In a stunning turn of events, the United States labor market has once again defied expectations as job vacancies unexpectedly surged in April 2023. This unexpected increase, reaching a remarkable 10.1 million job openings, surpassed market predictions and underscored the persistent tightness of the labor market. With the surge in job openings, speculation grows regarding the Federal Reserve’s potential for additional interest rate hikes. This article delves into the latest data, delves into the implications for the labor market and the Federal Reserve’s decision-making process, and provides unique insights into sector-specific and regional trends.

Surprising Rebound in Job Openings

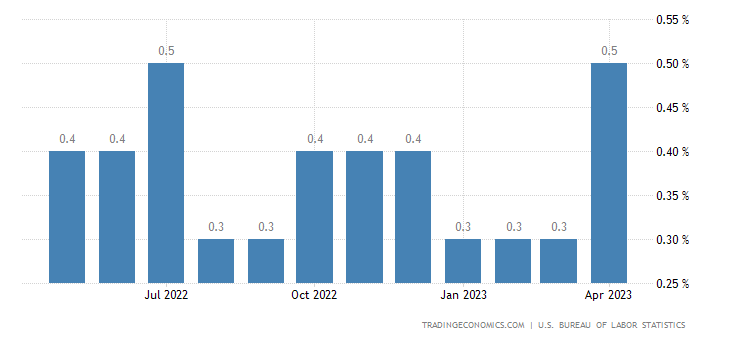

In an unprecedented development, the number of job vacancies in the United States rose by an impressive 358 thousand, reaching a staggering 10.1 million in April 2023. This unexpected rebound not only surpassed market expectations but also marked a significant increase from the previous month’s near two-year low. The sudden surge in job openings emphasizes the ongoing tightness of the labor market, prompting analysts to reevaluate its potential impact on the broader economy.

Potential Impact on Federal Reserve’s Decision

The surprising increase in job openings holds crucial implications for the Federal Reserve’s decision regarding interest rates. With a persistently tight labor market, exemplified by 1.8 job openings for every unemployed person in April, the pressure on the Fed to consider further rate hikes intensifies. This surge in job openings challenges the prevalent notion of a pause in rate increases, potentially reshaping monetary policy as the Fed strives to strike a balance between sustainable economic growth and inflation concerns.

Sector-Specific and Regional Trends

Beyond the headline figures, the latest data uncovers noteworthy sector-specific trends. Several industries experienced significant increases in job openings, providing valuable insights into the evolving labor market landscape. The retail trade sector, for instance, witnessed a substantial surge of 209 thousand job openings, indicating a potential upturn in consumer spending. Additionally, the health care and social assistance sector saw a surge of 185 thousand openings, while the transportation, warehousing, and utilities sector experienced a noteworthy increase of 154 thousand openings. These trends reflect the dynamic nature of the labor market and highlight sectors driving the surge in employment opportunities.

Geographically, job openings demonstrated varying patterns. The Western region emerged as a hotbed of opportunity with an impressive rise of 236 thousand openings, followed closely by the Midwest with 137 thousand openings. Meanwhile, the South experienced a more modest increase of 20 thousand job openings, while the Northeast encountered a decline of 34 thousand openings. These regional disparities underscore the importance of considering localized factors and economic conditions when assessing the overall labor market outlook.

Outlook for the Stock Market

The unexpected surge in job openings carries significant implications for the stock market. A robust labor market often translates into increased consumer spending power, potentially driving corporate profit growth and fostering positive investor sentiment. However, investors must closely monitor the Federal Reserve’s response to these labor market dynamics, as interest rate decisions can impact borrowing costs for businesses and potentially influence market performance.

New Possibilities on the Horizon

Looking ahead, the surge in job openings signals potential opportunities for job seekers and the prospect of wage growth in the future. As the labor market remains tight, it creates favorable conditions for workers, providing them with increased bargaining power. However, uncertainties persist, including the impact of future interest rate decisions and broader economic trends. Vigilantly monitoring these developments will be crucial in assessing the evolving labor market and its potential effects on the overall economy.

In conclusion, the surprising rebound in U.S. job openings presents both challenges and opportunities for the labor market and the Federal Reserve. The continued tightness of the labor market raises