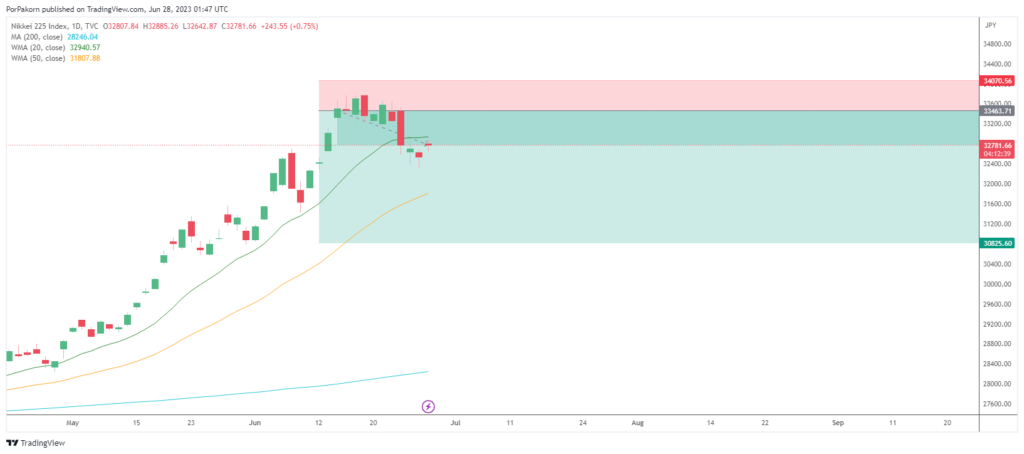

Introduction: Nikkei Stock Signal

In today’s dynamic financial landscape, the Nikkei 225 Index surged by an impressive 0.7% to surpass 32,700, while the broader Topix Index experienced a gain of 0.85%, reaching 2,273. This remarkable reversal of losses from the previous session was largely influenced by the encouraging performance of Wall Street. The upbeat economic data emanating from the United States has injected renewed optimism into the global economic outlook, despite concerns over persistent inflation and higher borrowing costs. Notably, the Japanese market has also been buoyed by a weakening yen, which not only bolsters the profit outlook for the country’s export-driven industries but also renders local assets more alluring to foreign investors. In this article, we delve deeper into the factors driving the Japanese market’s recent surge and the noteworthy contributions from key technology and heavyweight stocks.

Technology Stocks Lead the Way:

Technology stocks spearheaded the Japanese market’s upward trajectory, exhibiting robust gains that propelled overall investor sentiment. Among the standout performers, Advantest achieved an impressive 1.2% increase, while Socionext soared by an impressive 5.6%. Tokyo Electron, Keyence, and Renesas Electronics also contributed significantly to the market’s bullish sentiment, with gains of 1.7%, 2%, and 2.5%, respectively. These companies have leveraged their technological prowess and strategic positioning to navigate the challenging market conditions effectively. Their exceptional performance attests to the robustness of Japan’s technology sector and highlights the potential for further growth in this space. Investors would do well to pay heed to these stocks, as they exhibit strong momentum and offer attractive opportunities in the current market environment.

Noteworthy Contributions from Index Heavyweights:

In addition to the exceptional performance of technology stocks, several heavyweight companies within the Japanese market made significant strides, driving the overall positive momentum. Toyota Motor, a leader in the automotive industry, witnessed a commendable 1.6% surge. Nippon Tel, a prominent telecommunications company, followed suit, registering a noteworthy gain of 2%. Sony Group, Oriental Land, and Shin-Etsu Chemical also joined the rally, each contributing gains of 1.3%, 1%, and 1.9%, respectively. These index heavyweights exemplify the diverse sectors within Japan’s robust economy, demonstrating the strength and resilience of the nation’s key industries. Investors seeking stable and reliable investment opportunities should carefully consider the performance of these established companies, as they play a pivotal role in driving the Japanese market’s growth and stability.

The Impact of Wall Street’s Positive Lead:

The recent positive lead from Wall Street exerted a profound influence on the Japanese market, elevating investor sentiment and contributing to the overall surge in stock prices. The United States, as a global economic powerhouse, often serves as a barometer for market trends and investor confidence worldwide. The release of upbeat economic data from the US served as a strong catalyst, rekindling hopes for sustained global economic growth. Despite lingering concerns over inflation and higher borrowing costs, the market’s reaction to these challenges has been remarkably resilient. This resilience can be attributed to the favorable economic indicators, which have mitigated concerns to a considerable extent, and the growing optimism surrounding the prospects of the global economy.

Weakening Yen Boosts Export-Heavy Industries:

A notable factor driving the Japanese market’s recent gains is the depreciation of the yen. A weaker yen not only enhances the profit outlook for Japan’s export-driven industries but also enhances the attractiveness of local assets for foreign investors. The export-heavy sectors, including technology, automotive, and manufacturing industries, have been major beneficiaries of this favorable exchange rate environment. As the yen continues to weaken, these industries are poised to reap substantial benefits, thereby creating potentially lucrative opportunities for investors. It is crucial for investors to closely monitor currency movements and consider the impact on key sectors within the Japanese market. This strategic approach will enable investors to capitalize on favorable conditions and maximize their investment potential.

Conclusion: Nikkei Stock Signal

In conclusion, the Nikkei Stock Signal has been resoundingly positive, with the Japanese market witnessing a remarkable surge, propelled by Wall Street’s positive lead, technology stocks’ strong performance, contributions from index heavyweights, and the weakening yen. These combined factors have created an environment ripe with investment potential, despite concerns over persistent inflation and higher borrowing costs. As a financial professional, it is vital to remain vigilant and analyze market dynamics comprehensively. By capitalizing on the current opportunities and monitoring key developments within the Japanese market, investors can position themselves strategically to optimize their investment portfolios and achieve long-term financial success.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.