Introduction

In the ever-volatile world of finance, the upcoming week presents a labyrinth of economic events that will undoubtedly shape the course of stock markets. Investors, both novice and seasoned, are keeping a keen eye on several critical data points that could sway the tides of their investments. This week, our journey begins in the United States, where we delve into the intricacies of the Q3 GDP growth rate, the PCE Price index, personal income and spending, durable goods orders, and PMI readings from S&P Global. Alongside these domestic factors, we will also explore the pulse of the housing market, as well as the eagerly anticipated earnings reports from corporate giants such as Alphabet, Microsoft, Meta, Amazon, 3M, Coca-Cola, GM, and Spotify. Furthermore, we cast our gaze abroad to the central banks of the ECB, Bank of Canada, and Turkey’s TCMB, where interest rate decisions hold the power to send ripples across global markets. Flash services and manufacturing PMIs from Australia, Japan, France, Germany, the Euro Area, and the United Kingdom add further layers of intrigue to this week’s financial landscape. And, not to be forgotten, we scrutinize Australia’s inflation rate, Germany’s Ifo Business Climate, GFK consumer confidence, GDP growth rates in South Korea and Spain, and the UK’s unemployment rate, all of which stand as vital components of the intricate tapestry that is the stock market this week.

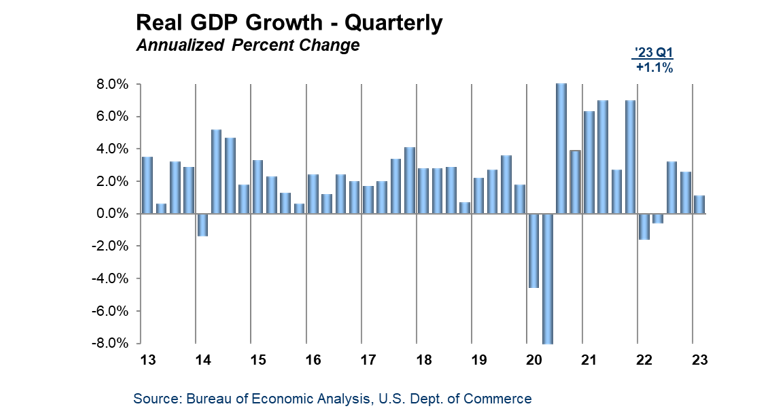

Starting on home soil, the United States presents an array of economic indicators that demand our attention. Firstly, the Q3 GDP growth rate is the heartbeat of the nation’s economic health. This figure encapsulates the overall growth of the U.S. economy, serving as an essential barometer for investors. Additionally, the PCE Price index, closely monitored by the Federal Reserve, guides the nation’s monetary policy. It measures inflation, a factor that significantly impacts investment decisions. When inflation rises, the purchasing power of the dollar diminishes, causing investors to seek alternatives such as stocks. The PCE Price index is, therefore, a critical data point for anyone navigating the stock market this week.

Meanwhile, personal income and spending provide insight into the financial well-being of Americans. Investors often view increasing personal income as a positive sign, as it implies greater consumer spending power. Consumer spending, in turn, fuels corporate revenues, which is a key factor in stock valuation. This intricate dance between personal income and consumer spending cannot be overstated. As investors ponder their stock choices this week, they must keep a watchful eye on this duo.

PMI reading

Durable goods orders and PMI readings from S&P Global are two more pieces of the puzzle. Durable goods orders reflect the demand for long-lasting products like machinery and equipment, providing a window into the nation’s industrial health. On the other hand, the Purchasing Managers’ Index (PMI) offers a glimpse into the manufacturing sector. A PMI above 50 signals economic expansion, while below 50 indicates contraction. These indicators are of paramount importance for those seeking clues about the stock market’s direction. A robust manufacturing sector implies growth and can bolster stock market sentiment.

Turning to the real estate market, housing market health is another essential factor affecting the stock market this week. Pending and new home sales are key indicators in assessing the strength of this sector. A buoyant housing market often suggests a strong economy, as it indicates consumer confidence and financial stability. When this market is robust, it can have a ripple effect on various industries, from construction to banking. For stock investors, it is vital to track these indicators closely, as they can be harbingers of broader economic trends.

Earnings reports

As the week unfolds, a tidal wave of earnings reports from major players such as Alphabet, Microsoft, Meta, Amazon, 3M, Coca-Cola, GM, and Spotify is poised to hit the stock market. These reports offer a wealth of information that can guide investment decisions. Revenue, profit margins, and guidance for future performance are among the key metrics examined by investors. A positive earnings report can trigger a surge in a company’s stock price, while a disappointing one can send it tumbling. Savvy investors must not only scrutinize these reports but also compare them to market expectations, as it is often the delta between reality and projections that sends shockwaves through stock prices.

On the international stage, central bank interest rate decisions are set to take center stage. The European Central Bank (ECB), Bank of Canada, and Turkey’s TCMB are among those making significant announcements. Interest rates are pivotal in shaping the financial landscape. A rate cut can stimulate economic activity and boost stocks, while a rate hike can have the opposite effect. Thus, investors need to stay attuned to the decisions made by these central banks, as they can greatly influence market sentiment and investment strategies.

