Introduction

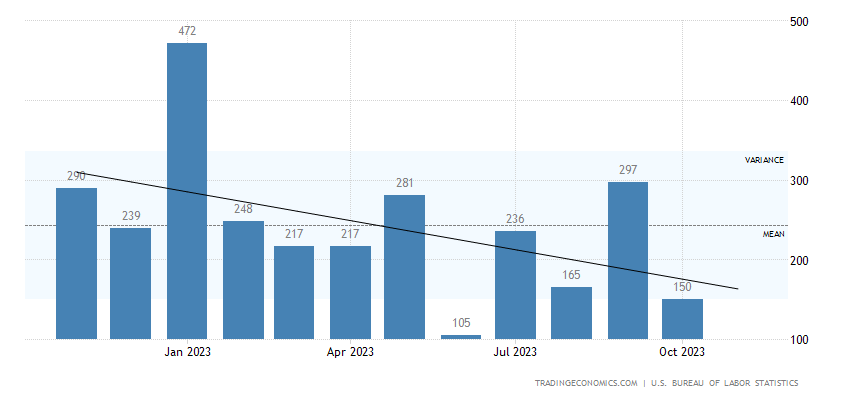

In the latest update on the U.S. labor market, we delve into the intricacies of the Non-Farm Payrolls report for October 2023. This critical economic indicator reveals a multitude of insights about the nation’s employment landscape. Though the data portrays a scenario with 150,000 new jobs added, a decline from the previous month, it is imperative to scrutinize the details within this report. This analysis, in the distinct style of Paul Krugman, will uncover the nuances that lie beneath the surface, shedding light on the implications for various sectors and the overall economic trajectory.

Understanding the Numbers

October 2023 witnessed the addition of 150,000 jobs to the U.S. economy, a stark contrast to the downwardly revised 297,000 jobs in September and well below market expectations of 180,000. A closer look at this data reveals the gradual cooling of the labor market. Several factors contributed to this cooling trend, including strikes by members of the United Auto Workers (UAW), which had a noticeable impact on manufacturing payrolls. While the figures may appear discouraging at first glance, let’s explore the sectors that played a pivotal role in shaping these statistics.

Sectoral Analysis

- Health Care: The healthcare sector emerged as a beacon of hope in October, adding 58,000 jobs. Among these, ambulatory healthcare services contributed 32,000 jobs, and hospitals accounted for 18,000. This robust growth signifies the resilience of the healthcare industry, which remains a cornerstone of the American job market.

- Government: With an impressive gain of 51,000 jobs, the government sector demonstrated a resurgence, returning to its pre-pandemic February 2020 level. This development suggests that government employment is on the path to recovery.

- Construction: The construction industry also played a significant role in bolstering job numbers, contributing 23,000 positions. This is a positive sign, reflecting ongoing infrastructure projects and the need for skilled labor in the construction domain.

- Social Assistance: The social assistance sector added 19,000 jobs, indicating the continued demand for services in this field. This sector’s steady growth underscores its importance in the broader employment landscape.

- Leisure and Hospitality: The leisure and hospitality sector witnessed an increase of 19,000 jobs. This growth may be attributed to the gradual recovery of the tourism and hospitality industries, as travel restrictions ease and consumer confidence returns.

- Professional and Business Services: The professional and business services sector expanded by 15,000 jobs, reflecting the ongoing demand for specialized expertise in various industries.

Challenges in the Manufacturing Sector

However, it’s not all sunshine and roses. The manufacturing sector faced significant challenges in October, with employment declining by 35,000 jobs. This decline exceeded forecasts of a 10,000 job reduction, primarily due to a 33,000 drop in motor vehicles and parts manufacturing, driven by strike activity within the United Auto Workers (UAW). The impact of strikes on manufacturing underscores the influence of labor disputes on the broader economic picture.

