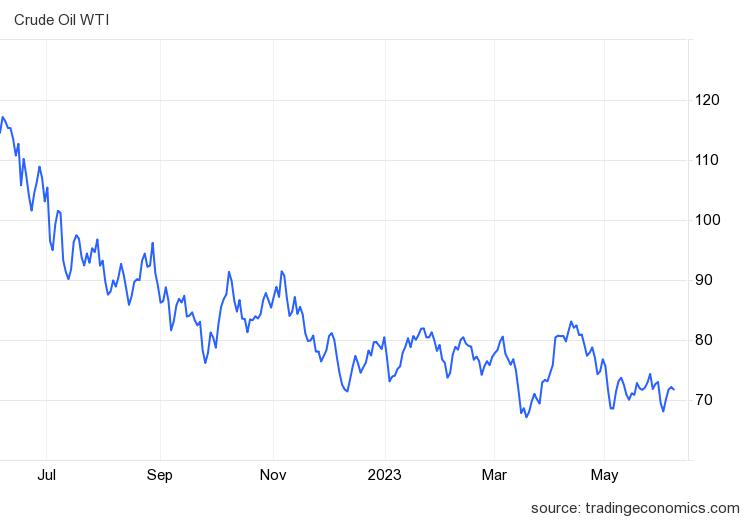

On Monday, oil prices saw a noticeable increase, rising by more than 1 % in trading. The West Texas Intermediate ( WTI ) crude futures were valued at approximately$ 72.5 per barrel, driven by prevailing market expectations of reduced supply, which outweighed concerns over a potential slowdown in demand. The US benchmark experienced a significant increase of up to 4.6 % in the early session, reaching$ 75 per barrel. This significant rise occurred not long after Saudi Arabia pledged to reduce output by an additional 1 million barrels per day, aiming for a regular production level of about 9 million in July

a level that hasn’t been seen in many years. Prince Abdulaziz bin Salman, the Saudi Energy Minister, assured the market of his unwavering commitment to ensuring stability, proclaiming his willingness to take all necessary measures to achieve this goal during a high-stakes OPEC + meeting held over the weekend. However, other OPEC + members expressed their intentions to maintain the existing production cuts until the end of 2024. The United Arab Emirates was given permission to increase its output targets for the upcoming year while Russia remained non-committal regarding any more output reductions. Notably, oil prices fell by 11 % in May and have dropped by almost 10 % since the start of the year. The oil market’s recent bullish sentiment was primarily driven by the decisions made by OPEC and its allies, known collectively as OPEC+. The market reacted positively to the announcement made by Saudi Arabia regarding their commitment to cutting production by an additional 1 million barrels per day. This move is seen as a strong signal of the organization’s dedication to stabilizing oil prices amidst concerns over a potential oversupply situation. Saudi Energy Minister Prince Abdulaziz bin Salman’s unequivocal statement at the OPEC+ meeting, vowing to take all necessary steps to bring stability to the market, instilled confidence among market participants.

Despite the resolute stance taken by Saudi Arabia, some OPEC+ members were not as forthcoming with their commitment to further production cuts. Russia, one of the key players in the alliance, did not make any firm commitments to reduce output beyond the existing agreed-upon levels. This lack of assurance from Russia raises questions about the unity within OPEC+ and the potential impact it could have on the stability of oil prices going forward. Additionally, the United Arab Emirates, a significant oil-producing country, received permission to increase its output targets for the coming year, further complicating the supply dynamics within the OPEC+ alliance.

The market sentiment surrounding oil prices has been heavily influenced by the interplay between supply and demand dynamics. While concerns over slowing demand persist, expectations of reduced supply have taken precedence in the current market landscape. The decision by Saudi Arabia to cut production, coupled with the ongoing commitment by other OPEC+ members to maintain existing cuts, reflects a collective effort to balance the market and prevent a potential oversupply scenario. However, the lack of a unified approach within OPEC+ regarding further output reductions and the UAE’s permission to increase production targets introduces an element of uncertainty that could impact the delicate balance between supply and demand.

Moreover, the recent fluctuations in oil prices cannot be divorced from broader macroeconomic factors. The performance of the US dollar, for instance, plays a crucial role in determining the direction of oil prices. A weaker dollar tends to bolster oil prices, as it makes crude oil, which is denominated in dollars, more affordable for buyers holding other currencies. Conversely, a stronger dollar can exert downward pressure on oil prices. Market participants closely monitor the dollar’s movements as a potential signal for oil price trends.

Additionally, economic indicators such as the Purchasing Managers’ Index (PMI) can provide valuable insights into the health of global manufacturing activity, which, in turn, impacts oil demand. A robust PMI reading suggests increased industrial production and heightened demand for oil, potentially driving prices higher. Conversely, a contraction in the PMI could signal a slowdown in manufacturing activity and subsequently dampen oil demand, thereby placing downward pressure on prices. Monitoring these economic signals becomes crucial for market participants seeking to anticipate and navigate oil price movements.

In conclusion, oil prices experienced a notable surge on Monday, driven by expectations of reduced supply outweighing concerns over slowing demand. The decisions made by OPEC+ members, particularly Saudi Arabia’s commitment to further production cuts, played a pivotal role in bolstering market sentiment. However, the lack of unanimity within OPEC+ regarding additional output reductions, as well as the UAE’s permission to raise production targets, introduced elements of uncertainty. Furthermore, factors such as the performance of the US dollar and economic indicators like the PMI contribute to the intricate dynamics that influence oil prices. As the market continues to navigate these complexities, stakeholders remain vigilant in interpreting trade signals and staying abreast of OPEC+ developments, which will shape the future trajectory of oil prices.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.