Introduction: This week signals

This week’s financial landscape promises a deluge of pivotal events and releases that will shape the direction of global markets. As investors eagerly await the unveiling of earnings reports from major US companies, including Bank of America, Morgan Stanley, Goldman Sachs, IBM, Netflix, Tesla, and Johnson & Johnson, the market sentiment hangs in suspense. Simultaneously, a keen eye will be cast upon various economic indicators, such as retail sales, industrial production, and housing data, encompassing existing home sales, housing starts, and building permits. Additionally, China’s release of second-quarter GDP growth, retail sales, industrial production, and fixed asset investments will significantly influence market movements. Moreover, inflation rates in the United Kingdom, Canada, Japan, New Zealand, and South Africa will warrant close observation. This week will also see monetary policy decisions from the central banks of Turkey and South Africa, Australia’s unemployment rate announcement, and retail sales data releases from the UK and Canada. This week signals

Earnings Reports: This week signals

The financial world’s attention will be fixed on the much-anticipated earnings reports of major US corporations. Bank of America, Morgan Stanley, Goldman Sachs, IBM, Netflix, Tesla, and Johnson & Johnson are set to disclose their performance metrics for the quarter. These reports offer crucial insights into the health of these industry giants and provide valuable indicators of economic conditions. Investors will closely scrutinize revenue figures, profit margins, and future projections, looking for signs of robust growth or potential concerns. Investors should analyze these reports holistically and consider not only the numbers but also the underlying narratives and management commentary. By doing so, one can gain a comprehensive understanding of the companies’ strategies and potential risks, enabling informed investment decisions.

Economic Indicators: This week signals

Beyond earnings reports, this week’s economic data releases carry substantial weight in guiding market sentiment. Retail sales figures will reveal consumer spending patterns, offering insight into overall economic activity. Industrial production data will shed light on the strength of the manufacturing sector, a key driver of economic growth. Furthermore, the housing market data, encompassing existing home sales, housing starts, and building permits, will reflect the state of the real estate industry, an essential component of economic health. Analyzing these indicators collectively allows investors to gauge the overall trajectory of the economy and make informed investment choices. However, it is important to consider the broader economic context and look for trends rather than relying on isolated data points. This week signals

China’s Economic Performance:

China’s economic performance is a critical factor influencing global markets. The release of China’s second-quarter GDP growth figures, retail sales, industrial production, and fixed asset investments will provide significant insights into the world’s second-largest economy. Investors will closely monitor these indicators as they provide valuable clues about the pace of economic recovery and the effectiveness of China’s policy measures. Given China’s significant role in global supply chains and its economic interdependence with other countries, any developments in China’s economic landscape can reverberate across international markets. Investors should stay informed about China’s economic performance and consider its potential impact on their investment portfolios. This week signals

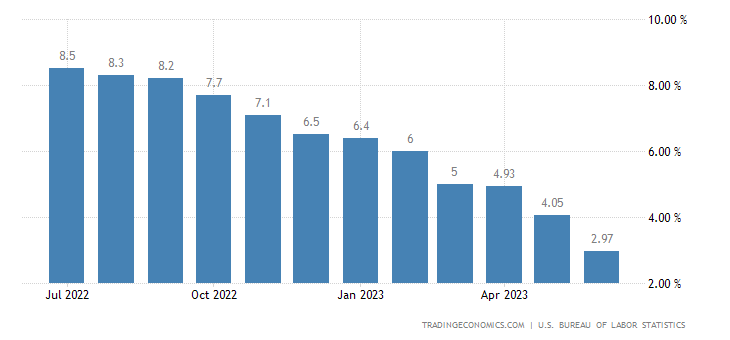

Inflation Rates:

Inflation rates are paramount as they impact economic stability and influence central bank policy decisions. This week, it is crucial to keep a watchful eye on inflation rates in the United Kingdom, Canada, Japan, New Zealand, and South Africa. Rising inflation can erode purchasing power and lead to increased production costs, potentially affecting corporate profitability. Central banks often respond to inflationary pressures by adjusting monetary policy, including interest rates. Consequently, investors need to assess the potential implications of inflationary trends on their investment strategies. By staying updated on inflation rates and central bank responses, investors can better position themselves to mitigate risks and identify opportunities.

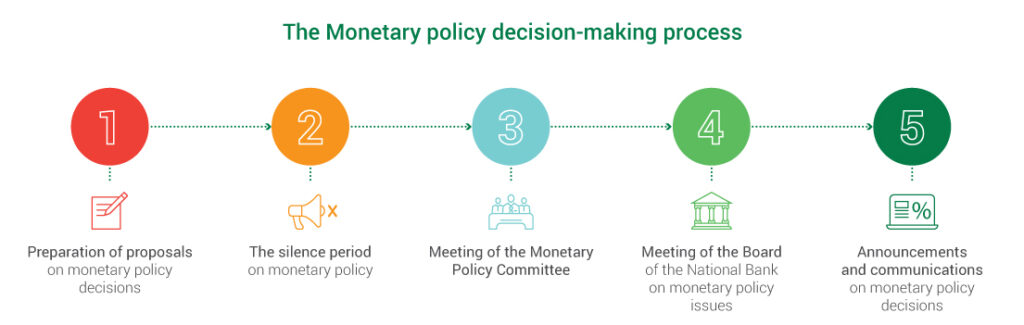

Monetary Policy Decisions:

When it comes to monetary policy decisions, we cannot underestimate their profound impact on the world of finance. This week, the central banks of Turkey and South Africa will step up to the plate and unveil their monetary policy stances. Now, these decisions hold the power to send shockwaves through the exchange rates, interest rates, and overall market sentiment. As investors, it’s crucial that we keep our ears to the ground and carefully evaluate the implications for specific asset classes. These central bank decisions are essentially a reflection of policymakers’ outlook on the current state of the economy. Their primary aim is to manage inflation, spur growth, and uphold financial stability. By gaining a deep understanding of the reasoning behind these decisions and their potential consequences, we can intelligently align our investment strategies and ride the waves of opportunity.

Key Economic Developments:

Australia’s release of the unemployment rate provides critical insights into the country’s labor market and economic conditions. A declining unemployment rate often signifies a robust economy, suggesting increased consumer spending and business investment. On the other hand, a rising unemployment rate can indicate economic weakness and dampen market sentiment. Investors should carefully analyze the unemployment rate data and consider its implications for various sectors and industries. Furthermore, retail sales data releases from the UK and Canada will offer valuable information about consumer spending patterns in these regions. Investors should examine these indicators to gain a nuanced understanding of market dynamics and identify potential investment opportunities. This week signals

Conclusion: This week signals

As this week unfolds, earnings reports, economic indicators, and central bank decisions will shape market sentiment and investor behavior. The outcomes of major US companies’ earnings reports, combined with the release of crucial economic data points, such as retail sales, industrial production, and housing data, will provide valuable insights into the health of the global economy. China’s economic performance will continue to influence global markets, while inflation rates and central bank decisions will play a pivotal role in shaping monetary policy and investor sentiment. By closely monitoring these developments and leveraging comprehensive analysis, investors can position themselves strategically, making informed decisions to navigate the dynamic financial landscape successfully.

Source: https://tradingeconomics.com