The Chinese property market has recently exhibited warning signs that have drawn attention to potential risks and their implications for the broader economy. This comprehensive article delves into the current state of China’s property market, analyzes key statistics, explores the impact of government support measures, examines changing attitudes among the younger generation, and assesses the future outlook for the market. Additionally, it provides insights into the potential implications for the stock market, new possibilities that may emerge, and a thorough comparison of stats from the previous year. By combining fundamental and technical outlooks, this article aims to provide a unique perspective on navigating the challenges and opportunities in China’s property market.

Table of Contents:

- Current State of China’s Property Market

- New Home Sales: A Comparative Analysis

- Stimulus Package: Bolstering the Market

- Government Support: Measures to Address Warning Signs

- Shifting Attitudes: Why the Younger Generation is Less Interested in Buying Homes

- Unemployment Comparison: Impact on the Property Market

- Future Outlook: Assessing the Prospects of China’s Property Market

- Implications for the Stock Market: Analyzing the Linkages

- New Possibilities: Exploring Innovation and Alternative Solutions

Current State of China’s Property Market

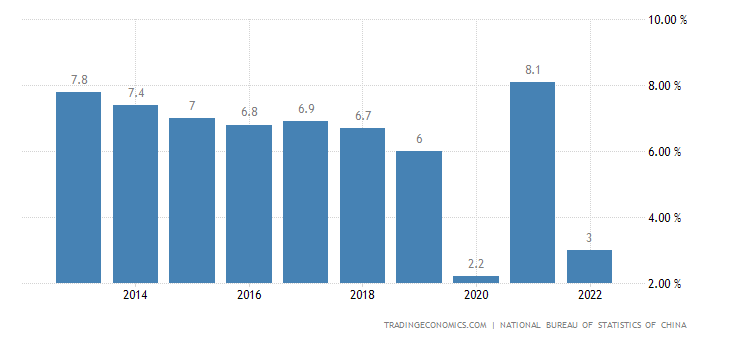

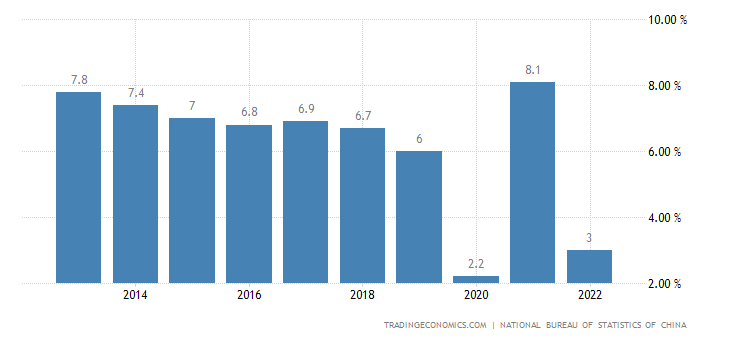

The Chinese economy expanded by 3% in 2022, the lowest since 1976 when excluding the atypical year of 2020, and well below the government’s target of 5.5%. This underperformance is closely tied to the property market’s performance. In April 2023, the House Price Index MoM in China decreased to 0.40%, down from 0.50% in March, according to the National Bureau of Statistics of China. These statistics raise concerns and highlight warning signs in the market.

New Home Sales: A Comparative Analysis

To gain deeper insights into the property market, it is crucial to compare new home sales data from the previous year. By examining the year-on-year changes, we can better understand the trends and dynamics in the market and identify potential warning signs.

Stimulus Package: Bolstering the Market

In response to the warning signs, the Chinese government has introduced a new stimulus package designed to revitalize the property market. This package includes measures such as reduced interest rates, relaxed mortgage restrictions, and tax incentives for homebuyers. These initiatives aim to stimulate new home sales and provide a much-needed boost to the market.

Government Support: Measures to Address Warning Signs

Recognizing the significance of the property market for the overall economy, the Chinese government has implemented several measures to stabilize the market. These measures include stricter regulations on speculative buying, increasing housing supply, and promoting affordable housing initiatives. However, the effectiveness of these interventions remains to be seen.

Shifting Attitudes: Why the Younger Generation is Less Interested in Buying Homes

The younger generation in China has shown a declining interest in purchasing homes. Several factors contribute to this shift, including soaring property prices, increasing debt burdens, and evolving lifestyle preferences. Understanding these changing attitudes is crucial for assessing the long-term stability and growth prospects of the property market.

Unemployment Comparison: Impact on the Property Market

Comparing unemployment rates between the current year and the previous year allows us to gauge the market’s vulnerability to economic fluctuations. Higher unemployment rates can dampen purchasing power and weaken demand for properties, exacerbating the warning signs in the market.

Future Outlook: Assessing the Prospects of China’s Property Market

Looking ahead, the future of China’s property market remains uncertain. The market will be influenced by various factors, including government policies, economic stability, and market sentiment. Monitoring indicators such as GDP growth, inflation, and housing affordability will provide insights into the market’s future direction.

Implications for the Stock Market: Analyzing the Linkages

The warning signs in China’s property market have implications for the stock market as well. Investors need to carefully analyze how the property market’s performance could impact related sectors, such as construction, banking, and real estate investment trusts (REITs). This analysis will aid in making informed decisions and managing risks in the stock market.

New Possibilities: Exploring Innovation and Alternative Solutions

While warning signs indicate challenges, they also present opportunities for innovation. Proptech solutions, affordable housing initiatives, and sustainable development practices are avenues to explore amid changing market dynamics. Industry players should embrace these possibilities and adapt to new trends.

Conclusion: Navigating Uncertainties and Seizing Opportunities:

In conclusion, the warning signs in China’s property market highlight potential risks and challenges. However, they also present opportunities for innovation and adaptation. Navigating these uncertainties requires careful monitoring of indicators, market trends, and policy developments. By staying informed and embracing new possibilities, investors and market participants can position themselves to seize opportunities in the evolving landscape of China’s property market.

Outlook on the stock market

The warning signs in the property market can have significant implications for the stock market. Investors should closely monitor developments and adjust their strategies accordingly.

Outlook on new possibilities in the future: Amid warning signs, new possibilities emerge, such as prop tech solutions, affordable housing initiatives, and sustainable development practices. Exploring these avenues can contribute to the market’s resilience and future growth.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?