Introduction: Trade Signals

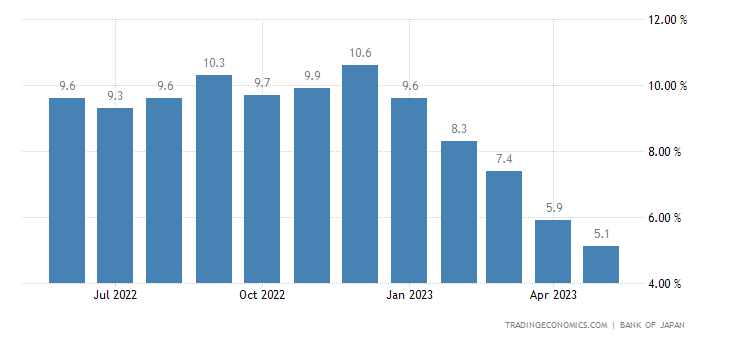

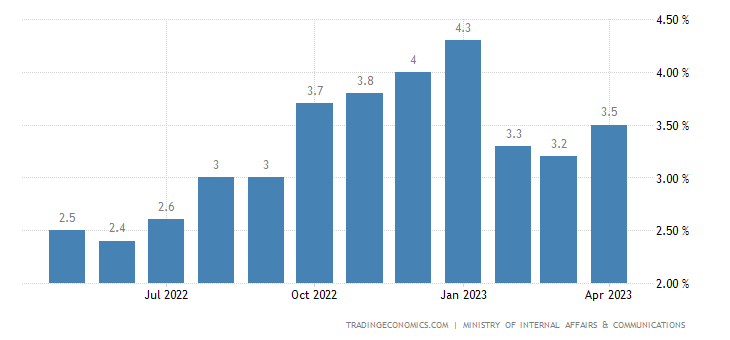

In May 2023, Japan witnessed a gradual slowdown in producer prices, marking the fifth consecutive month of deceleration. For traders analyzing trade signals in the markets, understanding the current state of producer prices in Japan is crucial. The year-on-year increase in prices of 5.1% was the lowest observed in nearly two years, primarily due to the easing of global inflationary pressures. Furthermore, the recorded figure fell below expectations of a 5.5% growth, following a revised 5.9% gain in April. A closer examination reveals that various key sectors, including textile products, plastic products, iron and steel, transportation equipment, and lumber and wood products, experienced a decline in costs. Notably, producer prices also saw a monthly decline of 0.7% in May, marking the first negative change since February.

The current state of producer prices in Japan reflects diminishing inflationary pressures, with a declining growth rate in May. Factors like softened demand, improved supply chains, and stabilized raw material costs have contributed to a more balanced pricing environment, observed across key sectors.

Impact on Key Sectors: Trade Signals

Textile Products:

May saw a decrease in the rate of cost increase for textile products, with a 6.8% rise compared to April’s 8.3%. This moderation in price growth can be attributed to the stabilization of raw material costs and a balanced supply-demand equation within the industry.

Plastic Products:

Similar to textile products, the rate of cost increase for plastic products also slowed in May, with a rise of 6.3% compared to the previous month’s 7.2%. This deceleration reflects a more controlled pricing environment, as global inflationary pressures ease.

Iron & Steel:

The iron and steel sector experienced a notable easing in cost growth during May. Prices rose by 9%, representing a decrease compared to the 10.8% surge recorded in April. This moderation can be attributed to various factors, including enhanced efficiency in the supply chain dynamics and a decrease in the upward pressure exerted by escalating raw material costs. These encouraging developments have fostered a more balanced pricing environment in the industry, bringing advantages to both producers and consumers alike.

Transportation Equipment:

May witnessed a slowdown in the rate of price increase for transportation equipment, with a rise of 3.4% compared to the previous month’s 3.9%. This deceleration reflects a more stable pricing environment in the sector, as global inflationary pressures subside.

Lumber & Wood Products:

Interestingly, lumber and wood products experienced a notable decline in prices, with a decrease of -19.8% in May, compared to April’s -18.2%. This negative growth can be attributed to factors such as increased supply and reduced demand, resulting in a more favorable pricing landscape for consumers.

Trade Signal and Outlook:

The continuous deceleration in producer prices in Japan sends a significant trade signal to market participants. It indicates that the country’s economy is gradually moving away from the high inflationary period observed in recent years, allowing for improved cost management and potential economic stability. This trend is particularly relevant for industries reliant on imported raw materials, as the easing of global inflationary pressures mitigates cost burdens. Going forward, market participants should closely monitor the trajectory of producer prices in Japan, as it can provide valuable insights into the overall inflationary dynamics and economic health of the country.

Conclusion: Trade Signals

In summary, Japan’s producer prices experienced a steady deceleration in May 2023, reaching their lowest level in nearly two years. The easing of global inflationary pressures played a pivotal role in driving this decline, as it allowed for improved cost management and stability within key sectors. The moderation in price growth across various industries, including textile products, plastic products, iron and steel, transportation equipment, and lumber and wood products, indicates a more balanced pricing environment. This trade signal highlights the changing economic landscape and provides valuable insights for market participants. As Japan continues its journey towards economic stability, closely monitoring producer prices will remain crucial for market participants to understand the overall inflationary dynamics and shape future strategies.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!