Microsoft Stock Performance: Microsoft stock, under the ticker symbol MSFT, closed at a trading price of $360.53 on Tuesday, November 7th, representing a noteworthy increase of $4.00 or 1.12 percent compared to the previous trading session. This surge in value over a single trading day is certainly worth noting. As we delve deeper into its performance, let’s examine the trends over the past month and year.

Over the past four weeks, Microsoft has demonstrated robust performance, gaining an impressive 9.31 percent. This consistent upward trajectory signifies the confidence that investors place in this tech giant. Notably, over the last 12 months, Microsoft’s stock price has ascended by a remarkable 57.53 percent, a testament to its stability and growth potential in the stock market.

Projections and Analyst Expectations: Now, let’s peer into the crystal ball of projections and analyze what lies ahead for Microsoft stock. According to Trading Economics global macro models and analysts’ expectations, Microsoft is expected to be priced at approximately $343.87 by the end of this quarter. Looking further ahead, in a year’s time, the stock is projected to reach $318.43.

Microsoft’s current market position stands strong, a testament to the unwavering faith the market has in its potential for sustained growth. Nevertheless, for the astute investor, it is imperative to delve deeper into the multifaceted factors that underpin these predictions, enabling us to make well-informed choices. In this extensive analysis, we embark on a journey to scrutinize Microsoft’s fiscal robustness, recent evolutions, as well as the prospects and hurdles that lay ahead.

Assessing Microsoft’s Fiscal Fortitude:

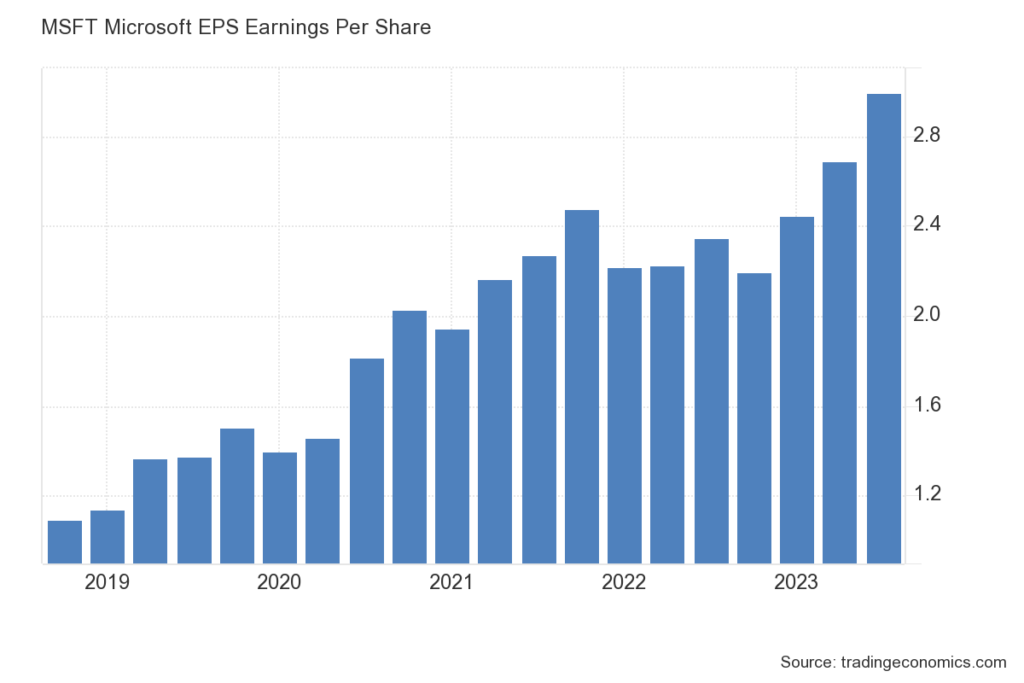

In our quest to ascertain the trajectory of Microsoft’s stock, an exploration of its financial vitality becomes paramount. Microsoft’s fiscal reports and performance metrics serve as the compass, guiding us towards understanding its capacity to generate revenue and profits, manage its financial obligations, and navigate the path of perpetual expansion.

