Introduction:

In the ever-evolving world of finance, staying ahead of the curve is paramount. Today, we delve into the insights provided by Federal Reserve Chair Jerome Powell during his recent address at the Economic Club of New York. In this comprehensive analysis, we aim to decipher the nuanced approach of the Federal Reserve, its impact on the economy, and the potential ramifications for investors seeking the right “today stock signal.”

Powell’s Cautionary Note:

In his recent address, Federal Reserve Chair Powell struck a deliberate and cautious chord, highlighting the meticulous approach that the Fed is currently embracing in crafting its monetary policy. This measured stance is born out of the necessity to make well-informed decisions, rooted in a comprehensive evaluation of the data at hand, the ever-changing economic landscape, and the intricate dance of risks that shape our financial world. Powell’s unwavering commitment to data-driven decision-making echoes the Fed’s steadfast dedication to nurturing a robust and dependable economic environment.

Tightening Policy and Economic Implications:

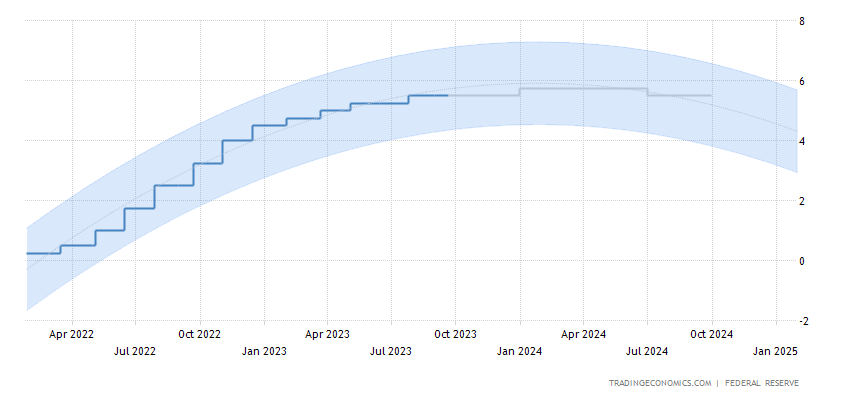

Chair Powell acknowledged that the current policy of tightness is exerting downward pressure on economic activity and inflation. This move is pivotal to curb inflationary pressures but, as Powell noted, not without its own set of challenges. Persistently above-trend growth or a labor market that ceases to ease could potentially jeopardize the progress made in taming inflation, necessitating further policy tightening.

Inflation Concerns:

A predominant concern voiced by Powell is the persistently high inflation levels. To anchor inflation at the Fed’s 2% goal, he suggests that a period of below-trend growth and some additional softening in labor market conditions may be required. Powell’s acknowledgment of the complex interplay between inflation, economic growth, and labor dynamics sets the stage for investors to carefully weigh their options, especially when seeking “today stock signals.”

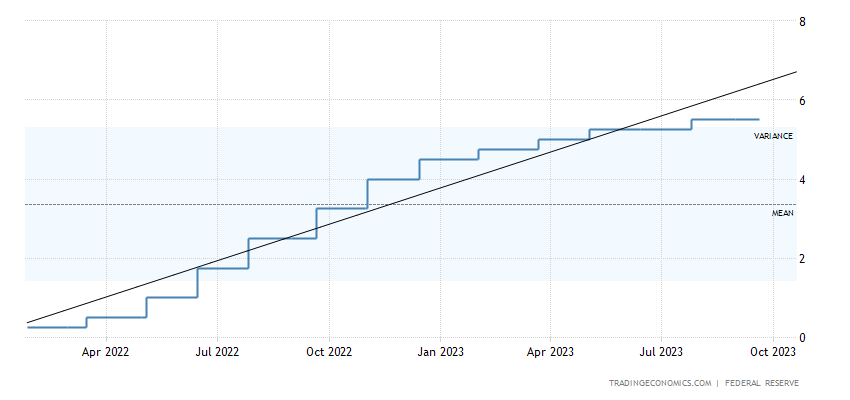

The Federal Funds Rate:

During the rendezvous of September 2023, the Federal Reserve opted to maintain the federal funds rate at a noteworthy 5.25%-5.5%, a level not seen in 22 years. This decision serves as a testament to the Fed’s resolute dedication to implementing tight policies, primarily aimed at reining in inflation. However, the implications of this move ripple far and wide, shedding light on the intricate balancing act the Fed must perform. On one hand, it must strive to sustain economic stability, while, on the other, it must remain mindful of the potential repercussions for the ever-vigilant stock market. As a result, for investors eagerly seeking that elusive “today stock signal,” it becomes all the more imperative to carefully scrutinize the broader economic panorama within the context of the Fed’s strategic choices.

