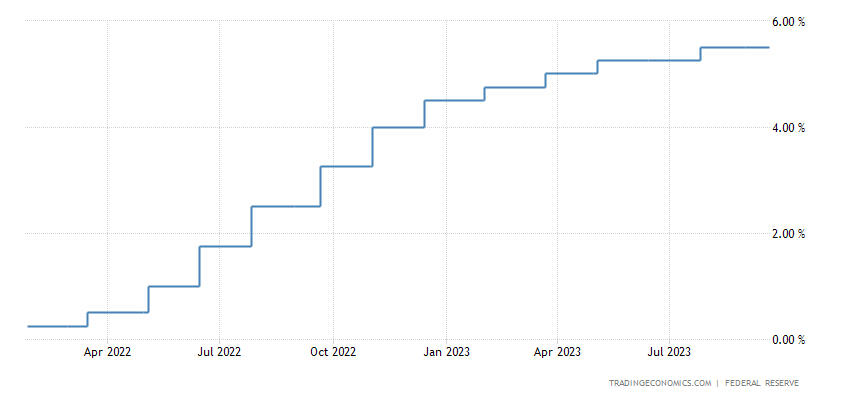

In the autumn of 2023, the Federal Reserve faced a pivotal juncture, steering the course of the nation’s economic ship. With resolute determination, the Fed decided to maintain the federal funds rate within the range of 5.25% to 5.5%, a level unseen in over two decades. This decision followed a 25 basis points hike in July, a move that had been widely anticipated by financial experts and market participants. Yet, what truly captured the attention of the financial world was the subtle but significant signal emanating from the Fed—a signal that hinted at the possibility of another interest rate hike within the same year. SP500 stock signal

The Dynamics of the Federal Funds Rate

The Federal Reserve’s choice to keep the federal funds rate at this historic high signifies its commitment to maintaining economic stability while simultaneously curbing inflation. As the Federal Reserve Chair deftly articulated during the September 2023 meeting, this decision reflects the central bank’s vigilance in navigating the economic seas through uncertain times. It’s akin to a captain skillfully adjusting the sails to harness the winds of economic forces while avoiding treacherous inflationary storms.

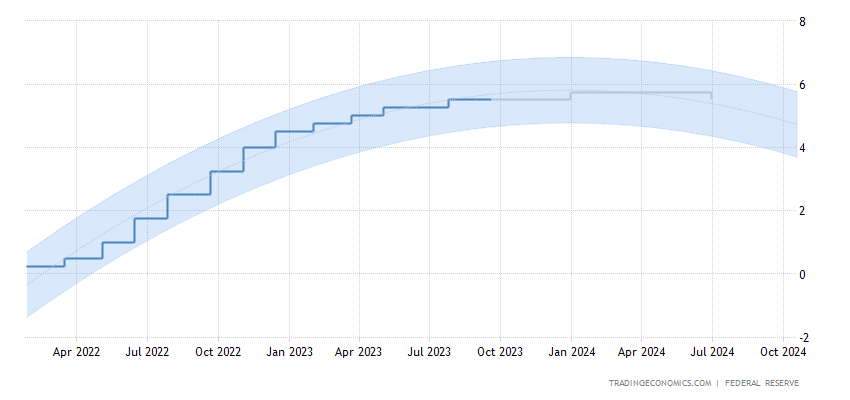

Projections and the Dot-Plot

To provide greater transparency and insight into its future policy moves, the Federal Reserve unveiled projections through the dot-plot. This graphical representation showed the likelihood of one more interest rate increase within the year, followed by two anticipated cuts in 2024. These projections serve as a guiding compass for market participants, helping them chart a course amidst the ever-changing tides of the economy. Investors seeking insights into specific sectors or market indices, such as the SP500, are keenly tuned into this economic orchestra, looking for the cues that will harmonize with their investment strategies.

The Federal Funds Rate’s Trajectory

The Federal Reserve’s projections indicate that policymakers anticipate the federal funds rate to remain at 5.6% for the current year, mirroring the projection made in June. However, in 2024, it is expected to ascend to 5.1%, a notable uptick from the earlier estimate of 4.6% from June. This trajectory underscores the central bank’s nuanced approach to balancing economic growth and inflation, demonstrating the importance of monitoring these developments closely for informed financial decision-making.

