Introduction

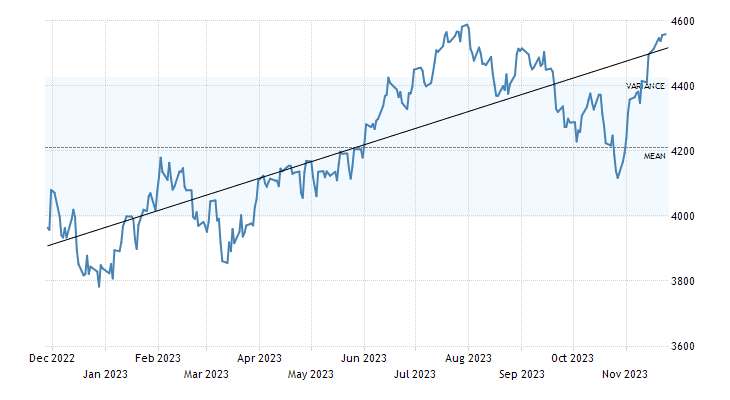

As the trading week commences, US stock futures display a measured retreat, a shift following a robust four-week ascent across the three primary indexes. Last week showcased notable movements: the Dow marked a 1.27% uptick, the S&P 500 secured a 1% gain, and the Nasdaq Composite ascended by 0.89%. The market landscape has been shaped by investors’ robust confidence that US interest rates have reached their zenith. However, recent indicators hint at the Federal Reserve’s rate hikes exerting tangible pressure on the broader economy, accentuated by lackluster consumer spending data. This sentiment is reinforced by the preliminary S&P Global PMIs presenting a mixed picture—a contraction in manufacturing against an accelerated pace in services. Keenly anticipated economic releases this week encompass new home sales, the latest Dallas Fed Manufacturing Survey, consumer confidence metrics, and crucial inflation figures.

In the realm of US stock futures, the current trajectory manifests a nuanced interplay of factors driving market sentiment and trajectory. Recent movements across major indexes reflect an intriguing narrative—a delicate balance between optimism and caution. The notable gains in the Dow, S&P 500, and Nasdaq Composite are emblematic of investors’ confidence in a plateauing of US interest rates, a belief that is increasingly under scrutiny amid signs of these hikes impacting consumer behavior and the broader economic landscape. The fluctuating sentiment further unfurls as preliminary data from S&P Global PMIs offer a mosaic of contrasting dynamics: while manufacturing showcases contraction beyond initial projections, the services sector portrays an accelerated growth trajectory.

Navigating this landscape of US stock futures necessitates a holistic understanding of the multifaceted variables impacting market movements. Investors keen on capitalizing on the market’s fluctuations must heed the subtle shifts in economic indicators and their reverberations across sectors. The confidence in US interest rates stabilizing has been a cornerstone of recent market buoyancy; yet, the tempered consumer spending and the nuanced PMI data underscore the importance of vigilance. This juncture demands a strategic approach, where investors stay attuned to upcoming economic data—such as new home sales, the Dallas Fed Manufacturing Survey, consumer confidence metrics, and pivotal inflation figures—as these will likely elucidate the trajectory of the markets in the immediate future.

In the context of US stock futures, astute investors are advised to adopt a prudent and diversified approach. The recent market movements, while emblematic of certain trends, also highlight the inherent volatility and complexity of the financial landscape. Acknowledging the nuanced interplay between macroeconomic indicators and market sentiment, investors are encouraged to diversify their portfolios, hedging against potential shifts in the market’s trajectory. A judicious approach involves balancing exposure across various sectors and asset classes, thus mitigating potential risks associated with specific market movements. Additionally, maintaining a long-term perspective amidst short-term fluctuations is pivotal, ensuring resilience and adaptability in navigating the evolving dynamics of US stock futures.

