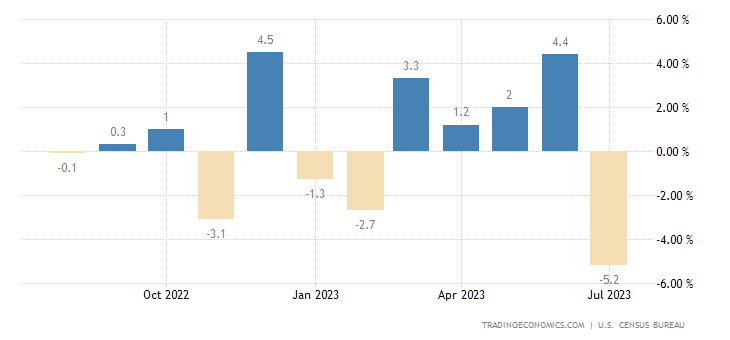

In the ever-shifting landscape of the American economy, the sudden tumble in new orders for manufactured durable goods in July 2023 has sent shockwaves through financial corridors. A precipitous decline of 5.2% followed June’s downwardly revised growth of 4.4%, catching many off-guard, as it surpassed market expectations of a milder 4.0% contraction. This downturn, the steepest since the aftermath of the April 2020 COVID-19 outbreak, is nothing short of a pivotal moment, suggesting multifaceted shifts in market dynamics and consumer preferences. US stock signal

The epicenter of this nosedive can be traced to the faltering demand for transport equipment. After an impressive streak of four consecutive months of expansion, orders for transport equipment plummeted by 14.3%, leaving industry experts scratching their heads. Specifically, both civilian aircraft, witnessing a dramatic decline of -43.6% as compared to June’s 71.1% surge, and defense aircraft, facing a notable setback of -10.9% versus a modest 2.0%, bore the brunt of this unprecedented slump.

However, the impact was not confined to the skies; the tech sector also felt the tremors. Orders for computers and electronic products backpedaled marginally at -0.1%, diverging from the 1.2% rise in the preceding month. Meanwhile, there was a silver lining in the storm cloud: machinery orders, after languishing at -0.6%, regained their footing with a commendable 1.1% upswing. Electrical equipment, appliances, and components mirrored this positive trend, experiencing an encouraging 1.0% growth as opposed to the prior 0.4%. Likewise, fabricated metal products and primary metals managed to stay afloat with a slight 0.7% and 0.1% rise, respectively.

A spotlight on the closely observed metric of non-defense capital goods excluding aircraft reveals a modest 0.1% uptick in July. This slight surge in the realm of business spending plans could potentially serve as a beacon of hope amid the otherwise grim panorama of declining figures.

As investors and market analysts grapple with these bewildering developments, a pertinent question emerges: What ripple effects could this plunge in durable goods orders have on the broader financial sphere, particularly in relation to the US stock signal? The abruptness of this decline underscores the intricacies of market sentiment, with the potential to stir fluctuations in stock trajectories, especially for companies closely tied to the manufacturing and aviation sectors.

The term “US stock signal” now reverberates with renewed significance. The market, like a complex organism, responds to a multitude of factors beyond its core. The durable goods debacle casts a shadow on the perceived health of the economy, raising concerns about weakening consumer demand and wavering investor confidence. These anxieties might translate into an ebb and flow in stock prices, prompting investors to reevaluate their portfolios in light of these unforeseen circumstances.

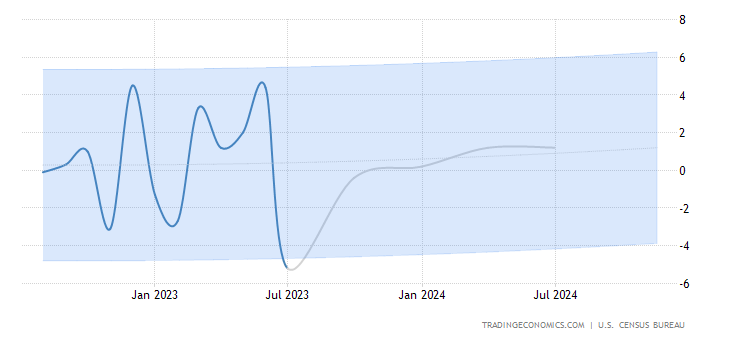

In times of such tumultuous market dynamics, historical context serves as an invaluable compass. The closest point of comparison lies in the aftermath of the COVID-19 outbreak in April 2020, when the echoes of uncertainty resonated far and wide. In a somewhat reminiscent fashion, the July 2023 decline sends shockwaves akin to those experienced during that time of global crisis, albeit within a more constrained scope. It is imperative to dissect the intricate parallels and distinctions between these two events to gauge the potential extent of the repercussions.

Durable goods orders were significantly impacted by the abrupt decline in demand for transport equipment, which saw a staggering 14.3% decrease. The previously upward trajectory of transport equipment orders was abruptly halted by this unforeseen drop, marking a drastic departure from the four consecutive months of growth the sector had experienced prior.

While the aviation industry has grappled with the whiplash of volatile consumer sentiments, the technology sector has navigated a separate trajectory. Computers and electronic products encountered a marginal setback, retreating by -0.1% as compared to June’s modest 1.2% upswing. This contrast in performance underscores the diversification of the impact across sectors and raises pertinent questions about the intricate interplay of market forces.

The ramifications of the July 2023 durable goods plunge ripple beyond immediate industry borders. For instance, the US stock signal, a pivotal beacon for investors, might sway in response to this upheaval. As market sentiment wavers in the face of this decline, companies entrenched in the manufacturing and aviation sectors could experience notable fluctuations in their stock trajectories.

The intrigue deepens as we examine the relationship between the recent decline and its predecessor in the aftermath of the COVID-19 outbreak. In both instances, uncertainty clouded the economic horizon, albeit with differing magnitudes and triggers. The aftermath of the pandemic saw a far-reaching impact, shaking foundations across industries, whereas the July 2023 event, though sharp, is a more contained tremor with distinct causal underpinnings.

A comparison between the current decline and the aftermath of the COVID-19 outbreak in April 2020 reveals intriguing parallels. In both cases, consumer confidence was significantly affected, leading to pronounced shifts in spending behavior and, consequently, in market dynamics.

It is within this tumultuous climate that the concept of a “US stock signal” takes on renewed importance. Investors, often navigating turbulent waters, seek indicators to guide their decisions. The durability of goods orders, a reliable marker of economic health, plays an instrumental role in shaping these signals. The recent decline casts a shadow on this signal, raising questions about its reliability in times of unforeseen economic shocks.

In the intricate dance of market forces, historical context holds paramount importance. Drawing parallels between the current decline and the aftermath of the COVID-19 outbreak offers insights into the potential trajectory of market sentiment. While the extent of the impact might differ, the echoes of uncertainty bear striking resemblance, serving as a stark reminder that the global economy remains susceptible to unforeseen upheavals.

Conclusion: US stock signal

In the labyrinthine world of finance, where uncertainty is the only constant, the July 2023 plunge in US durable goods orders resonates as a testament to the intricate ballet of market dynamics. The sudden decline, characterized by its nuances and sectoral divergences, amplifies the role of the US stock signal as an indicator of economic resilience. As investors scrutinize the aftermath and its potential reverberations, it becomes evident that even the most robust signals can falter in the face of unforeseen disruptions. The road ahead, while riddled with uncertainty, also presents opportunities for astute investors to navigate the undulating waves with a keen eye on the ever-evolving narrative of the market.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.