Introduction:

May 2023 brought an unexpected glimmer of hope for Japan’s export industry, defying the pessimistic predictions of a decline. It was a pleasant surprise that caught many off guard. In this article, we embark on a journey to provide you with a comprehensive analysis of Japan’s export performance during this Nikkei Trade signal.

Our aim is to unravel the story behind this surprising turn of events, shedding light on the key sectors and destinations that played a pivotal role. We will delve deep into the underlying factors that drove these trends, navigate through the challenges faced along the way, and offer valuable insights into the broader implications for Japan’s economy and the global trade landscape.

So, fasten your seatbelts as we embark on this exploration of Japan’s export dynamics in May 2023, uncovering the unexpected twists and turns that have shaped its trajectory. Together, we will navigate through the data and uncover the factors that contributed to this unforeseen growth, enabling us to grasp the significance and implications of Japan’s export performance during this period.

I.Overall Export Performance:

In May 2023, Japan’s exports witnessed a modest increase of 0.6% year-on-year (YoY), reaching JPY 7,292.6 billion. This positive outcome surpassed market forecasts of a 0.8% fall and marked the 27th consecutive month of growth. However, it is important to note that the pace of growth was the slowest since February 2021, primarily due to lower sales to China.

II.Sectoral Analysis:

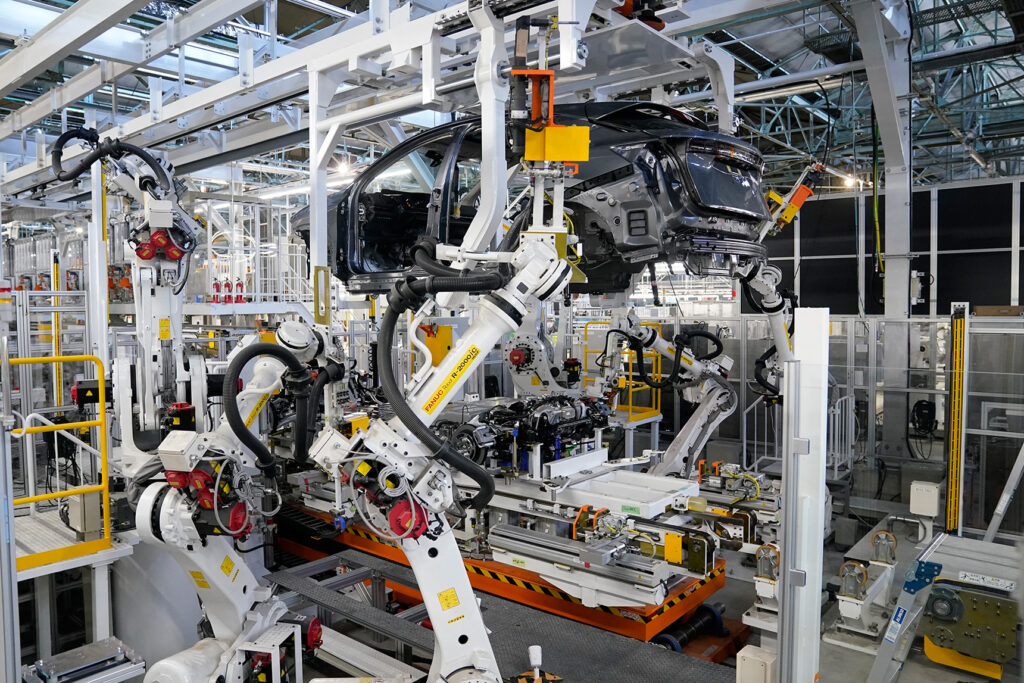

Transport Equipment: The transport equipment sector exhibited remarkable growth, with sales soaring by 38.9% YoY. This surge was mainly driven by the exceptional performance of motor vehicles, which experienced a substantial increase of 66.3%. Additionally, other sub-sectors within transport equipment witnessed an 8.5% growth.

Machinery:

However, amidst the overall positive export trend, the machinery sector faced a slight setback with a decline of 3.7%. This downturn can be primarily attributed to a slump in semicon machinery, which experienced a significant decrease of 20.2%. The demand for semiconductors took a hit, reflecting the challenges faced by this particular segment.