Microsoft’s fiscal prowess is indeed a compelling narrative. The company’s financial statements and key metrics unveil a saga of unwavering revenue growth, fortified profit margins, and judicious financial stewardship. These elements, in concert, cast an enticing aura around the prospect of investment in Microsoft. A triad of revenue streams, comprising cloud services, software, and hardware, has been instrumental in propelling the company’s profitability to greater heights.

Notably, Microsoft’s dedicated focus on the enlargement of its cloud computing services, with a particular spotlight on Azure, has carved a prominent niche for the company in the rapidly burgeoning sphere of cloud technology. This strategic positioning solidifies Microsoft’s stance as a preeminent leader in an arena where innovation and adaptability are the hallmarks of success.

Analysts foresee that Microsoft’s financial robustness will continue to serve as a pivotal driver of its stock’s performance. A substantial part of this confidence stems from the company’s ingenious utilization of a recurring revenue model. Software subscriptions, exemplified by Office 365, stand as prime examples of this approach, bestowing upon Microsoft a reliable and predictable income stream.

Recent Developments Unveiled:

It is prudent to remember that a stock’s fate isn’t tethered solely to historical data; it is equally shaped by the currents of contemporary events and unfolding narratives. In the realm of Microsoft, numerous recent occurrences bear the potential to exert significant influence on its stock price.

Among these noteworthy developments, the spotlight falls on Microsoft’s strategic acquisition of Nuance Communications, a renowned luminary in the field of conversational artificial intelligence. This calculated maneuver seeks to augment Microsoft’s prowess in healthcare technology, a sector ripe with expansive growth prospects. As the healthcare industry increasingly embraces AI-driven solutions, this acquisition stands poised to unlock fresh and lucrative revenue channels for the tech behemoth.

Moreover, Microsoft’s commitment to sustainability and reducing its carbon footprint is in alignment with global trends. The company has pledged to become carbon negative by 2030 and aims to eliminate its entire historical carbon footprint. These initiatives can enhance Microsoft’s reputation and potentially attract socially responsible investors.

Investors should stay informed about such developments as they can significantly influence Microsoft’s stock performance. It is worth noting that the company’s strong ESG (Environmental, Social, and Governance) practices can attract a broader investor base, reinforcing its stock’s appeal.

Opportunities and Challenges: Investing in Microsoft stock involves assessing not only its strengths but also the potential challenges and risks it faces. Let’s delve into some of the key opportunities and challenges that may affect the company’s performance in the coming years.

Opportunities:

• Cloud Computing Ascendancy: Microsoft’s Azure cloud platform has risen to the ranks of a formidable heavyweight in the competitive arena of cloud computing. In the midst of an unceasing digital revolution and the escalating thirst for cloud-based services, Microsoft stands at the vanguard, poised to exploit this transformative tide to its fullest advantage.

• Venturing into the World of Gaming: In Microsoft’s strategic playbook, an exhilarating chapter unfolds with the company’s foray into the gaming sphere. Microsoft’s Xbox gaming division and the alluring Game Pass subscription service continue to burgeon, fortified by the acquisition of the revered Bethesda Softworks. The gaming industry, rife with substantial revenue potential, beckons with open arms, and Microsoft is primed to seize the opportunities that abound.

• Pioneering Software Innovations: As an unrivaled titan in the realm of software, Microsoft’s product portfolio, including Windows, Office, and Teams, stands as an indomitable cornerstone for both businesses and individuals alike. The company’s ceaseless commitment to innovation in software and the offering of subscription-based services lay the fertile ground for the cultivation of perpetual revenue growth.

Challenges:

- Competition: The tech industry is fiercely competitive, and Microsoft faces rivals like Amazon, Apple, and Google. Maintaining its competitive edge requires continuous innovation and adaptability.

- Regulatory Scrutiny: Tech companies are under increased regulatory scrutiny, which could lead to antitrust actions or stricter regulations. These factors could impact Microsoft’s operations and stock performance.

- Economic Volatility: Economic downturns can affect enterprise spending on technology, which may influence Microsoft’s sales and profitability.