Introduction:

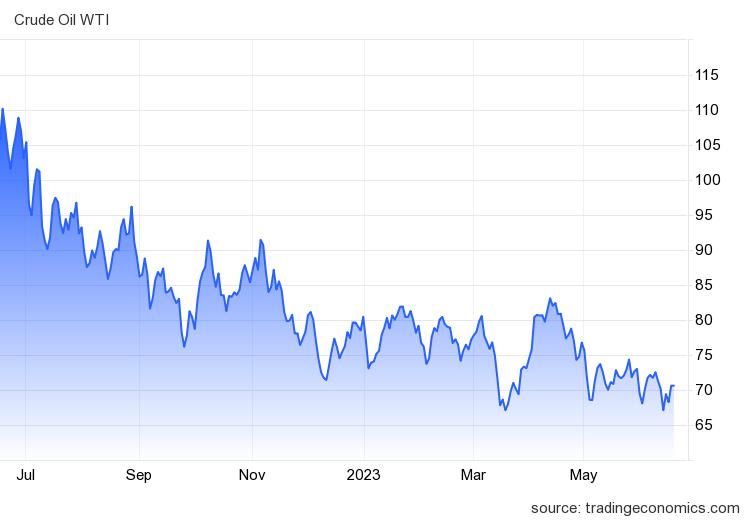

The remarkable surge of WTI crude futures above $70 per barrel has captivated market participants, driven by a convergence of factors and reinforced by a powerful oil trade signal. Notably, interest rate cuts in China and a temporary pause in the US Federal Reserve’s tightening campaign have bolstered the demand outlook, amplifying the oil trade signal. The International Energy Agency (IEA) predicts a massive 6% increase in worldwide oil calls for 2022 and 2028, similarly validating the superb alternate signal. Moreover, the recent depreciation of the dollar has stimulated oil markets, creating favorable trade signals and enhancing investment prospects. Nevertheless, amidst these promising signals, prudent investors remain vigilant due to prevailing economic uncertainties, including weak Chinese economic data and potential interest rate hikes by major central banks. In this comprehensive guide, our expert analysis and advice illuminate the path to navigating the intricacies of the oil market, effectively interpreting trade signals, and capitalizing on profit potential.

Factors Driving the Rally in WTI Crude Futures and Trade Signals

The surge in WTI crude futures is underpinned by compelling factors that generate robust oil trade signals. The interest rate cuts in China act as a catalyst, fostering economic growth and generating a bullish trade signal in the oil market. Additionally, the temporary pause in the US Federal Reserve’s tightening campaign bolsters investor confidence, reinforcing the trade signal for WTI crude futures. Prudent investors closely monitor these factors and seize the opportunity to capitalize on trade signals generated by these critical developments.

Projected Rise in Global Oil Demand: Insights and Trade Signals

The IEA’s projection of a substantial 6% increase in global oil demand between 2022 and 2028 provides valuable insights and reinforces the oil trade signal. This projected rise in demand signals a positive growth trajectory for the global economy and emphasizes the potential for profitable oil trades. Savvy investors capitalize on this trade signal by strategically positioning themselves to benefit from the anticipated surge in oil demand during the projected timeframe.

Leveraging Currency Dynamics: Oil Trade Signal Amplified

The recent depreciation of the dollar amplifies the oil trade signal, creating a favorable environment for investors. As the dollar weakens, oil becomes more attractively priced for holders of other currencies, enhancing the trade signal for WTI crude futures. Astute traders keenly analyze these currency dynamics and effectively leverage the oil trade signals generated by the weakening dollar.

Prudent Risk Management in the Face of Economic Uncertainties

While the oil trade signal indicates promising opportunities, it is crucial to exercise prudent risk management amidst economic uncertainties. Weak Chinese economic data and potential interest rate hikes by major central banks introduce elements of uncertainty that require careful consideration. By implementing robust risk management strategies, such as setting stop-loss orders, diversifying portfolios, and staying informed, investors can mitigate potential risks and position themselves to make well-informed trading decisions based on reliable trade signals.

Conclusion

In conclusion, the surge of WTI crude futures above $70 per barrel, fueled by interest rate cuts, the US Federal Reserve’s pause, and the IEA’s projection of rising global oil demand, generates powerful trade signals. The weakening dollar further amplifies these trade signals, creating a favorable environment for oil trading. However, prudent risk management remains paramount amidst economic uncertainties. By diligently analyzing oil trade signals, staying informed about economic developments, and employing sound risk management strategies, investors can optimize their profit potential and navigate the complexities of the oil market with confidence.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I have recently started a site, the info you provide on this website has helped me greatly. Thanks for all of your time & work.