Introduction

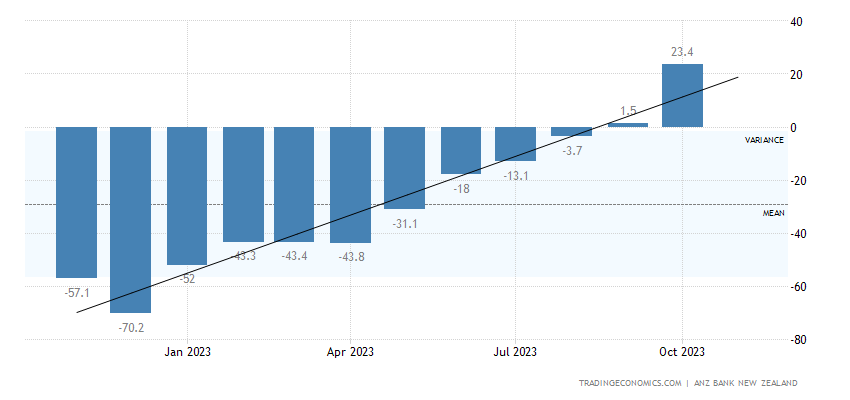

In October 2023, New Zealand’s economic landscape witnessed a remarkable upswing as the ANZ Business Outlook Index surged from 1.5 in September to an impressive 23.4. This significant leap, the highest reading since June 2017, marks a turning point in the country’s economic trajectory. With two consecutive months of positive figures, this transformation coincides with the aftermath of the general election held on October 14th. In this comprehensive analysis, we delve into the various facets of the ANZ Business Outlook Index, shedding light on the implications for New Zealand’s economic future. New Zealand Business Confidence

New Zealand’s Economic Resurgence

The ANZ Business Outlook Index is a reliable barometer of New Zealand’s economic health, and its recent surge is indeed a cause for optimism. The own activity outlook saw a substantial increase, jumping from 10.9 in September to an impressive 23.1. This surge is indicative of the renewed confidence in the business community, reflecting not only a recovery but also a burgeoning enthusiasm for growth and expansion. It is an essential driver of the overall index and indicates an economic revival on the horizon.

Export and Investment Intentions

The resurgence in New Zealand’s economic outlook is not confined to domestic activity alone. The intentions for exports and investments have also witnessed a considerable upturn. Export intentions increased from -0.4 in September to a positive 6.1, marking a return to a growth trajectory. This is a testament to New Zealand’s resilience in the face of global economic challenges. Moreover, investment intentions, which were at -4.1 in September, have turned positive at 3.8. This suggests that businesses are not only looking to sustain themselves but are also planning for expansion and long-term stability.

Employment on the Rise

One of the most promising aspects of the ANZ Business Outlook Index is the surge in employment intentions. The figure climbed from 1.2 in September to 5.6 in October. This indicates a renewed commitment by businesses to expand their workforce. The increase in employment intentions is not just a reaction to immediate demand but suggests a belief in the sustained growth of New Zealand’s economy. More jobs translate to increased consumer spending, which, in turn, fuels economic growth.

Profit Expectations and Their Implications

The ANZ Business Outlook Index also provides valuable insights into profit expectations, which play a pivotal role in shaping economic decisions. The figure surged from -13.2 in September to a positive -5.6 in October, marking the highest since August 2021. This positive outlook on profits has profound implications for businesses. It provides the financial cushion needed for investments, expansion, and innovation. Moreover, it signals to investors and stakeholders that New Zealand is a fertile ground for financial opportunities.

Stability in Pricing and Cost Expectations

The stability in pricing intentions, which changed only marginally from 47.1 in September to 46.3 in October, indicates a steady and controlled approach to price management among businesses. This is a positive sign, as excessive price fluctuations can create uncertainty in the market. Similarly, cost expectations, though down slightly from 78.6 in September to 76.0 in October, remain high. Businesses should consider this as an incentive to continue focusing on cost-saving measures and efficiency to ensure sustained profitability.

Wage Expectations and Their Impact

Wage expectations in October, at 81.3, remained relatively high, only slightly down from 82.2 in September. While high wage expectations can be a sign of a tight labor market, it also reflects the growing commitment to retaining and attracting skilled workers. Higher wages can lead to increased consumer spending, further boosting the economy. Businesses need to manage this aspect prudently to ensure a balanced approach that aligns with their profit expectations.

Ease of Credit

The ANZ Business Outlook Index also reveals that the ease of credit has improved, with the figure moving from -23.5 in September to -20.8 in October. This positive change indicates that businesses may find it easier to access credit, which is vital for financing growth and expansion. It is a favorable environment for businesses seeking capital to invest in their operations, research, and development.

Inflation Expectations

Inflation expectations remained relatively flat, with only a minor decrease from 4.95% in September to 4.94% in October. This stability in inflation expectations is a reassuring sign for businesses and consumers alike. High or unpredictable inflation can erode purchasing power, making long-term planning and investment challenging. Businesses should view this stability as an opportunity to make informed financial decisions. New Zealand Business Confidence

Construction Sector Resilience

The construction sector in New Zealand has shown remarkable resilience, with commercial construction improving significantly, moving from -29.6 in September to -4.0 in October. This rebound is indicative of renewed confidence in the commercial real estate market. Conversely, residential construction remained somewhat sluggish, with a marginal decrease from -13.6 in September to -12.5 in October. This divergence highlights the differences in demand and investor sentiment between the commercial and residential segments of the construction industry.

Conclusion: New Zealand Business Confidence

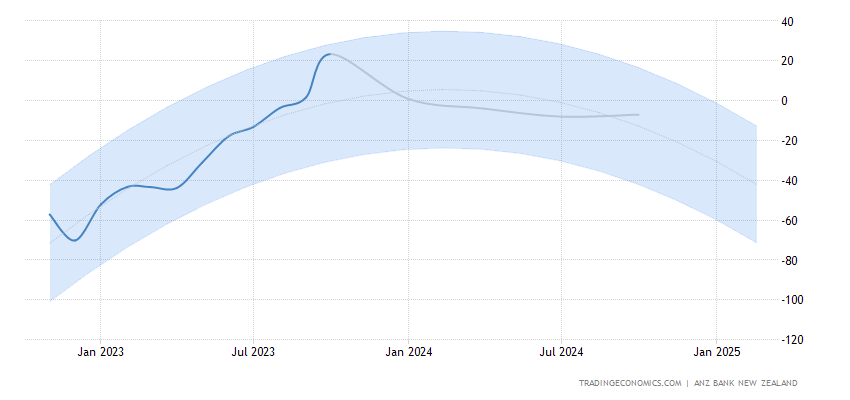

The resurgence of the ANZ Business Outlook Index in New Zealand paints a promising picture for the country’s economic future. With surging own activity outlook, positive export and investment intentions, and a rise in employment, New Zealand is poised for growth and stability. Profit expectations, stable pricing and cost forecasts, and higher wage expectations offer opportunities for businesses to thrive. The ease of credit and stable inflation expectations further support the favorable economic environment. The construction sector’s resilience, particularly in commercial construction, underscores the diversity of economic prospects in New Zealand. It’s crucial to emphasize that businesses should capitalize on this positive outlook by making strategic investments, managing costs, and maintaining a keen eye on market dynamics. The stability and growth witnessed in New Zealand’s economy present a unique window of opportunity for both local and international investors. However, prudent financial planning and risk management will be essential in navigating the evolving landscape. With the right approach, New Zealand’s resurgence can be the catalyst for long-term economic success.