Introduction: China stock signal

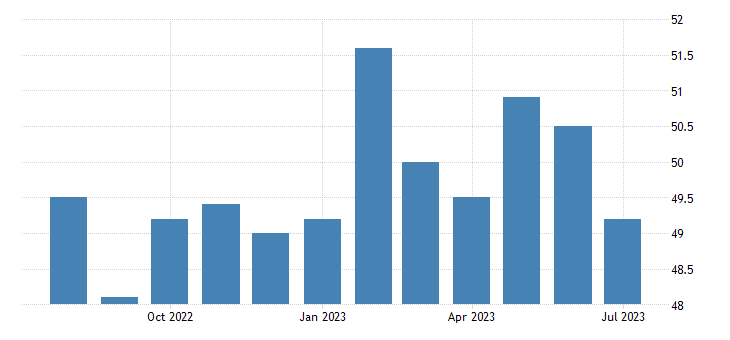

In July 2023, the Caixin China General Manufacturing Purchasing Managers’ Index (PMI) fell to a six-month low, recording a value of 49.2, down from the previous month’s 50.5. These numbers were dishearteningly below market expectations of 50.3, and they ominously signified the first decline in factory activity since April. As a professional financial writer, I delve into the implications of this significant event to decipher the China stock signal that might be lurking beneath the surface.

Understanding the Caixin China General Manufacturing PMI:

The Caixin China General Manufacturing PMI is a vital economic indicator, serving as a barometer for the overall health of the Chinese manufacturing sector. This index is based on surveys of purchasing managers from a wide range of manufacturing companies, reflecting their sentiments towards key factors such as new orders, production levels, employment, supplier deliveries, and inventories. The value of the PMI is crucial; it indicates whether the manufacturing sector is expanding (above 50) or contracting (below 50).

Interpreting the Six-Month Low:

The recent plunge in the Caixin China General Manufacturing PMI to 49.2 raises several concerns and implications for the Chinese economy and global financial markets. The sudden decline in factory activity suggests potential headwinds for China’s economic growth, which may ripple through various sectors and international trade relationships. As an expert financial writer, it is crucial to delve into the root causes of this downturn and investigate its effects on investor sentiment, particularly with regard to the China stock signal.

Factors Contributing to the Downturn:

Several factors might have contributed to the recent PMI downturn. The ongoing supply chain disruptions, coupled with the resurgence of COVID-19 cases in certain regions, could have hampered manufacturing activities. Moreover, the government’s measures to control inflation and manage debt levels may have also impacted business operations and investment decisions, leading to a drop in factory activity. Understanding these factors will aid investors in gauging the potential duration and severity of the current economic slowdown and its influence on the China stock signal.

Analyzing Investor Sentiment:

As we dig into the implications of the PMI’s decline, it’s evident that investors are likely to feel cautious about their exposure to Chinese stocks. The weakening manufacturing sector might cause corporate earnings to take a hit, and that could lead to a downturn in stock prices. Hey, folks, as a financial writer who’s got your back, I want to remind you how crucial it is to consider diversifying your portfolio and managing risks in the face of uncertainties in the Chinese market.

Now, I know times are tough, but staying cool-headed is the name of the game. Look into alternative investment opportunities, spread your eggs across different baskets – regions, sectors, and assets – to reduce your exposure to the risks linked with China’s manufacturing slowdown. By doing that, you might be able to safeguard yourself against potential losses and tap into growth potential elsewhere.

Impact on Global Markets:

China’s manufacturing sector plays a pivotal role in the global supply chain. Any disruption in this sector can have far-reaching consequences on the global economy and financial markets. As the world’s second-largest economy, China’s economic performance significantly influences international trade and investment flows. It is vital to assess how the decline in factory activity may impact multinational companies, commodity prices, and market sentiments worldwide. Understanding the China stock signal becomes even more critical for investors with exposure to global markets to make informed decisions.

China Stock Signal and Monetary Policy:

The decline in the Caixin PMI may prompt Chinese authorities to adjust their monetary policies to stimulate economic growth. As an expert financial writer, it is essential to analyze the potential policy responses, such as interest rate adjustments, liquidity injections, or targeted fiscal measures. Investors should stay vigilant for any policy changes that could affect their investments in Chinese assets. Moreover, understanding the nuances of China’s monetary policy can help investors anticipate potential opportunities and risks in the financial market.

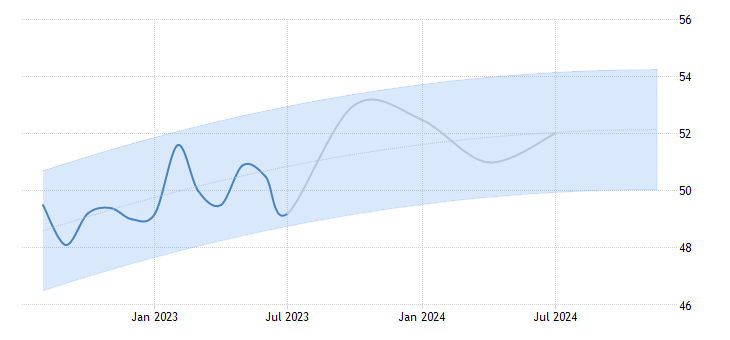

Long-Term Prospects for China’s Manufacturing Sector:

While the recent PMI decline is a cause for concern, it is essential to keep an eye on the long-term prospects for China’s manufacturing sector. As the Chinese government continues its efforts to transition towards a more consumption-driven economy and enhance technological innovation, new opportunities may arise for investors. Companies focusing on high-value-added products and sustainable practices could stand out in a post-pandemic world. Analyzing these trends will enable investors to make forward-thinking decisions aligned with the China stock signal.

The China stock signal has gained prominence among investors looking to capitalize on opportunities in the Chinese market. However, it is crucial to recognize that market signals are dynamic and influenced by multiple factors. As a professional financial writer, my advice is to use the China stock signal as one of the many indicators in a comprehensive investment strategy. Diversification, risk management, and a thorough understanding of macroeconomic and geopolitical factors are equally vital in navigating the Chinese financial landscape.

Conclusion: China stock signal

The recent decline in the Caixin China General Manufacturing PMI serves as a critical signal for investors seeking to comprehend the state of the Chinese economy and its potential impact on global markets. As a human professional financial writer, my analysis delves into the factors contributing to the downturn and offers advice on managing risks and seizing opportunities. While uncertainties persist, a nuanced understanding of the China stock signal and its implications can empower investors to make well-informed decisions and navigate the dynamic financial landscape effectively.

Source: tradingeconomics.com

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.