A Significant Plunge in UK Inflation Rates

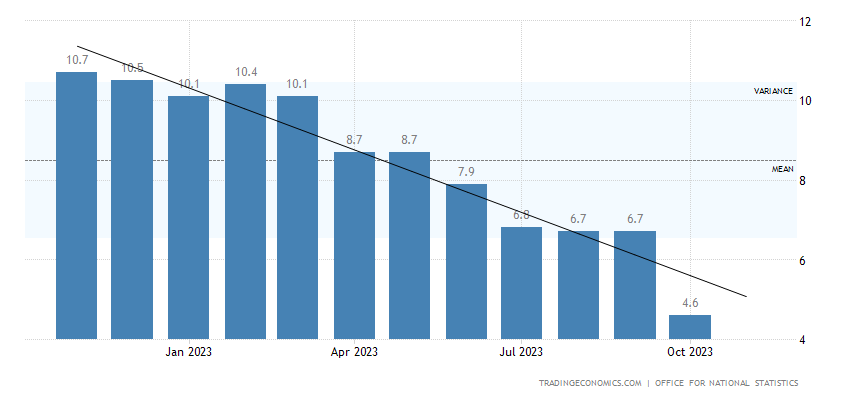

In October 2023, the United Kingdom witnessed a notable decline in its inflation rate, plummeting to 4.6% from the previous 6.7% recorded in both September and August. This significant shift, however, fell shy of the market’s projected 4.8%, marking the lowest inflation rate since October 2021. Notably contributing to this downturn was the recent reduction in energy costs, a ripple effect from Ofgem’s decision to lower the cap on household bills. This strategic move sparked a downturn in the cost of housing and utilities, reflecting a substantial 3.5% decrease, compared to September’s staggering 6.9% hike. The most notable drop came in gas and electricity prices, witnessing the most substantial decline since January 1989. UK Inflation Rate

Energy Price Reductions Spark Downward Trend

The implications of this decline extended beyond the energy sector, impacting various facets of consumer spending. Food inflation notably eased to 10.1%, a notable low since June 2022. Transport costs experienced a minor increase of 0.5%, contrasting with the previous 0.7%. Furthermore, sectors like restaurants and hotels, furniture, household equipment, maintenance, clothing, footwear, and miscellaneous goods and services all showcased a trend of decelerating inflation rates. Notably, the core inflation rate, excluding volatile elements such as food and energy, saw a parallel decrease, settling at 5.7%, the lowest since March 2022. Interestingly, on a monthly basis, the Consumer Price Index (CPI) remained static, registering no change.

Core Inflation Rates Show Parallel Deceleration

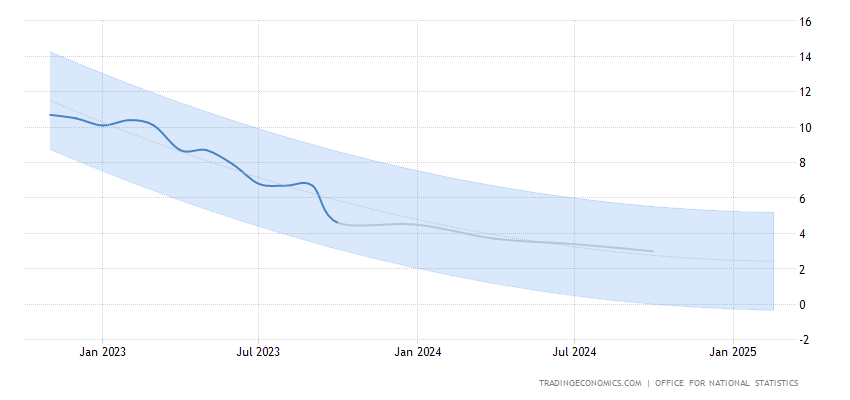

In considering the intricacies of the UK inflation rate dynamics, it’s imperative for consumers and investors alike to acknowledge the multifaceted factors influencing this fluctuation. While the reduction in energy prices due to regulatory interventions significantly contributed to the downturn, other components such as food, transport, and various services experienced a slowdown in price hikes. This signals a complex interplay of supply chain disruptions, global economic shifts, and governmental policies impacting the inflation trajectory. Acknowledging these diverse influences, individuals and businesses can strategize and make informed decisions to mitigate the effects of inflation on their finances.

Understanding the Complexities of UK Inflation Dynamics

For consumers, this phase of reduced inflation rates offers a window of opportunity to reassess spending patterns and financial strategies. Capitalizing on lower inflation rates, individuals can consider long-term investments, adjust budget allocations, and leverage this period to make substantial purchases, taking advantage of relatively stable prices across various sectors. Similarly, businesses can optimize pricing strategies, negotiate contracts, and explore expansion opportunities in a market exhibiting more predictable price trends.

Seizing Opportunities Amidst Lower Inflation Rates

In navigating the landscape of fluctuating inflation rates, proactive measures hold the key to financial resilience. Employing diversified investment portfolios, hedging against inflation risks, and staying informed about market trends and policy changes are instrumental. Moreover, maintaining a flexible financial plan that adapts to evolving economic conditions is crucial in safeguarding against the impacts of inflationary pressures.

In conclusion, the recent downturn in the UK inflation rate underscores a complex interplay of factors influencing consumer prices. Understanding these dynamics and adopting proactive financial strategies enable both individuals and businesses to not just weather the effects of inflation but potentially thrive in a changing economic landscape. As the economic climate continues to evolve, staying informed and agile in financial decisions remains paramount for sustained stability and growth.