared to the previous 5% increase. While this moderation might raise concerns about the government’s commitment to stimulus measures, it also implies a gradual return to fiscal discipline. However, the trade balance proved to be a drag on economic growth, subtracting 0.12 percentage points. This was primarily driven by a decline in exports, which plummeted by 10.8%, and a smaller decrease in imports, falling by 7.8%. The persistent uncertainty in global trade dynamics and supply chain disruptions could continue to pose challenges for the US trade balance and economic growth moving forward.

Consumer Spending Faces Headwinds:

Despite the overall positive economic performance, there were signs of strain on the consumer front. Consumer spending slowed significantly, registering a growth rate of 1.6% compared to the robust 4.2% seen in the previous period. Nevertheless, it is essential to note that this deceleration still exceeded market estimates, showcasing the American consumers’ continued resilience. Factors like easing inflation and a tight labor market played a role in cushioning the impact of reduced consumer spending. While goods consumption experienced a substantial slowdown, expanding only by 0.7% in contrast to the 6% growth in the past quarter, spending on services remained relatively strong, growing at 2.1% versus 3.2%.

The Persistent Decline in Residential Investment:

Residential investment continued to be a worrisome aspect of the economic landscape. The second quarter of 2023 saw a decline of 4.2%, marginally worse than the previous quarter’s 4% decrease. The ongoing challenges in the housing market, characterized by supply shortages and surging prices, have deterred potential buyers and hampered the growth of this vital sector. As the housing market plays a significant role in driving economic activity, this sustained decline raises concerns about the broader implications for economic growth. Policymakers and industry stakeholders must address the underlying issues to spur growth in residential investment and bolster the overall economic outlook. US stock signal

US Economy and Stock Market Signals:

The Q2 2023 economic data paints a complex picture of the US economy, with several indicators signaling potential opportunities and challenges for investors in the stock market. The robust growth in nonresidential fixed investment and the rebound of equipment and intellectual property products signify increasing business confidence and potential rewards for investors eyeing these sectors. Furthermore, the moderation in public expenditure could indicate a transition towards fiscal discipline, although investors will need to monitor government policies closely.

However, the slowdown in consumer spending and the continuous decline in residential investment demand attention. While consumer spending remained above market expectations, the underlying factors affecting it, such as inflation trends and labor market conditions, warrant careful observation. Additionally, the persistent slump in residential investment requires targeted measures to stabilize the housing market and reinvigorate this critical sector’s growth.

Conclusion: US stock signal

In conclusion, the US economy demonstrated commendable resilience and surpassed market expectations in the second quarter of 2023. The surge in nonresidential fixed investment and the rebound of equipment and intellectual property products highlight the nation’s growing business confidence. Nonetheless, challenges in consumer spending and the persistent decline in residential investment require close monitoring.

As an expert financial writer, I advise investors to closely examine these economic indicators and their potential implications for the stock market. Diversification and a prudent approach to risk management remain essential in navigating the complex economic landscape. By staying informed and adaptable, investors can identify potential opportunities while mitigating risks, aligning their portfolios with the dynamic trends shaping the US economy and the stock market.

Source: tradingeconomics.com

InMotion Hosting: InMotion Hosting offers fast and reliable hosting services with excellent customer support. They provide a variety of hosting options, including business hosting, VPS hosting, and dedicated servers.

HostGator: HostGator is known for its affordable plans and reliable performance. They offer unlimited storage and bandwidth, a variety of hosting options, and excellent customer support. [url=http://webward.pw/]http://webward.pw/[/url].

InMotion Hosting: InMotion Hosting offers fast and reliable hosting services with excellent customer support. They provide a variety of hosting options, including business hosting, VPS hosting, and dedicated servers.

HostGator: HostGator is known for its affordable plans and reliable performance. They offer unlimited storage and bandwidth, a variety of hosting options, and excellent customer support. [url=http://webward.pw/]http://webward.pw/[/url].

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.