Conclusion

The dynamism within the realm of US stock futures underscores the importance of informed decision-making and strategic planning. As the market grapples with the implications of US interest rate hikes, investors must remain vigilant, leveraging insights from economic data releases and market indicators to inform their investment strategies. The recent gains across major indexes juxtaposed against nuanced economic signals demand a nuanced approach—one that balances optimism with caution. By maintaining a diversified portfolio, staying informed about economic indicators, and adopting a prudent, long-term perspective, investors can navigate the shifting terrain of US stock futures with resilience and confidence.

mexico drug stores pharmacies

https://cmqpharma.online/# mexican pharmaceuticals online

mexican pharmaceuticals online

buying prescription drugs in mexico: cmq pharma mexican pharmacy – mexico drug stores pharmacies

http://canadapharmast.com/# canadian neighbor pharmacy

mexican rx online: mexican pharmacy – mexico drug stores pharmacies

reputable mexican pharmacies online: mexican drugstore online – mexican pharmaceuticals online

india pharmacy п»їlegitimate online pharmacies india world pharmacy india

my canadian pharmacy: canadian pharmacy antibiotics – global pharmacy canada

https://foruspharma.com/# reputable mexican pharmacies online

mexican rx online buying from online mexican pharmacy medicine in mexico pharmacies

mexican border pharmacies shipping to usa: mexico drug stores pharmacies – mexico drug stores pharmacies

indian pharmacy online: reputable indian pharmacies – reputable indian pharmacies

http://indiapharmast.com/# top online pharmacy india

mexican pharmaceuticals online: mexican pharmacy – п»їbest mexican online pharmacies

buying prescription drugs in mexico online mexico pharmacy mexican border pharmacies shipping to usa

legitimate canadian online pharmacies: canada drugs online – canadian world pharmacy

http://indiapharmast.com/# best online pharmacy india

top online pharmacy india world pharmacy india india pharmacy mail order

purple pharmacy mexico price list: mexican border pharmacies shipping to usa – pharmacies in mexico that ship to usa

best canadian online pharmacy: safe canadian pharmacies – canadian pharmacy online store

buying prescription drugs in mexico online: pharmacies in mexico that ship to usa – mexico drug stores pharmacies

canadian medications cheap canadian pharmacy online the canadian drugstore

http://canadapharmast.com/# canadian drug

reputable canadian pharmacy: pharmacy in canada – legal canadian pharmacy online

mexican border pharmacies shipping to usa: mexican pharmacy – mexican drugstore online

https://indiapharmast.com/# indian pharmacy online

medication from mexico pharmacy mexican mail order pharmacies pharmacies in mexico that ship to usa

online shopping pharmacy india: Online medicine home delivery – top 10 pharmacies in india

medicine in mexico pharmacies: mexico pharmacy – mexico pharmacies prescription drugs

cheapest online pharmacy india: Online medicine order – indian pharmacies safe

https://canadapharmast.online/# canadianpharmacymeds com

mexico drug stores pharmacies best online pharmacies in mexico purple pharmacy mexico price list

mexican drugstore online: best online pharmacies in mexico – reputable mexican pharmacies online

http://foruspharma.com/# buying from online mexican pharmacy

paxlovid for sale: paxlovid covid – paxlovid pill

https://doxycyclinedelivery.pro/# doxycycline online pharmacy uk

average price of doxycycline: rx doxycycline – doxycycline hyclate

http://ciprodelivery.pro/# ciprofloxacin 500mg buy online

https://paxloviddelivery.pro/# paxlovid for sale

buy ciprofloxacin over the counter ciprofloxacin mail online ciprofloxacin mail online

http://paxloviddelivery.pro/# paxlovid price

drug doxycycline 100mg: best pharmacy online no prescription doxycycline – doxycycline 500mg

https://clomiddelivery.pro/# buy clomid without rx

http://clomiddelivery.pro/# clomid rx

can i get generic clomid without a prescription can i get cheap clomid tablets buying clomid without rx

https://doxycyclinedelivery.pro/# order doxycycline without prescription

pharmacy prices for doxycycline: 631311 doxycycline – doxycycline 400 mg price

https://paxloviddelivery.pro/# Paxlovid over the counter

http://clomiddelivery.pro/# where can i get cheap clomid without a prescription

paxlovid generic paxlovid pill Paxlovid buy online

https://paxloviddelivery.pro/# paxlovid cost without insurance

doxycycline cheap australia: doxycycline for sale – doxycycline 30

http://ciprodelivery.pro/# cipro ciprofloxacin

http://doxycyclinedelivery.pro/# where to buy doxycycline

doxycycline 250 mg tabs doxycycline over the counter australia doxycycline generic

http://doxycyclinedelivery.pro/# doxycycline capsules for sale

paxlovid covid: paxlovid cost without insurance – п»їpaxlovid

http://ciprodelivery.pro/# buy cipro

https://ciprodelivery.pro/# purchase cipro

http://paxloviddelivery.pro/# buy paxlovid online

purchase cipro cipro for sale cipro for sale