Introduction: China PMI

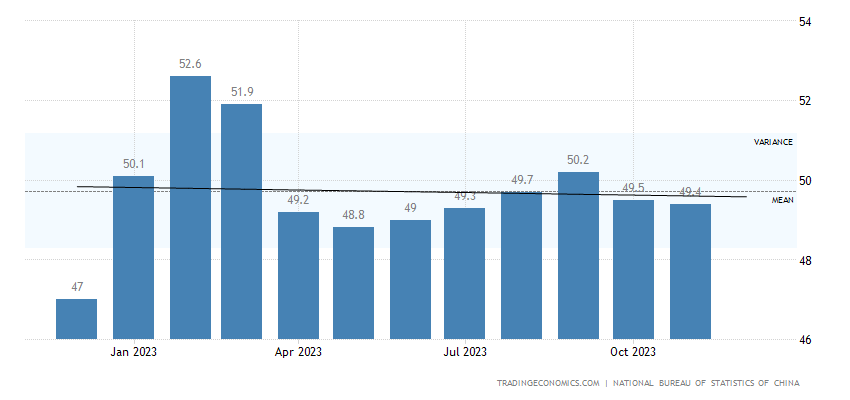

In November 2023, China’s official NBS Manufacturing PMI took a slight dip, sliding from October’s 49.5 to 49.4, marking a decline beneath market expectations of 49.7. This trend, now in its second consecutive month, illuminates a critical need for increased governmental support to bolster the country’s economic growth. China PMI

Specifically, several key metrics within the PMI demonstrate noteworthy shifts. New orders exhibited a swifter contraction, dropping from 49.5 in October to 49.4, while foreign sales experienced their most significant decline in four months, descending from 46.8 to 46.3. Notably, output growth hit its lowest point since July, recording 50.7 against October’s 50.9, concurrent with a continued decrease in employment figures, reaching 48.1 compared to 48.0 in the previous month.

Simultaneously, procurement levels experienced a three-month low, declining from 49.8 to 49.6, albeit a marginal change. The delivery time, however, witnessed a slight improvement, shortening from 50.2 to 50.3, indicating potential efficiency enhancements within the production cycle.

On the cost front, input price inflation showed a marked easing, hitting a five-month low at 50.7 versus the prior month’s 52.6. Interestingly, despite this, output prices continued their downward trend for the second consecutive month, registering 48.2 compared to 47.7, albeit at a slower rate.

Amidst these fluctuations, an encouraging trend emerged in business sentiment, which surged to its highest level since February, reaching 55.8 against the previous month’s 55.6. This uptick could signify growing confidence among industry players, possibly signaling brighter prospects ahead.

The implications of these PMI movements are substantial, demanding a keen focus on strategies to stabilize the manufacturing sector. Government intervention, including targeted policies to boost domestic demand, enhance export competitiveness, and stimulate employment growth, stands crucial in reviving the economy.

Additionally, fostering innovation, investing in technological advancements, and promoting sustainable practices within manufacturing could augment resilience against market fluctuations. Moreover, fostering stronger international partnerships and trade relations could aid in mitigating the impact of declining foreign sales.

Conclusion:

In conclusion, while November’s PMI figures reflect certain concerning trends in China’s manufacturing landscape, they also hint at potential avenues for improvement. A comprehensive approach, integrating both short-term interventions and long-term structural reforms, remains imperative to steer the sector toward sustainable growth and resilience in the face of evolving economic dynamics.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.