Introduction: U.S trade signal

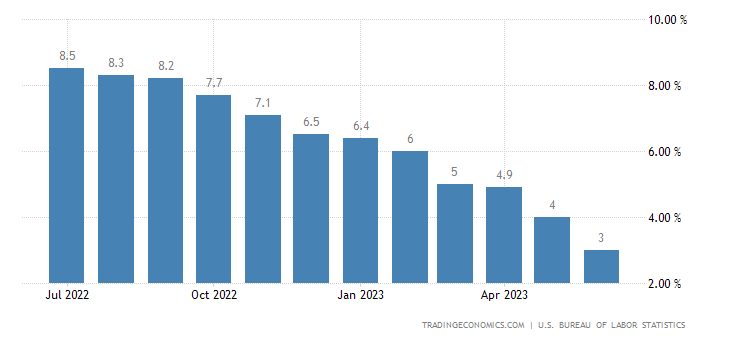

In June 2023, the United States witnessed a significant deceleration in its annual inflation rate, reaching a 2-year low of 3%. This marked decline, compared to May’s 4% and market expectations of 3.1%, calls for a comprehensive analysis of the underlying factors influencing this slowdown. The primary driving force behind this phenomenon lies in the high base effect from the previous year when the nation faced an alarming surge in energy and food prices, catapulting the headline inflation rate to the highest levels seen since 1981, at 9.1%. In this article, we delve into the multifaceted components that contributed to this intriguing shift in inflation dynamics, while also exploring its potential implications for the U.S. trade signal.

Energy Sector Impact:

The energy sector played a crucial role in shaping the inflation landscape. Notably, energy costs experienced a substantial slump of 16.7% in June, as opposed to a comparatively milder decline of 11.7% in May. This decline was chiefly driven by a notable reduction in fuel oil prices, which plummeted by 36.6%. Furthermore, gasoline and utility gas service prices witnessed a significant drop of 26.5% and 18.6%, respectively. Surprisingly, amidst this overall downward trend, electricity prices saw an increase of 5.4%. The shift in energy prices significantly influenced the overall inflation rate, as the cost of energy holds substantial weightage in consumer spending patterns.

Food and Shelter Sectors:

Apart from the energy sector, the inflation rate for both food and shelter experienced a slowdown. In June, food inflation decreased to 5.7%, compared to May’s 6.7%. This moderation can be attributed to factors such as improved supply chain dynamics, stabilizing food production costs, and reduced transportation expenses. Moreover, the shelter sector witnessed a similar decline, with the inflation rate falling from 8% in May to 7.8% in June. The steady moderation in these two vital sectors contributes to the overall easing of inflationary pressures.

Automotive and Transportation: U.S trade signal

The automotive industry, a vital pillar of the U.S. economy, recently experienced a slight deceleration in inflationary pressures. During June, the rate at which prices were rising for new vehicles dipped to 4.1%, down from the previous month’s 4.7%. This modest slowdown can be attributed to a mix of factors that have contributed to a more stable environment. Firstly, there has been a stabilization in raw material prices, easing the cost burden on manufacturers. Additionally, increased production capacities have played a role in maintaining a more balanced supply-demand dynamic.

Similarly, the apparel sector witnessed a marginal decline in inflation, falling from 3.5% in May to 3.1% in June. This easing of price pressures indicates a certain degree of stabilization within the industry, providing consumers with potential benefits in terms of affordability.

In the realm of transportation services, a notable deceleration in inflationary trends has been observed. Rates have dropped from a worrisome 10.2% to a more manageable 8.2%. This significant slowdown suggests a potential stabilization within the sector, which can have positive implications for the U.S. trade signal.

Collectively, these developments in the automotive, apparel, and transportation sectors point towards a level of stabilization and offer a glimmer of hope for future benefits. As the U.S. trade signal navigates these shifts, it becomes increasingly important for policymakers, investors, and market participants to closely monitor these trends and adjust their strategies accordingly.

Healthcare and Used Vehicles:

Beyond the sectors we discussed earlier, let’s turn our attention to two other areas that played a role in the recent slowdown of inflation: the healthcare industry and the market for used cars and trucks.

Within the healthcare sector, there’s been a welcome decline in the costs of medical services, with a decrease of 0.8%. This signifies a potential relief for consumers, as it suggests a reduction in healthcare expenses. It’s heartening to see this trend, as it may alleviate some of the financial burdens individuals and families face when seeking medical care.

Another noteworthy development is the significant drop in prices for used vehicles, which experienced a decline of 5.2%. This decline implies improved affordability and opens up potential opportunities for those in the market for a pre-owned car or truck. The prospect of lower prices may encourage consumers to consider purchasing a vehicle, thereby stimulating demand and influencing spending patterns.

These developments in healthcare and the used vehicle market hold considerable implications for both individual consumers and the broader dynamics of the market. Lower healthcare costs can alleviate financial strain and potentially free up resources for other expenditures, while more affordable used vehicles can provide individuals with transportation options they may have previously found out of reach. These shifts in spending patterns have the potential to shape overall market dynamics, driving economic activity in new and exciting ways.

Core Inflation and Implications:

The core inflation rate, which excludes volatile energy and food prices, dropped to 4.8% in June, marking the lowest level seen since October 2021. This moderation suggests a broader-based easing of inflationary pressures across various sectors. The implications of this deceleration are far-reaching, potentially impacting monetary policy decisions, consumer behavior, and trade signals. However, it is crucial to closely monitor future data releases to ascertain whether this trend persists or undergoes any significant fluctuations.

Conclusion: U.S trade signal

The recent deceleration in the U.S. inflation rate, driven by factors such as energy, food, shelter, automotive, and healthcare sectors, holds crucial implications for the country’s trade signal. The moderation witnessed across these sectors suggests a potential improvement in consumer purchasing power, increased market stability, and enhanced trade prospects. However, it is vital to remain vigilant and evaluate future developments to understand the sustainability of this trend. Investors, policymakers, and market participants should stay informed and adapt their strategies accordingly, as this new inflationary landscape unfolds.

2 thoughts on “U.S. Trade Signal : Analyzing the Current State of Inflation and its Implications”