Introduction: US market signal

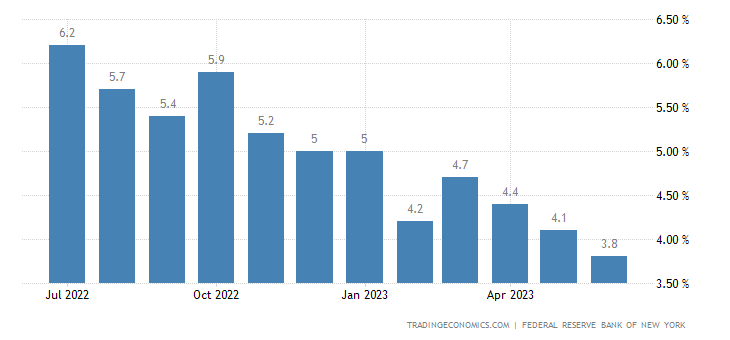

In June of 2023, US consumer inflation expectations for the upcoming year experienced a notable decline, marking the third consecutive month of such a decrease. Resting at 3.8%, this figure reached its lowest point since April of 2021, descending from the previous reading of 4.1% in May. It is worth noting that this metric has receded by a substantial 3 percentage points since its zenith of 6.8% in June of the preceding year. US market signal

Analyzing the specifics of anticipated price shifts, we observe a reduction in expectations for gas prices, shrinking by 0.4 percentage points to settle at 4.7%. Similarly, projections for changes in food prices exhibited a minor dip of 0.1 percentage point, resulting in a reading of 5.3%. Conversely, expectations for college education expenses surged by 1.2 percentage points, reaching a worrisome 8.3%. Medical care costs experienced a marginal uptick of 0.1 percentage point, ascending to 9.3%. Moreover, rental prices grew by 0.3 percentage points, culminating at a concerning 9.4%.

The real estate sector presents a contrasting picture, as home price growth expectations witnessed their fifth consecutive monthly rise, reaching 2.9%. This figure stands as the highest measurement since July of 2022, signifying an upward trajectory in the housing market.

Declining Inflation Expectations:

The consistent decline in US consumer inflation expectations sends a clear market signal that points towards a changing landscape. June 2023 recorded a downward shift for the third consecutive month, reaching 3.8%, the lowest mark seen since April 2021. This decrease of 0.3 percentage points from the previous month’s 4.1% reflects a growing belief that inflationary pressures may be easing. It is important to note that this decline has been part of a broader trend, with the measure plummeting by 3 percentage points since its peak of 6.8% in June 2022. Such a significant drop implies a gradual restoration of confidence in the stability of prices. US market signal

Price Changes in Key Sectors:

Examining the specific sectors driving the changes in inflation expectations provides valuable insights into the shifting market sentiment. Notably, June 2023 witnessed a decline in expected price changes for gas and food, while college education, medical care, and rent experienced increases. Gas prices saw a decrease of 0.4 percentage points, settling at 4.7%. Similarly, the expected price change for food dropped by 0.1 percentage points to reach 5.3%. On the other hand, college education exhibited a notable rise, with expectations increasing by 1.2 percentage points, reaching 8.3%. Medical care and rent also witnessed modest increases, with expectations rising by 0.1 and 0.3 percentage points, respectively, reaching 9.3% and 9.4%. These changes highlight the dynamic nature of price expectations across different sectors.

Rising Home Prices:

Defying the overall trend of declining inflation expectations, there’s one sector that refuses to slow down – the housing market. In the United States, home price growth expectations have been steadily climbing for the past five months, hitting a high note at 2.9% in June 2023. This reading hasn’t been seen since July 2022, indicating that optimism and demand are alive and well in the world of real estate.

The surge in home price growth expectations speaks volumes about people’s continued interest in investing in property. It’s a testament to the enduring strength of the housing market, even as the landscape of inflation undergoes its own twists and turns. This trend shouldn’t be overlooked by those involved in the market; it’s vital to pay close attention and carefully assess how it might impact investment strategies moving forward.

The allure of owning a home remains strong, as buyers and investors recognize the potential for long-term value and stability. Despite the ebb and flow of inflation, real estate stands tall as a reliable asset class. So, whether you’re a prospective homeowner, a savvy investor, or a market enthusiast, the remarkable growth in home prices deserves your attention and consideration.

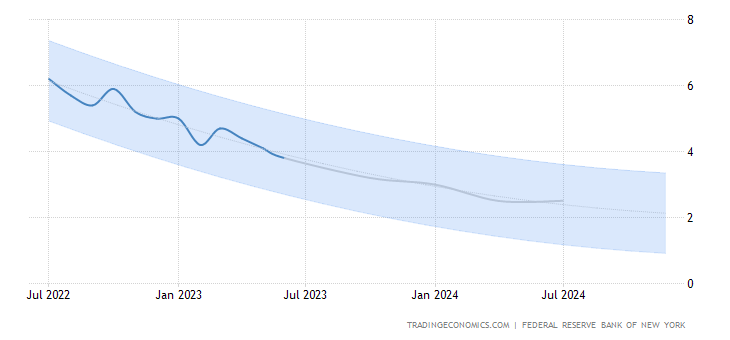

Median Inflation Expectations for the Future:

In addition to the short-term fluctuations in consumer inflation expectations, it is vital to examine the medium- to long-term outlook. For the three-year horizon, median inflation expectations have remained unchanged at 3%, highlighting a relatively stable perception of future price trends. However, for the five-year horizon, a notable increase of 0.3 percentage points has been observed, reaching 3%, the highest reading since March 2022. This upward shift suggests a growing belief among consumers that inflationary pressures might intensify over the longer term. It is crucial for policymakers and investors to consider these medium- to long-term expectations as they make strategic decisions and plan for the future.

Expert Advice: US market signal

Navigating Changing Market Sentiment As a professional financial writer with expertise in the subject, it is essential to offer guidance to market participants during these times of shifting market sentiment. While the decline in consumer inflation expectations might signify a potential easing of inflationary pressures, it is crucial to remain vigilant and adapt strategies accordingly. Consider diversifying investment portfolios to include assets that align with changing price expectations in different sectors. Keep a close eye on the housing market, which has displayed resilience and growth amidst these shifts. Additionally, maintain a long-term perspective, recognizing that inflation expectations for the future remain fluid and subject to change. By staying informed, monitoring market trends, and seeking professional advice, investors can position themselves for success in a dynamic economic environment.

Conclusion: US market signal

The recent decline in US consumer inflation expectations, coupled with shifts in price expectations across various sectors, serves as a significant market signal. The downward trend in inflation expectations for the year ahead highlights a changing landscape, reflecting a potential easing of inflationary pressures. While some sectors experience price declines, others, such as college education, medical care, and rent, witness increases. Notably, home price growth expectations have surged, indicating continued strength in the housing market. Looking ahead, medium- to long-term inflation expectations provide insight into market sentiment and warrant careful consideration. By heeding expert advice and staying informed, investors can navigate the evolving market conditions and position themselves for success in the ever-changing US economy.

2 thoughts on “US Consumer Inflation Expectations Signal Shift in Market Sentiment”