Manufacturing PMIs

In addition to central bank decisions, the week unfolds with flash services and manufacturing PMIs from several countries, including Australia, Japan, France, Germany, the Euro Area, and the United Kingdom. These indices are powerful tools for assessing the health of a nation’s economy. They capture a snapshot of activity in the services and manufacturing sectors, offering insight into the direction of economic growth. Savvy investors can leverage these indicators to make informed decisions about their portfolios. For example, a rising PMI in a particular country may indicate an investment opportunity in that region.

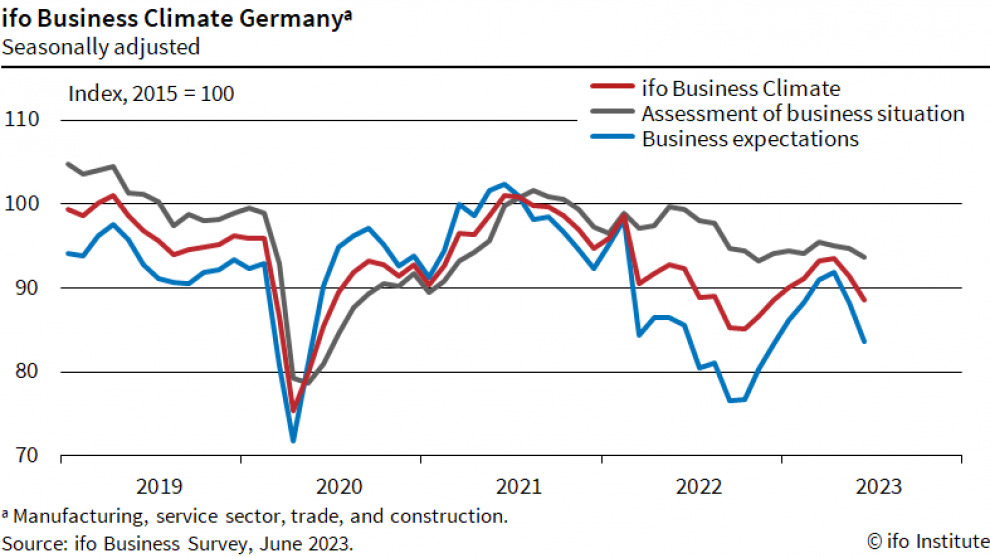

Australia’s inflation rate, Germany’s Ifo Business Climate, and GFK consumer confidence are like the orchestra’s notes in the symphony of global financial markets. Inflation rates, for instance, dance in harmony with the ebb and flow of a nation’s economic pulse, and their ripples touch the very core of exchange rates and international investments. They’re not just numbers on a screen; they’re the lifeblood of economic landscapes.

Now, let’s take a moment to appreciate Germany’s Ifo Business Climate. Think of it as the mood ring of Europe’s largest economy. This index doesn’t just reflect the sentiment of the business community; it’s a window into their collective soul, an emotional barometer for economic expectations. When the Ifo Business Climate changes its tune, investors and analysts listen closely, knowing that a shift in this melody can lead to dramatic consequences.

And then there’s GFK consumer confidence, a measure of the human spirit in financial form. It’s a gauge of how people view their own financial futures, and their willingness to open their wallets in the present. This is the heartbeat of consumer sentiment, the rhythm of the economy, and when it quickens or slows, the financial world takes notice.

These indicators aren’t just dry statistics; they’re the storytellers of our global economy. They whisper secrets about market movements, shout warnings about financial storms, and offer guidance to those who are wise enough to listen. So, whether you’re an investor, an economist, or simply someone curious about the pulse of the world, pay attention to these vital indicators; they are the voices that shape our financial narrative.

Additionally, GDP growth rates in South Korea and Spain, along with the UK’s unemployment rate, provide further dimensions to our analysis. A growing GDP is typically associated with economic prosperity, which tends to drive stock markets higher. On the other hand, unemployment rates reflect the health of the labor market, and lower unemployment often leads to increased consumer spending and economic growth. Understanding the nuances of these international indicators is crucial for investors navigating the stock market this week.

As we round off our thorough exploration of the stock market this week, it’s quite clear that the scene out there is a bustling hub of potential and peril. This intricate dance of economic cues, earnings disclosures, and choices made by the central bank weaves a tapestry of constant change, demanding unwavering attention and well-informed judgment.

For folks in the investor’s arena, the name of the game is staying clued in. It’s not just about the hard numbers; it’s about grasping the broader economic consequences that ride in on the coattails of these factors. To steer your way through the stock market’s ever-shifting currents and seize the opportunities that beckon, you’ve got to dig deep into the financial terrain.

This week, as you mull over your investments and keep a hawk’s eye on every twist and turn in the market, remember this: knowledge reigns supreme in the realm of finance. So, keep those facts flowing, keep your guard up, and may your investments bear the fruit you seek.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.