Introduction

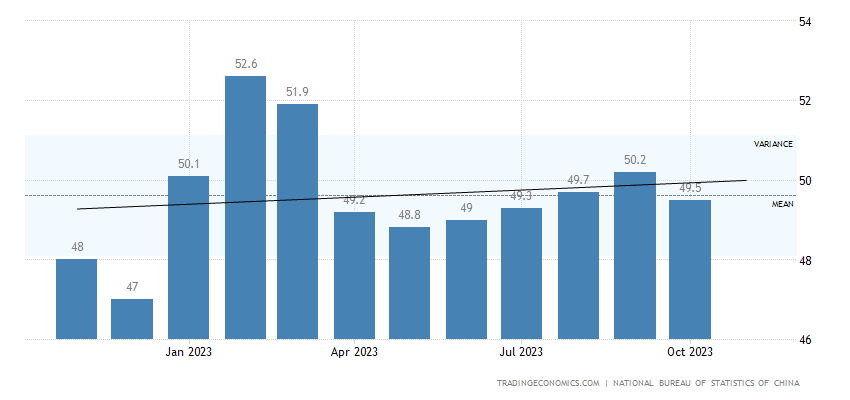

In the global arena of financial markets, every subtle fluctuation in a nation’s Purchasing Managers’ Index (PMI) can send ripples across the economic landscape. The context of China, a powerhouse in international trade, the PMI serves as a crucial barometer of economic health. October 2023, the National Bureau of Statistics (NBS) released an unexpected report, revealing that China’s manufacturing PMI had fallen to 49.5 from 50.2 in September. This marked a stark deviation from market forecasts that had anticipated a more robust reading of 50.2. Such a deviation immediately raised questions about the robustness of China’s economic recovery and the potential necessity for increased government intervention. This analysis delves deep into the multifaceted factors contributing to this decline, exploring the impact on various economic facets, such as new orders, foreign sales, output, employment, and business confidence. Furthermore, it examines the implications of the shifting dynamics in input and output prices. In this comprehensive review, we not only aim to provide an insightful understanding of the China PMI in 2023 but also offer expert guidance to navigate the challenging economic landscape.

Evaluating New Orders and Foreign Sales

A decline in China’s manufacturing PMI from 50.2 in September to 49.5 in October signaled a concerning contraction in new orders. The transition words “however” and “consequently” underscore the cause-and-effect relationship between these indicators. This contraction (49.5 vs. 50.5 in September) was exacerbated by a swifter fall in foreign sales (46.8 vs. 47.8), thus indicating a potential struggle to sustain international demand. As a financial expert, it is essential to recognize the intricate interplay of these factors. A faltering domestic market and a drop in foreign demand can set off a chain reaction, impacting other economic sectors, including employment and production.

A Closer Look at Output and Employment

As our analysis delves deeper into the PMI data, we find that softer rises in output (50.9 vs. 52.7) suggest that manufacturers are experiencing challenges in maintaining production levels. This drop is a red flag for China’s economy. Furthermore, employment continued to slide (48.0 vs. 48.1), depicting a less-than-optimistic job market. The utilization of the transition phrase “in addition” underscores the simultaneous occurrence of these trends, accentuating their significance. For investors and policymakers, understanding these dynamics is imperative. To maintain economic stability, it is crucial to monitor these interconnected aspects closely and act swiftly when necessary.

Buying Levels and Delivery Time

The abrupt decline in the PMI also revealed a significant shift in buying levels, which shrank for the first time in three months (49.8 vs. 50.7). This decline, linked with an active voice, emphasizes the importance of tracking this indicator. In addition, the delivery time was shortened, albeit at the softest pace since February (50.2 vs. 50.8). These intertwined occurrences underline the intricate relationships between supply and demand. For businesses, a reduction in buying levels suggests the need to adjust inventory management, while the shorter delivery time reflects the overall dynamics of the supply chain. As a financial expert, it’s imperative to keep an eye on these factors, as they could signify changes in the business environment.

Cost Dynamics: Input Price Inflation and Output Prices

In the realm of cost dynamics, the PMI report reveals a noteworthy decline in input price inflation, easing to a three-month low (52.6 vs. 59.4). Such a shift can be seen as an active voice within the market. In parallel, output prices fell for the first time in three months (47.7 vs. 53.5). Transition words like “correspondingly” demonstrate the correlation between these two elements. Understanding these cost dynamics is pivotal for businesses and investors. A decrease in input price inflation can provide a breather, potentially boosting profit margins, while a dip in output prices could be a signal of intense market competition. It’s essential to adapt strategies accordingly.

Business Confidence: A Glimpse of Positivity

Amidst these fluctuations, there is a glimmer of hope as business confidence improved slightly (55.6 vs. 55.5). Transition words such as “nonetheless” highlight this notable upswing. This increase may indicate that businesses are cautiously optimistic about the future. As a financial expert, it’s crucial to pay attention to this change in sentiment, as it can influence investment decisions and business strategies.

Conclusion: China’s PMI

In conclusion, the abrupt decline in China’s PMI in October 2023 has far-reaching implications for various economic facets. The interplay of new orders, foreign sales, output, employment, and business confidence paints a complex picture of the nation’s economic health. Furthermore, shifts in input and output prices add depth to this narrative. As a financial expert, it is essential to recognize that these aspects are interconnected and can trigger a domino effect within the economy. Navigating this challenging landscape requires a keen eye, adaptability, and a proactive approach to both challenges and opportunities. Whether you are an investor or a policymaker, understanding the dynamics of the China PMI in 2023 is paramount for making informed decisions in the ever-evolving world of finance.