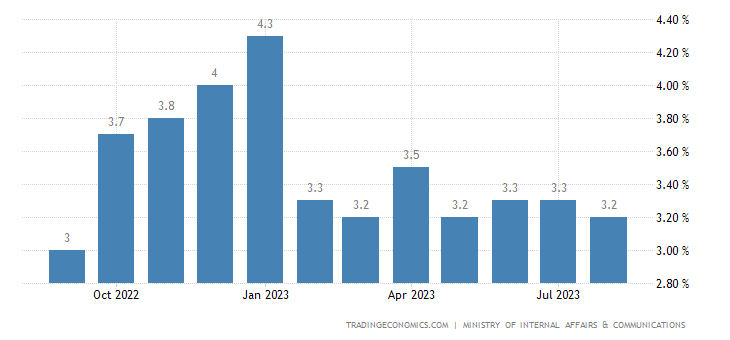

In the intricate world of economics, keeping a keen eye on inflation rates is akin to charting the temperature of a nation’s economic health. As we delve into the specifics of Japan’s economic scenario, the annual inflation rate in the Land of the Rising Sun merits our attention. August 2023 witnessed a gentle descent, with inflation edging down to 3.2% from the previous month’s 3.3%, marking the lowest reading in three months. This nuanced decline carries with it a tale of price movements across various sectors, offering insight into the intricate dance of supply and demand within the Japanese economy. Japan Stock Signal

Understanding Inflation Dynamics

The heart of this inflationary narrative lies in the myriad sectors that compose a nation’s economic fabric. Japan’s price landscape in August 2023 revealed nuanced shifts, mirroring both consumer habits and broader economic trends. Prices continued their ascent in sectors such as food, housing, furniture & household utensils, transport, clothing, medical care, education, culture & recreation, and miscellaneous items. Yet, in stark contrast, the prices of fuel, light, and water charges tumbled swiftly for the seventh consecutive month, led by declining costs in electricity and gas. This duality in price movements paints a vivid picture of the multifaceted dynamics within Japan’s economy.

Core Inflation and the Bank of Japan’s Target

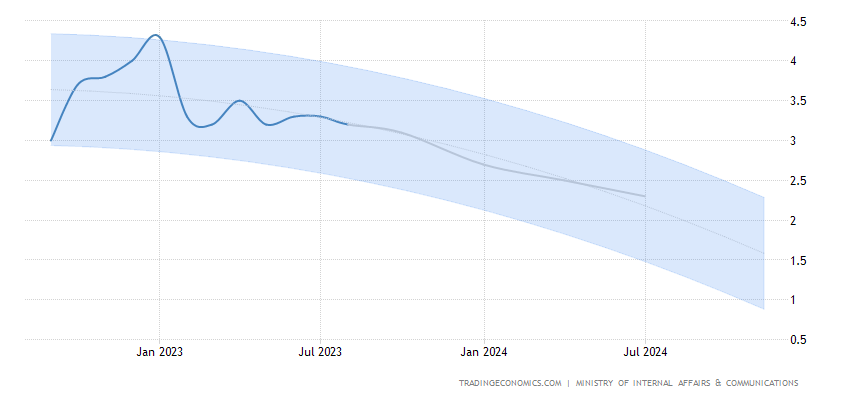

While the overall inflation rate took a slight dip, core inflation—the metric that excludes volatile items—remained steadfast at a four-month low of 3.1%. This figure slightly exceeded market consensus, which had anticipated a 3.0% rate. However, it’s important to note that this rate still lingers outside the Bank of Japan’s coveted 2% target for the 17th consecutive month. This steadfastness in core inflation reflects the intricate challenge faced by the Bank of Japan in steering the nation’s economy towards its price stability objectives.

Monthly Price Fluctuations

Delving further into the nuances of Japan’s price landscape, August 2023 saw consumer prices rise by a modest 0.2%. This uptick represented a slight easing from the 0.4% gain observed in July, which had marked the steepest increase in three months. These monthly fluctuations in consumer prices offer a glimpse into the ebb and flow of Japan’s economic tide. They underscore the importance of understanding the broader context of price movements and their impact on the lives of everyday Japanese citizens.

The Japan Stock Signal: A Multi-Faceted Insight

Amidst these inflationary intricacies, the “Japan stock signal” has emerged as a pivotal keyword, resonating throughout financial markets. While seemingly distinct, the stock market and inflation are intertwined, and their interplay can offer invaluable insights to investors and analysts alike. It serves as a reminder that within the vast tapestry of economics, even seemingly unrelated strands are woven together, creating a comprehensive narrative.

Nurturing a Holistic Perspective

For investors and market participants, comprehending the Japan stock signal within the context of inflationary dynamics is essential. As the Bank of Japan navigates the labyrinthine path toward its 2% inflation target, the stock market responds to these economic currents. Savvy investors understand that this dance between inflation and stock performance is a two-way street. The stock market reflects not only the state of the economy but also investor sentiment and expectations for the future. As such, monitoring the Japan stock signal is paramount for informed decision-making in the ever-evolving world of finance.

Conclusion

In the intricate dance of inflation and stock market signals, Japan’s economic landscape offers a rich tapestry of insights. The nuanced shifts in the annual inflation rate, core inflation, and monthly price fluctuations provide valuable cues for economists, investors, and policymakers. The “Japan stock signal” reminds us that within the dynamic world of finance and economics, every piece of the puzzle is interconnected. As we navigate these complex waters, Paul Krugman’s wisdom echoes: understanding these intricacies is not just about numbers but about the impact on real lives and real opportunities.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?