GDP Growth and Its Far-Reaching Implications

In parallel to interest rate projections, the Federal Reserve’s economic outlook forecasts robust GDP growth in 2023, with an expected increase of 2.1% compared to the previous projection of 1%. Moving forward to 2024, this growth rate is predicted to be 1.5%, surpassing the earlier estimate of 1.1%. These revised figures reflect the Federal Reserve’s optimism about the nation’s economic trajectory, signaling opportunities for businesses, investors, and workers alike. It’s a testament to the dynamic nature of the economy, where shifts in policy can usher in a brighter economic outlook.

Inflationary Pressures and Core Rates

Inflation remains a key concern for the Federal Reserve, and the projections unveiled in September 2023 revealed subtle adjustments in their approach. Personal Consumption Expenditures (PCE) inflation is now expected to reach 3.3% for the current year, a slight uptick from the previous estimate of 3.2%. However, for 2024, inflation is expected to stabilize at 2.5%. The core inflation rate, which excludes volatile elements, is projected to decrease to 3.7% in 2023, down from the earlier estimate of 3.9%. In contrast, the core rate is expected to remain steady at 2.6% for 2024. These adjustments highlight the Federal Reserve’s ongoing efforts to strike a delicate balance between price stability and economic growth, providing a glimpse into the path they believe the economy will traverse.

Labor Market Dynamics: A Source of Encouragement

Let’s now turn our gaze to an indicator that carries profound significance in the lives of ordinary Americans—the unemployment rate. It’s not just a statistic; it’s a measure of livelihoods and aspirations. In 2023, we anticipate a positive shift in this vital indicator, with the rate poised to dip to 3.8%. This is indeed heartening news, especially considering the previous projection stood at 4.1%.

As we venture into the landscape of 2024, the forecast suggests that the unemployment rate will hold steady at 4.1%, down from the earlier estimation of 4.5%. These numbers paint a vivid portrait of a labor market that displays remarkable resilience—a market that forms the bedrock of the Federal Reserve’s broader economic strategy. It underscores the central bank’s commitment to nurturing a robust job market, a place where individuals and families can flourish, confident in the availability of steady employment opportunities.

For the venerable economist Paul Krugman, these trends echo his call for policies that prioritize the well-being of people, for behind every data point lies a story of real lives and real aspirations. In this narrative, the unemployment rate’s positive trajectory becomes a beacon of hope, lighting the path to a brighter economic future for all.

Market Insights and the SP500 Stock Signal

The Federal Reserve’s actions and projections hold significant sway over financial markets, both domestically and internationally. In the wake of the September 2023 announcement, investors and analysts have been recalibrating their strategies and portfolios. Amidst this recalibration, the “SP500 stock signal” has emerged as a critical keyword, reflecting the interconnected nature of global financial markets.

Understanding the SP500 Stock Signal

The SP500, often considered a bellwether of the broader U.S. economy, has garnered significant attention following the Fed’s decision. Although seemingly unrelated, this signal underscores the intricate web of global financial interconnectedness. The performance of the SP500 can be influenced by changes in U.S. interest rates, presenting challenges and opportunities for investors. It serves as a reminder that in today’s interconnected world, the financial health of one market can send ripples throughout the globe.

Navigating the Impact

For investors and market participants, comprehending the SP500 stock signal within the context of the Federal Reserve’s actions is paramount. While the Fed’s decisions primarily impact the U.S. economy, their consequences extend far beyond American borders. Savvy investors are advised to diversify their portfolios, consider currency risk, and closely monitor how shifts in interest rates may influence global market dynamics. It’s a reminder that in a world characterized by economic interdependence, a holistic perspective is essential for informed decision-making.

Conclusion

In the ever-evolving landscape of finance and economics, the Federal Reserve’s policies and projections serve as a guiding light for investors and analysts alike. The September 2023 decision to maintain a high federal funds rate target range, along with the accompanying insights, underscores the intricate interplay of economic forces at play. As the global financial community watches closely, the “SP500 stock signal” reminds us that in today’s interconnected world, a ripple in one market can create waves across the globe. To navigate these waters successfully, vigilance, adaptability, and a deep understanding of the economic currents are paramount. Paul Krugman’s wisdom resonates: in this dynamic landscape, staying informed and agile is the key to financial success.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.