Introduction

In the ever-evolving world of finance, US stock futures have become a focal point for investors, traders, and analysts. The anticipation of the Federal Reserve’s impending policy decision looms large, casting a shadow over the market. Widely expected to maintain steady interest rates, this pivotal moment in the financial landscape sets the stage for a comprehensive examination of the intricate web that is the US stock futures market.

The Federal Reserve’s Decision

As US stock futures gently ebb and flow in the prelude to the Federal Reserve’s announcement, investors brace for impact. The anticipation is palpable as market participants analyze the potential consequences of the central bank’s latest policy decision. The prospect of interest rates held at their current levels adds an intriguing layer to this narrative, a notion that can sway the equilibrium of the stock market.

Yum China Holdings and Match Group: A Tale of Two Tumbles

In the labyrinthine realm of US stock futures, it is essential to scrutinize individual equities. Yum China Holdings, in extended trading, witnessed a precipitous 9% tumble. A disappointing third-quarter revenue miss sent ripples through the market, emphasizing the importance of timely corporate earnings reports. Simultaneously, Match Group’s stock value plummeted by 8%, courtesy of an unimpressive revenue guidance for the upcoming fourth quarter. These stark declines underscore the delicate balance between investor sentiment and financial performance.

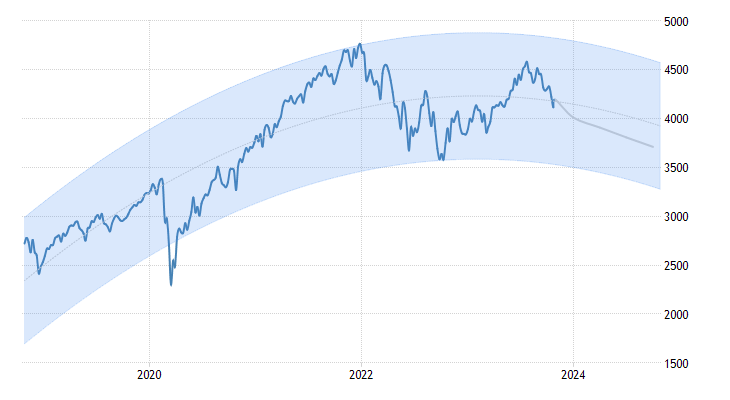

Market Performance and Sectors in Focus

Delving into the heart of US stock futures, the performance of major indices on the previous trading day paints a vivid picture. The Dow, with a commendable 0.38% rise, showcased its resilience. Meanwhile, the S&P 500 displayed a robust gain of 0.68%, while the Nasdaq Composite added 0.48% to its value. All 11 S&P sectors soared, with real estate, financials, and utilities leading the charge. The diverse sectors mirror the complex tapestry of the stock market and reveal its multifaceted nature.

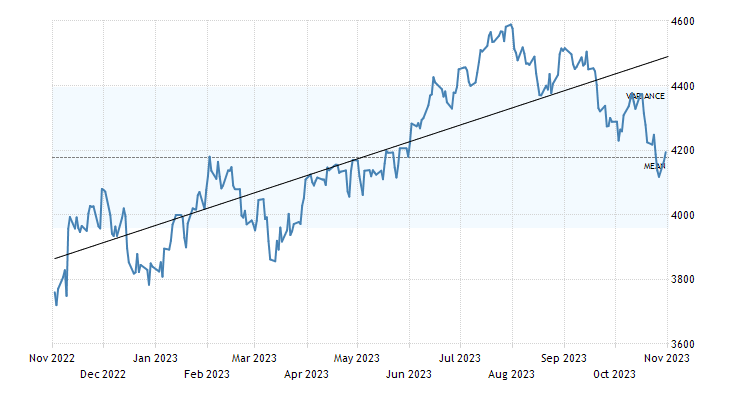

Analyzing the Recent Market Surge

US stock futures have embarked on a remarkable journey, ascending for two consecutive sessions. Traders attribute this surge to a technical rebound, an anticipated respite from oversold levels. However, underlying this upward momentum lies a continuous assessment of mixed corporate results, elevated Treasury yields, and broader economic uncertainties. These factors illustrate the intricate dance between market fundamentals and investor sentiment, which is vital for traders and investors to grasp.

Expert Insights and Advice

For investors navigating the turbulent waters of US stock futures, it is imperative to remain vigilant and well-informed. Keep a watchful eye on the Federal Reserve’s pronouncements, as they can sway the course of the market. Diversification of your portfolio is key, as witnessed in the varying sector performance of the S&P 500. Stay attuned to the subtle nuances of individual equities, as demonstrated by the contrasting fates of Yum China Holdings and Match Group. And remember, the recent market surge is a testament to the market’s resilience, but always consider the broader economic context in your investment decisions.

Conclusion

In the complex world of US stock futures, the Federal Reserve’s policy decisions, corporate earnings reports, and market performance are intertwined like threads in a grand tapestry. Understanding these intricate connections is the key to navigating this dynamic landscape successfully. As an expert financial writer, it is your duty to provide valuable insights and advice to your readers, helping them make informed decisions in their pursuit of financial success. Stay vigilant, embrace diversification, and remain adaptable to market fluctuations, for therein lies the path to enduring prosperity in the realm of US stock futures.