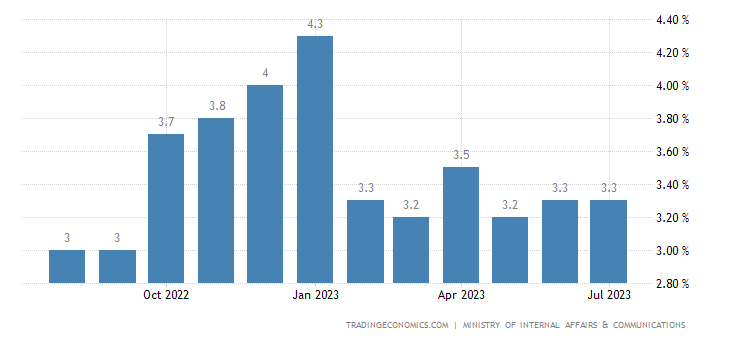

Amidst the ebb and flow of global economic tides, Japan’s economic landscape stands as a canvas of intrigue, painted with the hues of inflation. July 2023 brought forth a symphony of statistics, unveiling a robust annual inflation rate that remained steady at 3.3%, akin to a ship steadfast against turbulent currents. This figure, however, bore a defiant stance against market predictions, standing notably higher than the anticipated 2.5%. A curtain-raiser to the financial opera, these numbers reveal a story of price surges across diverse sectors. Japan stock signals

Diving into the specifics, the price indices play out like a sonnet, each note contributing to the crescendo of inflation. The chorus of ascending prices resonates prominently in sectors like food, whose melody danced at 8.8%, housing nestled at 1.1%, and transport with a steady rhythm at 2.2%. The minuet of escalating prices continued, embellishing itself upon furniture & household utensils at 8.4%, clothes at 4.1%, medical care at 2.2%, education at 1.3%, culture & recreation at 4.8%, and finally, a finishing note of 1.2% for miscellaneous expenses.

In this complex choreography of economic elements, fuel, light, and water charges staged their own pas de deux, diminishing for the sixth consecutive month. The downward spiral of -9.6%, compared to the earlier -6.6%, drew its essence primarily from the realm of electricity, which plummeted to -16.6% from its preceding -12.4%. Amidst this intricate ballet, core inflation emerged as a leading soloist, waltzing to a 4-month nadir of 3.1% in July, a graceful dip from June’s 3.3%. This harmonious yet discordant interplay continues to sing the saga of the Bank of Japan’s elusive 2% target, which remains a distant dream for the sixteenth month.

Zooming into the narrative at a finer lens, the rhythm of a month’s heartbeat becomes evident. In a resonating pulse, consumer prices witnessed a 0.4% surge, a crescendo unseen in the past three months. A stark departure from June’s 0.2% stride, this rhythm captures the pulse of consumer sentiments, as wallets open and expenditures surge in the summer heat. Japan stock signals

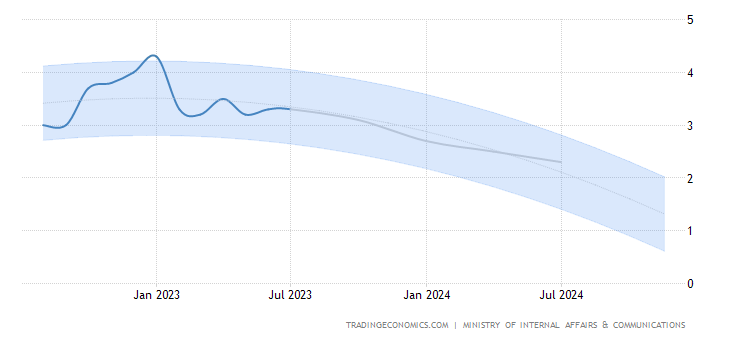

Now, in the theater of financial markets, a related melody of stock signals beckons investors. Amidst the crescendo of inflation, the stock market signals echo with both harmony and dissonance. The resonance lies in the realization that inflation, albeit seemingly contrary, can indicate economic vigor and growth. As prices rise, so do revenues for companies, painting a hopeful backdrop for stockholders. However, this opera also has its discordant notes. Escalating inflation might herald the conductor of higher interest rates, a symphony that can dampen corporate borrowing and consumer spending, thus orchestrating a market retreat.

In the midst of these intertwined symphonies, the SEO keyword “Japan stock signal” resounds as a thematic motif. Traders and investors, ever attentive to the melodies of the market, seek to decode these signals, a fusion of financial algorithms and human intuition. The current crescendo of inflation, in particular, wields its influence over these signals. As inflation climbs, so do expectations for corporate earnings. Savvy market players keep a watchful eye on how companies maneuver within this complex orchestration, aiming to seize the crescendos and navigate the dissonances.

To capture these melodies and reflect them in portfolio strategies, the sage advice is to embrace versatility. As the pendulum of inflation swings, diversification becomes a sturdy compass. Beyond that, astute investors immerse themselves in the financial libretto, reading between the lines of economic reports and central bank statements. The Japan stock signal, pulsating within this financial symphony, requires a nuanced understanding—a fusion of the quantitative and the qualitative, a dance between statistical models and the artistry of market sentiment. Japan stock signals

In conclusion, Japan’s inflation narrative is a multifaceted epic, painting a canvas where prices sway and stock signals resonate. July 2023’s inflation performance, resolute at 3.3%, echoes against the corridors of forecasted expectations, while diverse sectors contribute to this financial opera. Amidst this symphonic dance, stock signals flutter as leaves in the wind, shaped by inflation’s gusts. The melody of economic growth harmonizes with the discord of potential interest rate hikes. In this intricate symphony, investors grasp for the elusive “Japan stock signal,” bridging the gap between algorithmic precision and human market intuition. As the financial opera plays on, those who master its rhythms stand to take center stage.