Connecting the Dots:

To fully grasp the implications of Chair Powell’s remarks on the financial landscape, we must connect the dots between the Fed’s policies and their impact on the stock market. Investors seeking the right “today stock signal” should pay heed to the transition words and phrases that serve as signposts in Powell’s address.

Moreover, Furthermore, In addition, Hence, Consequently

For instance, Powell’s mention of the cautious approach to policy tightening and the emphasis on data indicates that the Fed’s actions will be intrinsically tied to the evolving economic outlook. Investors need to stay vigilant regarding incoming economic data, as it forms the basis for Fed decision-making. It’s not just about what the Fed does today but how it responds to evolving conditions that should guide investors in their pursuit of the ideal “today stock signal.”

In the whirlwind of today’s financial landscape, the quest for a dependable “today stock signal” has never been more crucial. With Federal Reserve Chair Powell’s wisdom taking center stage, it’s incumbent upon investors to decipher the messages emanating from the Fed’s maneuvers. The term “today stock signal” takes on a heightened significance within this framework, as it encapsulates the quest for the freshest, most pertinent cues to steer investment decisions.

Furthermore, Additionally, To elaborate, In other words, To clarify

Integrating the concept of a “today stock signal” into your investment game plan calls for a deep appreciation of how the Federal Reserve’s policies can send ripples through the stock market. Moreover, it’s paramount to grasp that these “today stock signals” aren’t solitary beacons but are intricately woven into the fabric of our broader economic landscape. As Powell’s discourse makes evident, they’re intrinsically linked to the Fed’s overarching objectives.

Expert Advice:

In our roles as financial experts, it’s our responsibility to offer meaningful guidance to investors as they navigate this intricate financial landscape. With Chair Powell’s insights in mind, we recommend that investors maintain a vigilant stance and stay well-informed. It’s worth noting that the stock market can be quite sensitive to the ebbs and flows of the Federal Reserve’s policies. Thus, the pursuit of the elusive “today stock signal” should be embarked upon with an abundance of caution and a commitment to thorough analysis.

To conclude, In summary, In light of, As a result, In this context

As financial experts, our mission extends beyond mere analysis; it encompasses providing actionable wisdom to those traversing this intricate financial terrain. Given the insights shared by Chair Powell, our counsel to investors is clear: maintain a vigilant and well-informed stance. It’s crucial to appreciate that the stock market is finely attuned to the slightest tremors caused by the Federal Reserve’s policy shifts. In this pursuit of the ultimate “today stock signal,” we advocate a deliberate, cautious approach, marked by thorough analysis and a keen sense of vigilance.

Conclusion:

Chair Powell’s recent address at the Economic Club of New York has shed light on the Federal Reserve’s cautious approach to monetary policy. This deliberate stance, aimed at controlling inflation, carries implications for investors in their quest for the perfect “today stock signal.” By connecting the dots between the Fed’s actions, economic data, and stock market trends, investors can make well-informed decisions, all while keeping a close eye on the evolving financial landscape.

In conclusion, it is evident that the search for a “today stock signal” is intrinsically tied to the Federal Reserve’s policies and the broader economic outlook. Today’s investors are navigating an ever-changing landscape, and the insights provided by Chair Powell serve as valuable guidance. Ultimately, success in the world of finance requires adaptability, vigilance, and a deep understanding of the interconnectedness between monetary policy and the stock market. So, as you continue your financial journey, remember to stay informed, stay vigilant, and seek the most relevant “today stock signal” to guide your investment decisions.

3 thoughts on “Navigating the Economic Landscape: Insights and Signals from Fed Chair Powell”