Introduction

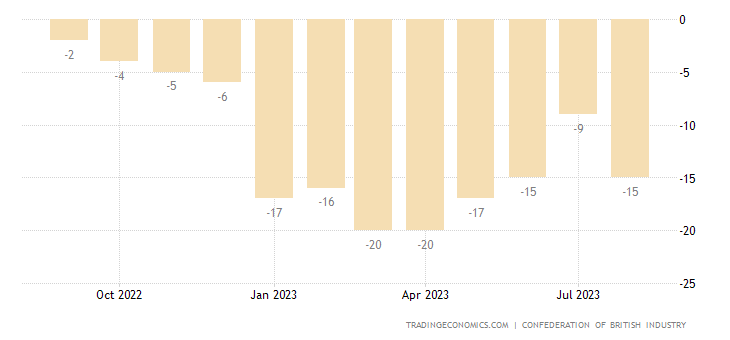

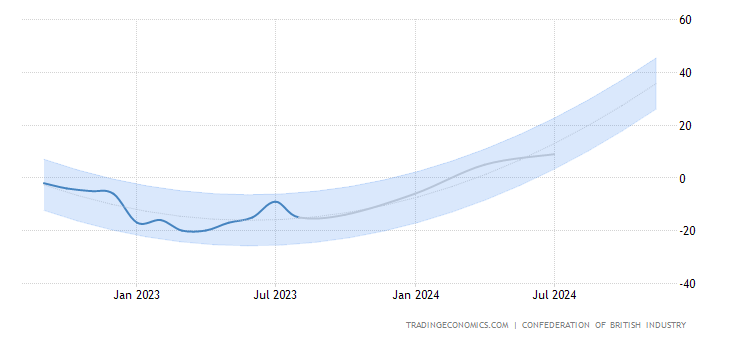

In the realm of British industry, a recent survey conducted by the Confederation of British Industry (CBI) casts a discerning light on the present state of affairs. In August 2023, the CBI’s total order book balance encountered a setback, relinquishing six points from the prior month to arrive at a value of -15. However, this figure fell below the market’s prognostications, which had pegged it at -13. Concurrently, the yardstick measuring output across the past three months plunged from a positive +3 reading in July to a negative -19, marking the lowest point seen since September 2020. Evidently, this decline was most pronounced in the automotive and mechanical engineering sectors, serving as significant indicators of the overall industry downturn. U.K stock signals

The economic reverberations of this survey extend beyond the immediate. Delving deeper, the gauge of price expectations – a quintessential measure of inflationary pressures – also bore witness to a nadir not glimpsed since February 2021. This, in turn, contributes to a broader narrative of a burgeoning deceleration in inflation across manufacturing realms. For seasoned observers and investors, the implications are clear: a shifting landscape within the United Kingdom’s economic tapestry.

Commentary from Martin Sartorius, a luminary economist within the CBI, adds a layer of nuanced understanding to this disquieting tableau. “With the velocity of output volumes contracting at a pace unparalleled since the outbreak of the COVID-19 pandemic, and with order books displaying signs of distress, the insights drawn from this survey are unequivocally somber,” Sartorius observes. Yet, within this overcast horizon, a silver lining emerges in the form of abating price pressures. This, Sartorius indicates, is poised to bestow a modicum of solace upon manufacturing enterprises, thereby rippling positively through the broader economic landscape.

U.K stock signals

Peering through the financial lens, the echoes of this survey are felt on the stock market floor. With the keyword “U.K stock signal” in mind, the trends unveiled have the potential to serve as a lighthouse for investors navigating the murky waters of decision-making. As the CBI survey reverberates across trading screens, it conjures an atmosphere of cautious optimism amongst market participants. Indeed, the interplay between manufacturing performance and stock valuations is a complex symphony, yet these indicators offer a melodic theme for consideration.

Transitioning from the macro to the micro, the survey’s revelations delve into the dynamics of specific sectors. The automotive industry, once a stalwart of the British economic landscape, now finds itself at the heart of this narrative. The reverberations of Brexit, compounded by a global shortage of semiconductor chips, have undeniably left their marks. This symbiotic blend of domestic policy shifts and international supply chain disruptions has painted a challenging panorama for car manufacturers, as echoed in the survey’s findings.

Parallelly, the mechanical engineering sector experiences a resonance with the challenges faced by its vehicular counterpart. Within its intricate machinery lies a mirroring tale of supply chain complexities and demand fluctuations. As consumers and industries pivot towards sustainable practices, this sector stands at a crossroads, compelled to align its offerings with a shifting zeitgeist. The survey’s metrics poignantly capture this dynamic shift, underscoring the hurdles that mechanical engineering enterprises must surmount in these transformative times.

For the investor seeking clarity amid this economic tableau, the prudent path involves more than perusing spreadsheets and financial journals. As “U.K stock signal” resonates as a guiding keyword, the art of reading between the lines takes center stage. The CBI survey, with its intricate metrics and insights, provides a potent opportunity for the discerning investor to glean insights beyond the obvious. The stock market is often likened to a tempestuous sea, yet within its undulating waves lie patterns discernible to the astute observer.

As the pendulum of economic fortune continues its oscillation, market sentiment remains inextricably intertwined with the pulse of manufacturing. The CBI survey, casting a probing gaze into the tapestry of order books and output, serves as a bellwether not only for industry stakeholders but also for investors at large. Amid the flux of economic indicators, the survey unfurls a tapestry of transition words – “however,” “additionally,” “conversely” – which offer the reader a roadmap through the nuanced narrative.

In conclusion, the CBI survey’s revelations navigate the intricate intersection of manufacturing, economics, and stock market dynamics. The ebbs and flows captured within its metrics elucidate a tale of resilience, challenges, and adaptation. From the labyrinths of the automotive and mechanical engineering sectors to the market’s response, the story told is one of interconnectedness. As the echo of “U.K stock signal” reverberates through trading halls, the survey’s insights serve as a testament to the power of information in guiding strategic decisions. In a world where economic seas remain unpredictable, the CBI survey stands as a lighthouse of knowledge, illuminating the path forward for industries and investors alike. U.K stock signals

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.