In this comprehensive review, we will delve into the details of the recent debt ceiling deal reached in the United States. The agreement, aimed at avoiding a catastrophic default and ensuring the government can continue to meet its financial obligations, encompasses various key provisions. We will examine the suspension of the debt ceiling, caps on spending (excluding defense), funding for IRS tax enforcement, and the streamlining of energy project permits. Additionally, we will discuss the implications of this deal for the stock market and explore potential future opportunities.

Table of Contents:

- Suspension of the Debt Ceiling

- Caps on Spending, Excluding Defense

- Funding for IRS Tax Enforcement

- Streamlining Energy Project Permits

- Conclusion: Implications and Outlook

Suspension of the Debt Ceiling

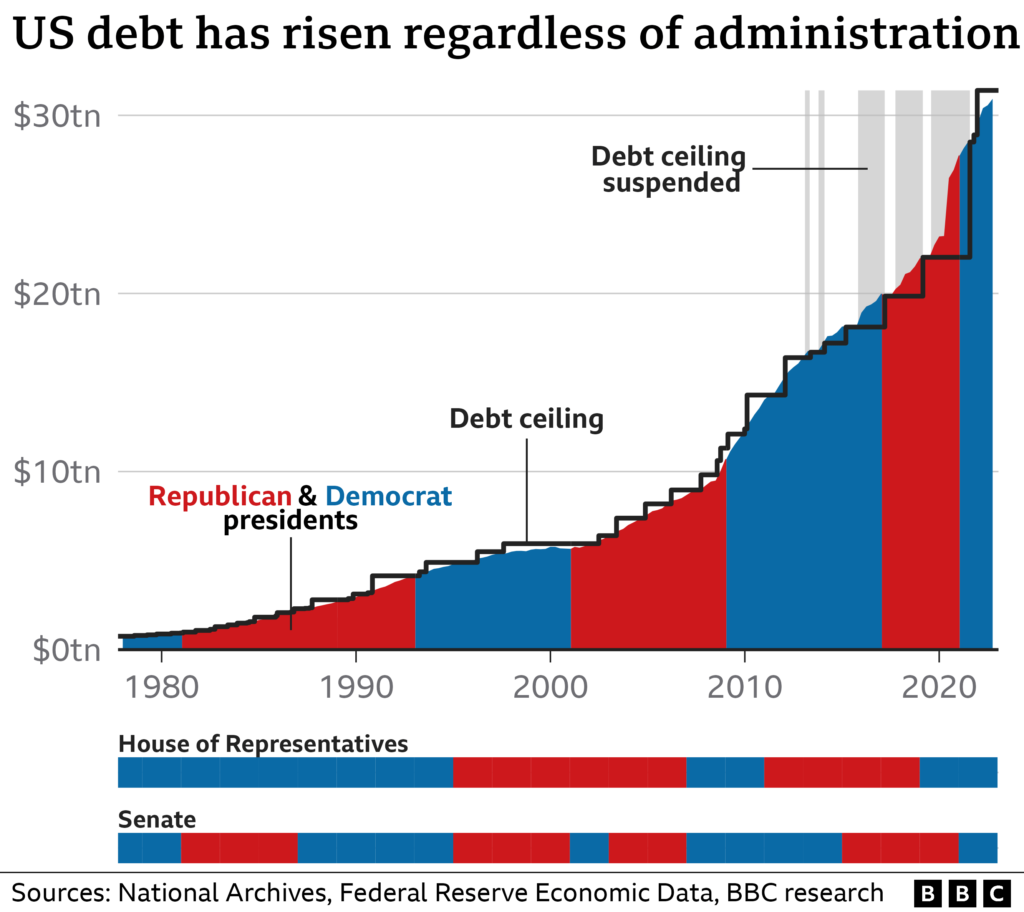

The debt ceiling, which has been a contentious topic in recent years, has been suspended until 2025. This means that the government can continue to borrow funds without a specified limit, ensuring the payment of bills and avoiding a default. By temporarily removing this constraint, the deal aims to provide stability until after the presidential election in November 2024. This suspension allows policymakers to focus on other pressing matters without the constant threat of a debt ceiling deadline, offering a reprieve from the previous political gridlock and uncertainty.

