Introduction

The S&P Global US Composite PMI for September 2023 has cast a spotlight on the intricate tapestry of the American economy. This preliminary estimate, revealing a slight decline from August, underscores a broader stagnation in private sector activity. As we delve into this comprehensive analysis, we’ll dissect the various facets of the PMI report, shedding light on its implications for investors and economists alike. Moreover, we’ll explore the potential SP500 stock signals that can be derived from these economic trends.

Private Sector Stagnation: A Four-Month Decline

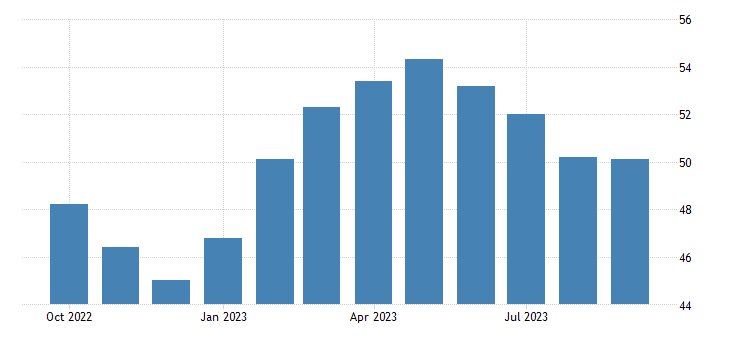

The S&P Global US Composite PMI, standing at 50.1 in September 2023, signals the fourth consecutive month of declining performance—a trend not witnessed since February. This tepid figure reflects a private sector grappling with challenges. Service sector growth has dipped to an eight-month low, while manufacturing output continues to contract, weighed down by high-interest rates and persistent inflationary pressures. The American economic landscape appears to be treading water, and this stasis raises questions about the trajectory of future growth.

New Business and Outstanding Business: A Worrying Confluence

What should truly command our attention is the concurrent decline in the influx of new business, marking its most significant drop since December 2022, coupled with the swiftest descent in outstanding business levels since May 2020. This intriguing confluence of events sketches a portrait of mounting uncertainty and a palpable hesitancy within the private sector. It’s not just a statistical anomaly; it’s a narrative unfolding before our eyes—a narrative that holds the potential to send ripples across the investment landscape.

This scenario should be on the radar of every astute investor, particularly those with a keen eye on deciphering the ever-elusive SP500 stock signals. The intricate dance of these economic elements, as they intermingle and influence one another, can serve as a compass guiding investment strategies through the uncharted waters of the market. Each data point is a brushstroke on the canvas of the economy, and interpreting these strokes accurately is the art of successful investing.

Accelerated Job Creation Amidst Stagnation

Intriguingly, amidst the prevailing stagnation, there emerges a glimmer of hope—a beacon of optimism, if you will. The rate of job creation, against the backdrop of economic headwinds, has surged to its most rapid pace since May. This statistical anomaly hints at a certain cautious optimism that seems to permeate businesses’ outlooks on the future.

However, this glimmer of hope should be embraced with a sense of caution and perspective. It’s akin to a single ray of sunlight piercing through dark clouds. While it’s heartening to witness businesses stepping up their hiring game, we must place this development within the broader context of an economy grappling with stagnation. The complexities of economic dynamics often paint a nuanced picture, and understanding this uptick in job creation requires a discerning eye—one that appreciates both the potential for growth and the challenges that continue to loom on the horizon.

Inflationary Pressures and Business Confidence

Inflation remains a key driver of economic dynamics. Input cost inflation has quickened to its highest level since June, adding further strain to businesses already contending with an array of challenges. On the flip side, the rate of charge inflation is among the slowest seen in three years. This dynamic bears implications for profit margins and consumer behavior, both of which can reverberate through the stock market.

Moreover, business confidence, a pivotal indicator of economic sentiment, has dipped to a nine-month low. This decline in confidence can have a self-fulfilling effect, influencing business decisions and potentially hampering investment and expansion plans.

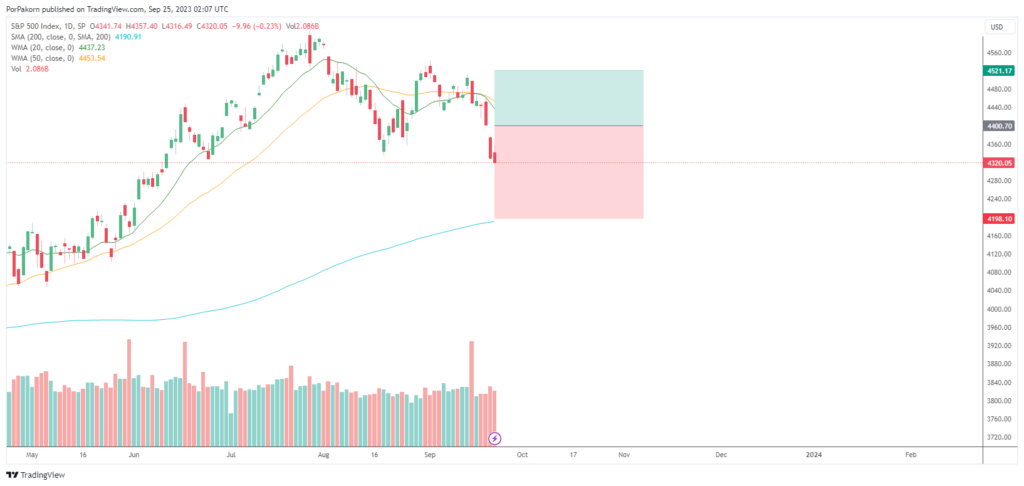

SP500 Stock Signal: Navigating Uncertain Waters

As investors navigate these uncertain economic waters, it’s crucial to glean potential SP500 stock signals from the PMI report. The declining private sector activity, coupled with a contraction in manufacturing and the erosion of business confidence, may warrant a cautious approach. The resilience of job creation amid stagnation could offer a silver lining, but it should be considered in the context of broader economic challenges.

Inflationary pressures and their impact on profit margins should also be closely monitored. A delicate balance exists between maintaining competitiveness and passing on rising costs to consumers. Investors should remain vigilant for signals of how businesses are managing this challenge.

Conclusion

The S&P Global US Composite PMI for September 2023 paints a nuanced picture of an economy grappling with stagnation, declining private sector activity, and inflationary pressures. While the acceleration in job creation offers a glimmer of hope, it should be viewed alongside other indicators of economic sentiment.

For those seeking SP500 stock signals, a cautious approach may be prudent. Navigating these uncertain economic waters requires a keen understanding of the intricate interplay of economic factors and their potential impact on the stock market. Staying informed and adaptable remains the key to successfully weathering these economic challenges.

One thought on “S&P Global US Composite PMI: A Comprehensive Analysis of Economic Trends and SP500 Stock Signals in September 2023”