Assessing the Bigger Picture

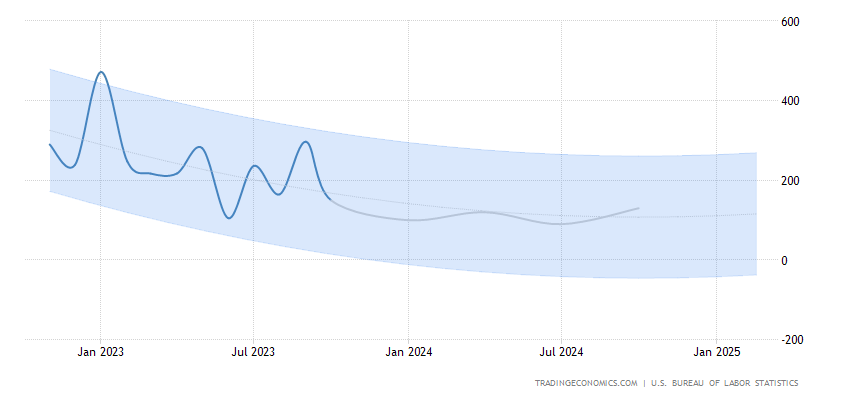

While October’s job growth was below the average monthly gain of 258,000 over the previous 12 months, it’s crucial to recognize that this figure remains comfortably above the 70,000-100,000 jobs needed per month to keep pace with the growth in the working-age population. This underscores the resilience of the U.S. labor market, which continues to expand, albeit at a slightly slower pace. The non-farm payrolls report, in this context, should be viewed as part of the broader economic tapestry rather than a solitary snapshot.

Non-Farm Payrolls and Economic Implications

The Non-Farm Payrolls report serves as a vital economic barometer, influencing various aspects of the financial world. It impacts monetary policy decisions by the Federal Reserve, stock market performance, and consumer sentiment. A nuanced understanding of this report is essential for anyone engaged in financial markets or economic forecasting.

Federal Reserve’s Dilemma

One of the report’s most immediate impacts is on the Federal Reserve’s policy decisions. The central bank closely monitors employment data, and fluctuations in the non-farm payrolls figures can sway its stance on interest rates. A strong job market may prompt the Fed to consider raising rates to prevent overheating, while a weak labor market may lead to rate cuts to stimulate economic growth. As we navigate the intricate web of monetary policy, the October 2023 data presents a challenge for the Federal Reserve, with slower job growth and labor disputes complicating their decision-making.

Market Response

Financial markets are also sensitive to the non-farm payrolls report. Stock markets can react positively to robust job growth, as it signifies a healthy economy and increased consumer spending. Conversely, weaker employment data can trigger market volatility. In October 2023, the subpar job gains and manufacturing decline led to mixed reactions in financial markets, highlighting the significance of comprehending the report’s nuances for investors and traders.

Consumer Sentiment

Beyond the financial realm, non-farm payrolls influence consumer sentiment. Job security and wage growth are essential factors in determining consumer confidence. A buoyant job market with wage increases can lead to higher consumer spending, while a sluggish job market may result in more cautious spending habits. The October data, while showing cooling job growth, may not necessarily translate to a decline in consumer sentiment, given the overall resilience of the labor market.

Expert Advice

In these times of economic uncertainty, it’s absolutely vital for financial pros and investors to wrap their heads around the nitty-gritty of the Non-Farm Payrolls report. To truly ride the waves of this ever-shifting economic sea, you’ve got to keep your ear to the ground, stay ready for those market rollercoasters, and stay ahead of the game when it comes to guessing how the Federal Reserve will react to these job figures.

Now, as someone who’s been around the block a few times in this field, let me share some friendly advice: Make sure you’ve got your gaze firmly fixed on the ongoing saga of the U.S. job market. It’s going to remain a major driving force that’ll mold the future of our nation’s economy.

Conclusion

The October 2023 Non-Farm Payrolls report isn’t just a bland set of statistics; it’s a portal into the intricate web of the U.S. labor market. Sure, the headline numbers might not immediately knock your socks off, but there’s a rich tapestry of strengths and challenges woven into the fabric of different sectors, waiting for those willing to delve a little deeper.

Now, you might wonder why this report is worth your attention. The answer is simple: it holds the key to understanding how the Federal Reserve will move, how financial markets will sway, and even how Joe and Jane Public will feel about their wallets. And in this ever-changing financial landscape, staying ahead of the curve means being well-informed. So, my seasoned advice in these uncertain times is this: keep a vigilant eye on the ever-shifting economic terrain, and arm yourself with knowledge to navigate the complexities of Non-Farm Payrolls data, making wise decisions in the ever-evolving world of finance.