Introduction

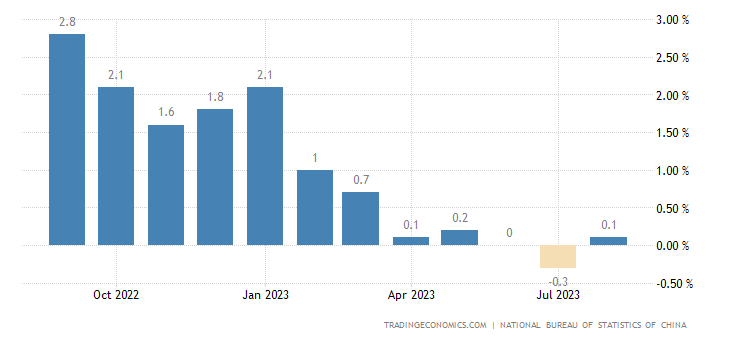

In August 2023, the world’s economic gaze turned once again to China, where consumer prices experienced a mild surge of 0.1% year-on-year (YoY). This slight uptick took many by surprise, as market forecasts had predicted a more substantial 0.2% gain. It marked a noteworthy reversal following the first drop in over two years, with July seeing a 0.3% decline. This article delves deep into the intricacies of China’s consumer price dynamics, shedding light on the factors that contributed to this shift. Moreover, it explores the implications of these trends for China stock signals, offering insights and expert guidance for investors and enthusiasts alike.

Understanding the Consumer Price Landscape

To comprehend the nuances of China’s recent consumer price movements, we must first dissect the data. Non-food prices played a pivotal role, registering a 0.5% increase, signaling a rebound from previously stagnant readings. Key contributors to this upswing included clothing (1.1% vs. 1.0% in July), housing (0.1% vs. 0.1%), health (1.2% vs. 1.2%), and education (2.5% vs. 2.4%). Concurrently, transport prices saw a less severe decline (-2.1% vs. -4.7%). Meanwhile, food prices took a different trajectory, descending by 1.7%, mirroring the pace observed in July, with particular emphasis on the plummeting prices of pork.

The Macro Perspective: Inflation Projection

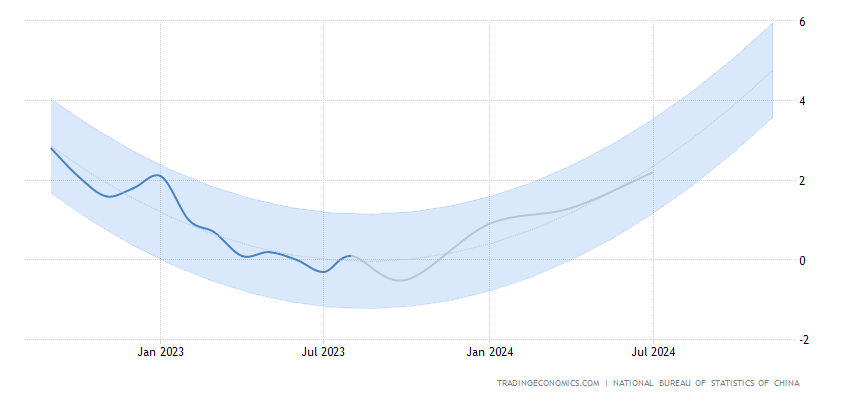

China’s statistics agency recently offered valuable insights into the inflation outlook. Their analysis indicates a gradual uptick in inflation as the impact of a high base year fades into the background. This projection carries significant implications for investors, particularly those closely monitoring China stock signals. As inflation gathers momentum, the broader economic landscape, including stock market dynamics, is poised to undergo noteworthy shifts.

Consumer Prices and the Core Factor

Within the intricate realm of consumer prices, core inflation figures, excluding food and energy components, held steady at a 0.8% YoY growth rate in August, mirroring July’s performance. This consistency reflects the sustained resilience of these sectors. Notably, this marks the fastest pace since January. On a monthly basis, consumer prices experienced a 0.3% gain in August, aligning seamlessly with consensus expectations. This followed a 0.2% growth observed in July, suggesting a steady trajectory in the months to come.

The Significance of China Stock Signals

For investors, economists, and financial analysts, deciphering China stock signals is akin to navigating a complex labyrinth. The country’s economic indicators have a profound ripple effect on global markets. Consumer price fluctuations, as we’ve seen, are just one piece of this intricate puzzle. To gain a comprehensive understanding of China’s economic health, investors must consider a holistic approach, taking into account inflation trends, fiscal policies, and global market dynamics.

Strategic Insights for Investors

As we dissect the latest developments in China’s consumer prices and their potential impact on China stock signals, it becomes increasingly clear that strategic insights are invaluable for investors. Here are some key considerations:

- Diversify Portfolios: Given the uncertainty surrounding inflation and consumer prices, diversifying your investment portfolio is crucial. A well-balanced mix of stocks, bonds, and other assets can help mitigate risk.

- Monitor Inflation Closely: Keep a close eye on inflation indicators, as rising inflation can erode the purchasing power of your investments. Adjust your portfolio accordingly.

- Stay Informed: Stay informed about China’s economic policies and their potential impact on various sectors. Government policies can significantly influence stock signals.

- Long-Term Perspective: While short-term fluctuations may be unsettling, it’s essential to maintain a long-term perspective when investing in Chinese stocks. China’s economy has a history of resilience and growth.

Conclusion

In conclusion, China’s recent consumer price movements have shed light on the intricate web of factors influencing the nation’s economy. These developments are not isolated but are part of a broader narrative that includes inflation projections, core consumer prices, and their implications for China stock signals. As investors continue to navigate this dynamic landscape, it is essential to remain vigilant, diversified, and well-informed. By doing so, investors can position themselves to make informed decisions and capitalize on opportunities as they arise in the ever-evolving Chinese market.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?