Moreover, Nikkei Trade signal the broader category of manufactured goods within the machinery sector also witnessed a decline of 7.5%. This decline highlights the potential hurdles and obstacles encountered by this sector, indicating that there are underlying challenges that need to be addressed. It’s crucial for industry players to closely examine these factors and strategize accordingly in order to navigate the uncertainties and reinvigorate growth in the machinery sector. By identifying and tackling the challenges head-on, Japan’s machinery industry can aim to regain its momentum and drive future export growth in the global market.

Electrical Machinery:

Exports of electrical machinery faced an 8.0% decrease, primarily driven by declines in the semiconductors (-12.1%) and IC (-10.4%) sub-sectors. This decline highlights the impact of global supply chain disruptions and fluctuations in demand for electronic components.

Chemicals:

Sales of chemicals experienced a contraction of 15.0%, primarily influenced by declines in the plastics (-16.8%) and organic chemicals (-9.8%) segments. This downturn can be attributed to factors such as reduced global demand, changing consumer preferences, and increasing environmental considerations.

III. Market Destinations:

Positive Performers: Japan’s exports saw encouraging growth in several key markets. Sales to the United States increased by 9.4%, while Indonesia experienced a notable rise of 8.1%. Germany, India, Russia, and the European Union (EU) also demonstrated strong demand, with growth rates of 17.2%, 23.5%, 34.8%, and 16.6%, respectively.

Nikkei Trade signal

On the flip side, some markets encountered a downturn in imports from Japan, presenting a contrasting picture. Hong Kong, a significant trading partner, experienced a notable decrease of 10.2%. Similarly, Taiwan, South Korea, and the Philippines faced more pronounced declines of 19.5%, 11.2%, and 20.9%, respectively.

The challenges faced in these markets stem from a combination of factors, including regional economic dynamics, evolving trade policies, and shifts in consumer preferences. Changes in the economic landscape of these regions, along with the dynamic nature of trade regulations, have impacted the demand for Japanese exports.

Furthermore, evolving consumer preferences have played a role in shaping the decline. As consumer tastes and preferences shift, the demand for certain Japanese goods may decrease in these markets. This emphasizes the need for Japanese exporters to remain agile, adaptable, and responsive to changing consumer trends in order to regain momentum in these regions.

Understanding the intricacies of each market’s challenges will be instrumental in formulating effective strategies to address the specific hurdles faced in Hong Kong, Taiwan, South Korea, and the Philippines. By closely examining these factors and tailoring their approach accordingly, Japanese exporters can seek opportunities to revive growth and regain their foothold in these markets.

IV Implications and the Way Forward:

The surprising growth in Japan’s exports during May 2023, despite the challenges encountered, showcases the remarkable resilience of its economy and the adaptability of its industries. It is a testament to the unwavering spirit of Japanese businesses and their ability to find opportunities even in uncertain times.

However, Nikkei Trade signal it is important to approach the future with caution, as the global trade landscape remains shrouded in uncertainty. Japan’s export performance is intricately intertwined with a complex web of factors that shape the global economic stage. From the ebbs and flows of the global economy to the rapid advancements in technology, the ever-shifting geopolitical dynamics, and the evolving preferences of consumers worldwide, all these elements exert their influence on Japan’s exports.

To ensure a sustainable growth trajectory, Japan must proactively respond to these dynamic forces. Embracing innovation, investing in research and development, and fostering collaborations will be key to staying ahead of the curve. By harnessing emerging technologies, identifying emerging market trends, and comprehending the intricacies of global trade dynamics, Japan can position itself strategically to seize future opportunities.

Moreover, diversifying both the export markets and product portfolios will be crucial in mitigating risks associated with overdependence on specific sectors or regions. Exploring untapped markets, adapting to changing consumer demands, and expanding the reach of Japanese exports will foster resilience in the face of external shocks.

In conclusion, Japan’s unexpected export growth in May 2023 is a testament to its economic fortitude. However, the journey ahead requires unwavering vigilance and agility. By capitalizing on technological advancements, understanding evolving consumer preferences, and venturing into new markets, Japan can chart a course toward sustainable export growth and continue to play a vital role in the global trade arena.

Hey very nice blog!! Man .. Beautiful .. Amazing .. I will bookmark your blog and take the feeds also…I am happy to find a lot of useful information here in the post, we need work out more strategies in this regard, thanks for sharing. . . . . .