Introduction

In the volatile world of commodities trading, few assets capture the attention of investors and economists quite like crude oil. The global energy landscape is inextricably linked to the price of this essential resource, and fluctuations in its value can send ripples throughout the financial world. This in-depth analysis explores the recent movements in WTI (West Texas Intermediate) crude oil futures, with a focus on their implications for global markets. In particular, we delve into the factors driving crude oil prices, the influence of a strong dollar and surging Treasury yields, the dynamics of the US manufacturing sector, and the role of geopolitical developments, such as the Iraq-Turkey oil pipeline. Additionally, we will examine the upcoming OPEC+ meeting and its potential impact on oil production and prices. Crude oil signal

Factors Behind Crude Oil Price Movements

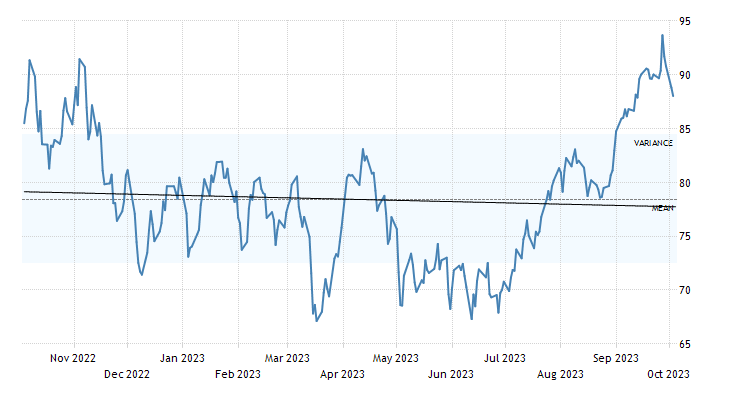

WTI crude oil futures, a benchmark for global oil prices, have recently experienced a downward trajectory, falling toward the $88 per barrel mark. This decline can be attributed to a confluence of factors that have cast a shadow over the commodity markets. To gain a comprehensive understanding of these dynamics, we must explore the various facets of the crude oil signal.

One significant driver of crude oil price movements is the strength of the US dollar. In recent trading sessions, the dollar has scaled fresh ten-month highs against a basket of its peers. This surge in the dollar’s value exerts downward pressure on crude oil prices. As the dollar strengthens, crude oil becomes more expensive for buyers using other currencies, which can lead to reduced demand and, consequently, lower prices.

Another crucial element impacting crude oil prices is the surge in Treasury yields. The 10-year US yield has rallied to its highest levels since 2007, largely due to robust US economic data. This development has reinforced expectations that the Federal Reserve will maintain higher interest rates for an extended period. Elevated interest rates can dampen economic growth and consumer spending, further contributing to the bearish sentiment in the oil market.

US Manufacturing Sector and Price Pressures

The health of the US manufacturing sector is a critical barometer for the global economy and, by extension, crude oil demand. Recent data on the ISM Manufacturing PMI for the US indicates that the contraction in the manufacturing sector has slowed significantly. This is a positive sign, suggesting that the sector may be on the path to recovery. When manufacturing activities expand, they often require increased energy consumption, which can bolster crude oil demand and support higher prices.

Furthermore, the data shows that price pressures in the manufacturing sector eased in September. This development suggests that inflationary pressures may be abating, which could alleviate concerns about rising production costs. A stable or declining inflation rate can provide some relief to businesses and consumers, potentially supporting economic growth and oil demand.

Geopolitical Developments: The Iraq-Turkey Oil Pipeline

One geopolitical factor that has garnered attention in the crude oil market is the readiness of the oil pipeline between Iraq and Turkey. Observers have noted that the pipeline appears set for operations in the near future. This development has the potential to increase oil flows from the region, which could help alleviate global supply tightness.

The Iraq-Turkey pipeline‘s operational status is closely watched as it can impact the availability of crude oil in international markets. An increase in the supply of oil from this pipeline could act as a counterbalance to the factors pressuring oil prices downward, potentially stabilizing or even pushing prices higher.

The OPEC+ Meeting and Output Cuts

Looking ahead, market participants are eagerly anticipating the OPEC+ meeting scheduled for the near future. OPEC+ is expected to discuss and potentially maintain previously announced output cuts. These production cuts have been instrumental in stabilizing crude oil prices and preventing oversupply in the market.

OPEC+ meetings often serve as a pivotal moment for crude oil markets, as they can provide insights into the future production plans of key oil-producing nations. Investors closely monitor the outcomes of these meetings, as any decisions to increase or decrease production quotas can have a significant impact on oil prices and market sentiment.

Crude Oil Signal: Navigating the Future

In conclusion, the recent movements in WTI crude oil futures underscore the intricate web of factors that influence the commodity markets. A strong US dollar, surging Treasury yields, the dynamics of the US manufacturing sector, geopolitical developments such as the Iraq-Turkey oil pipeline, and OPEC+ meetings all contribute to the intricate tapestry of crude oil price dynamics.

As investors and market participants navigate these turbulent waters, it is essential to remain vigilant and informed. Understanding the signals provided by these various factors can help traders and businesses make informed decisions about their oil-related investments and strategies. In this dynamic landscape, staying ahead of the crude oil signal is not only a financial necessity but a strategic imperative for long-term success.

Whether you are a seasoned trader, an energy sector executive, or an interested observer, keeping a watchful eye on these developments is key to thriving in the ever-changing world of crude oil markets. As we continue to monitor these factors, we will gain a deeper understanding of the crude oil signal and its profound implications for the global economy and financial markets.