Caps on Spending, Excluding Defense

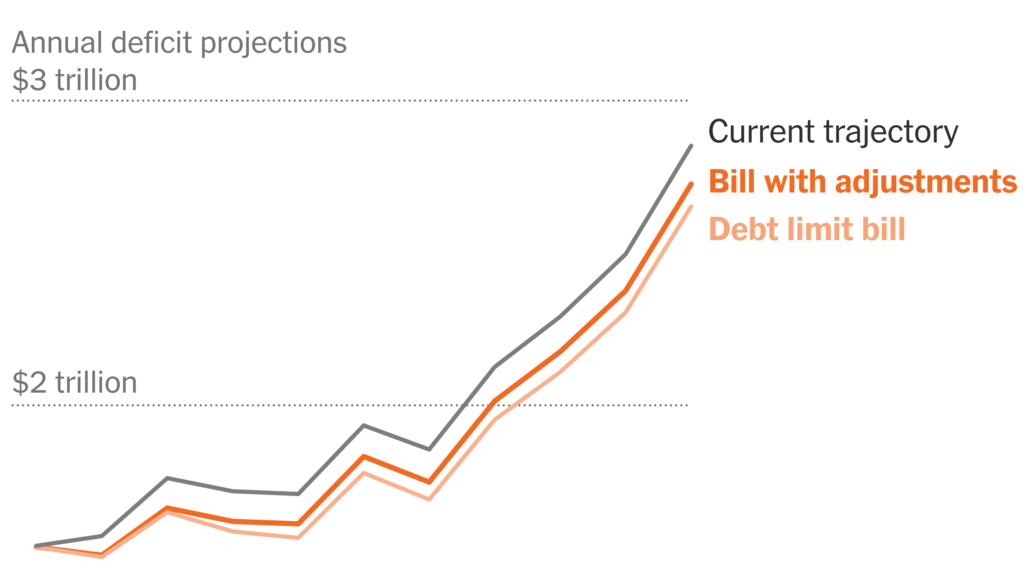

As part of the agreement, there are spending caps in place, with defense spending being exempted. Republicans had initially sought a freeze on overall spending for ten years, accompanied by increased defense spending and cuts to other budgets. However, the deal maintains non-defense spending at current levels in the upcoming year and allows for a 1% increase in 2025. The full implications of these spending caps are not yet entirely clear, but they signal an attempt to control government expenditure and address concerns about the national debt’s long-term impact.

Funding for IRS Tax Enforcement

A notable aspect of the debt ceiling deal is the inclusion of $80 billion over a decade to bolster IRS tax enforcement efforts targeting the wealthiest Americans. This funding aims to enhance tax compliance and close loopholes in the tax code. Originally met with resistance from Republicans, who raised concerns about increased audits, a compromise was reached with President Biden agreeing to a $20 billion reduction in funding. Nevertheless, this provision represents a significant win for Democrats, as it allows for stronger tax enforcement measures and potential revenue generation.

Streamlining Energy Project Permits

The deal also includes provisions to streamline the permitting process for both fossil fuel and renewable energy projects. This change seeks to expedite the environmental review process and facilitate the development of energy infrastructure. However, the specific projects to be prioritized remain a point of contention between the parties. Republicans advocate for more gas pipelines and fossil fuel projects, while Democrats prioritize clean energy initiatives. This division may present challenges in implementing a unified approach to energy development.

Conclusion: Implications and Outlook

The debt ceiling deal carries significant implications for the stability of the US economy and its financial markets. By suspending the debt ceiling until 2025, the agreement provides a temporary respite from the recurring debates surrounding the government’s borrowing limit. The spending caps and funding for IRS tax enforcement reflect efforts to control government expenditure and improve tax compliance. Moreover, the streamlined energy project permitting process aims to expedite infrastructure development, albeit with disagreements over the focus between fossil fuels and clean energy.

The implications for the stock market are largely dependent on the perception of stability and confidence in the US economy. The avoidance of a default scenario is likely to be positively received by investors, as it mitigates the potential for disruptions and market volatility. However, market reactions will also be influenced by factors such as overall economic conditions, corporate earnings, and global market dynamics.

Looking ahead, the debt ceiling deal opens up possibilities for more focused discussions on long-term fiscal policies, including addressing the national debt and structuring sustainable government spending. It provides an opportunity for bipartisan collaboration and consensus-building, paving the way for future negotiations and potential reforms. The deal’s outcomes may shape the trajectory of economic recovery, the direction of fiscal policy, and the prioritization of key initiatives such as clean energy transition and tax enforcement.

Final thoughts

The debt ceiling deal signifies a compromise between Democrats and Republicans to temporarily suspend the debt limit until 2025, providing relief from the recurring debates surrounding this issue. While the agreement seeks to avoid a default and its adverse impact on the economy, it also includes provisions for spending caps, IRS tax enforcement funding, and streamlined energy project permits. The following sections will provide an in-depth analysis of each component and its potential implications.

The point of view of your article has taught me a lot, and I already know how to improve the paper on gate.oi, thank you.