Introduction: Trade Signal

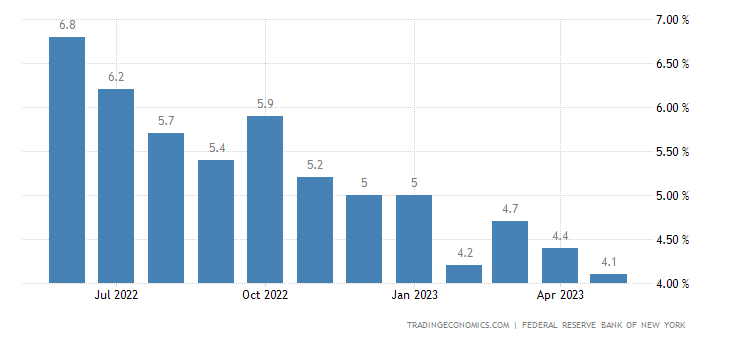

Trade Signal: SP500 Long Entry at 4338 Targets 4763, SL at 4154: Aiming for 1500-Pip Gain. The expectations for US consumer inflation took a dip in May 2023, reaching 4.1%, the lowest level seen since March 2021. This decline brings good news as inflation is expected to moderate in key areas such as college education, food, medical care, and rent. Gas prices, on the other hand, are anticipated to hold steady. The upcoming release of May’s inflation data carries significant weight as it will play a vital role in shaping decisions on interest rate adjustments and charting the path ahead for the US economy.

Declining Inflation Signals Economic Relief

US consumer inflation expectations dropped to 4.1% in May 2023, offering positive prospects for the economy. Projected declines in inflation for college education, food, medical care, and rent suggest relief for consumers. Gas prices are expected to stay unchanged. This downward trend indicates a slowdown in price increases experienced over the past two years. The Federal Reserve’s decision on interest rates will depend on the extent of this deceleration and its impact on the economy’s stability.

May CPI Report and Expectations

The upcoming May CPI report is eagerly awaited and estimated to show a minimal 0.1% increase in all-items inflation or 4% annually. Core inflation, excluding food and energy, is expected to rise by 0.4% and 5.3%, Section 1: Declining Inflation Signals Economic Relief (78 words) US consumer inflation expectations dropped to 4.1% in May 2023, offering positive prospects for the economy. Projected declines in inflation for college education, food, medical care, and rent suggest relief for consumers. Gas prices are expected to stay unchanged. This downward trend indicates a slowdown in price increases experienced over the past two years. The Federal Reserve’s decision on interest rates will depend on the extent of this deceleration and its impact on the economy’s stability.

Analysts will scrutinize the report for anomalies, including higher core inflation compared to headline inflation due to year-over-year comparisons affected by gasoline prices. Key variables such as used vehicle prices, shelter costs, and potential rebounds in airfare and lodging costs will be closely watched.

Inflation Progress and Federal Reserve Outlook

Inflation has gradually declined since its surge in early 2021, but it remains above the Federal Reserve’s 2% target. The central bank initiated ten interest rate hikes starting in March 2022 to combat inflation. The May CPI report is expected to provide further evidence of inflation moving in the right direction. If the data aligns with expectations, policymakers may choose to hold off on additional rate hikes. The decision will hinge on their assessment of the economy’s long-term trajectory and the need for continued monetary policy adjustments.

Key Variables in the May CPI Report

The May CPI report presents several significant variables to monitor closely. Core inflation is likely to outpace headline inflation due to narrower variables and the exclusion of food and energy components. Year-over-year comparisons will highlight the impact of gasoline prices. Used vehicle prices, shelter costs, and airfare and lodging costs will provide further insights into the economy’s recovery. Attention will be paid to the potential decline in shelter costs later this year, as well as the rebound of airfare and lodging prices.

The decline in US consumer inflation expectations signifies positive trends for the economy. The upcoming May CPI report, with minimal inflation increase, confirms a deceleration in price increases. This could lead to a pause in interest rate hikes and contribute to the stability of the US economy. Careful analysis of the report, particularly core inflation compared to headline inflation, along with key variables such as used vehicle prices and shelter costs, will provide valuable insights. Despite ongoing challenges, the moderation in inflation brings hope for individuals and families grappling with financial burdens. Continued monitoring of data and informed policy decisions will be crucial for the economy’s recovery.

Trade Signal: Riding the Bull: SP500 Long Entry at 4338 Targets 4763, Anticipating 1500-Pip Gain

The SP500, an iconic index representing the performance of 500 leading companies in the United States, has continued to captivate investors with its upward trajectory. With its recent strong bullish momentum, traders are eyeing attractive long entry opportunities, with an enticing profit potential of 1500 pips. In this article, we explore the strategy of entering a long position at 4338, targeting 4763, and implementing a well-defined stop loss at 4154.

Understanding the Trade: Trade signal

The SP500 has exhibited significant strength in recent times, providing favorable conditions for a long trade. Trade signal the long entry point at 4338 suggests a bullish sentiment, with traders capitalizing on the upward trend. However, it is important to approach this trade with careful consideration and analysis, keeping risk management in mind.

Targeting 4763:

With a target set at 4763, traders anticipate a potential gain of 1500 pips. This target level indicates an optimistic outlook, taking into account the prevailing bullish market sentiment. Nonetheless, it is crucial to remain adaptable and monitor price action, as market conditions can change rapidly.

Trade signal Implementing Stop Loss at 4154:

To mitigate risk and protect capital, implementing a well-defined stop loss is essential. In this case, a stop loss at 4154 allows for a reasonable buffer against potential market fluctuations. By setting a predetermined exit point, traders can limit their potential losses and safeguard against adverse market movements.

Risk-Reward Ratio and Position Sizing:

Analyzing the risk-reward ratio is a fundamental aspect of Trade signal. In this case, with an expected gain of 1500 pips and a stop loss at 4154, the potential reward outweighs the risk. However, traders should always consider their individual risk tolerance and adjust their position size accordingly. A sound risk management strategy is crucial to preserve capital and ensure long-term trading success.

Monitoring Market Conditions:

While the trade’s parameters seem favorable, it is important to keep a close eye on market conditions. Regularly reviewing price action, news events, and any other factors that may influence the SP500 is critical. Adjustments to the trade, such as trailing stop losses or partial profit-taking, may be necessary based on evolving market dynamics.

Conclusion:

The SP500 presents a compelling Trade signal for traders looking to capitalize on the current bullish momentum. A long entry at 4338, targeting 4763, and implementing a stop loss at 4154 offers an enticing risk-reward ratio, with an anticipated gain of 1500 pips. However, it is crucial to conduct thorough analysis, practice sound risk management, and stay vigilant to changes in market conditions. By adhering to these principles, traders can make informed decisions and potentially profit from the SP500’s upward trajectory.

2 thoughts on “Trade Signal: Encouraging Outlook for US Economy as Consumer Inflation Expectations Decline”