McDonald’s Corporation, a leading global fast-food chain, holds a prominent position in the stock market. Its stock performance is influenced by various factors, including financial performance, market trends, consumer demand, and competitive positioning. This article provides an in-depth analysis of McDonald’s stock, examining its recent trading session, long-term performance, price forecasts, and implications for the stock market.

Table of Contents

- Understanding McDonald’s Stock Performance

- Recent Trading Session and Price Movements

- Long-Term Performance Analysis

- Forecasting McDonald’s Stock Price

- Analysts Expectations and Trading Economics Projections

- Implications for the Stock Market

- Exploring New Possibilities and Growth Factors

- Dividends and Shareholder Returns

- Conclusion

Understanding McDonald’s Stock Performance

McDonald’s Corporation, a globally recognized fast-food chain, holds a prominent position in the stock market. Understanding the factors that influence its stock performance is crucial for investors. This section explores key drivers such as financial performance, market trends, consumer demand, and competitive positioning to gain a deeper understanding of McDonald’s stock performance.

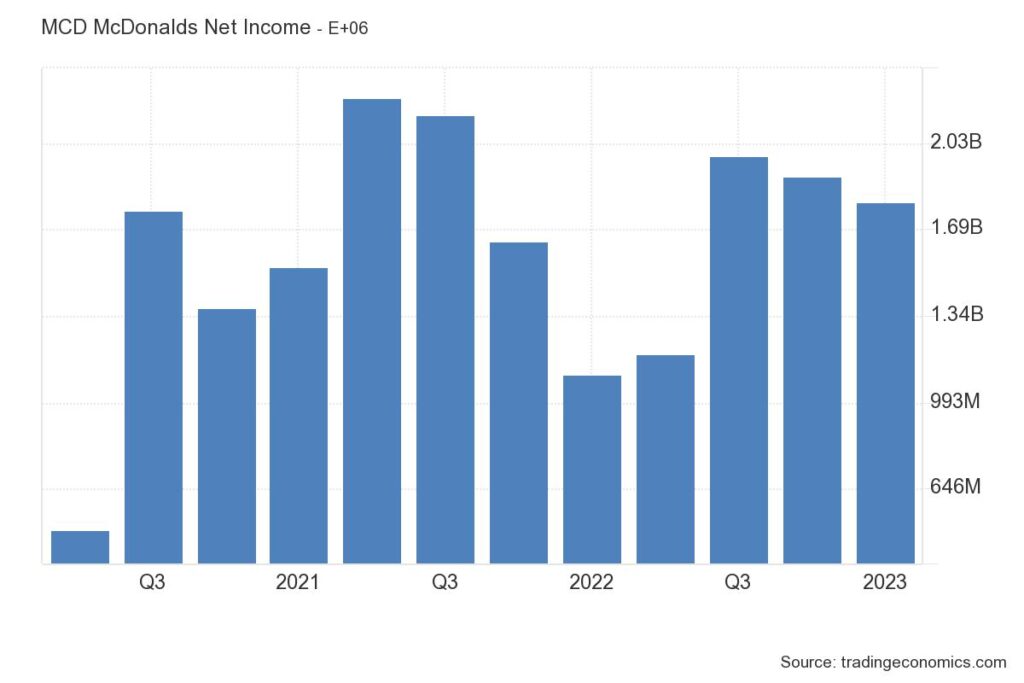

To evaluate McDonald’s stock performance, it is crucial to consider factors such as revenue growth, profitability, market share, and brand strength. By analyzing these factors, investors can assess the company’s ability to generate returns and navigate challenges in the competitive fast-food industry.

Recent Trading Session and Price Movements:

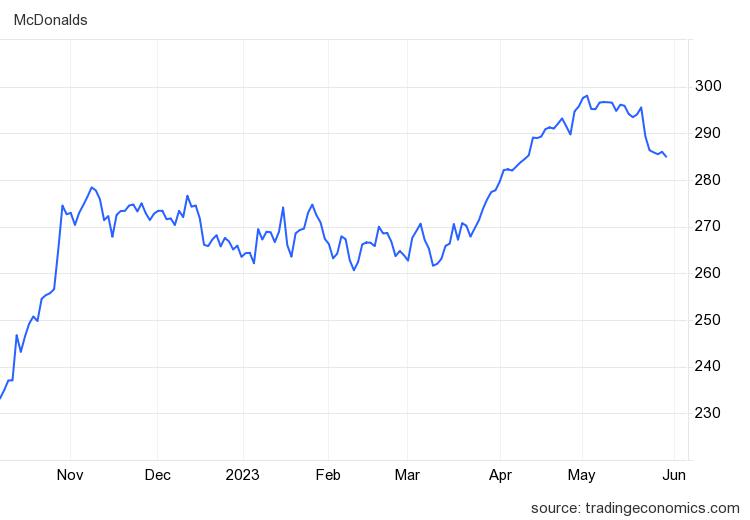

Examining the most recent trading session, we find that McDonald’s stock traded at $284.99 on Wednesday, May 31st. This price reflects a decrease of $1.12 or 0.39 percent from the previous trading session. Analyzing recent price movements and trading patterns helps identify short-term market sentiment and potential factors influencing the stock’s performance.

Long-Term Performance Analysis

Examining McDonald’s stock performance over the last four weeks and 12 months provides valuable insights into its long-term trajectory. During the last four weeks, the stock experienced a decline of 4.23 percent, while over the past 12 months, its price rose by 13.00 percent. This section delves into the underlying factors and market conditions driving these trends.

Forecasting McDonald’s Stock Price

To gain a forward-looking perspective, we turn to forecasts and projections. According to Trading Economics’ global macro models and analysts expectations, McDonald’s stock is projected to be priced at $277.80 by the end of this quarter and at $254.48 in one year. These projections provide valuable insights into the potential future trajectory of the stock price.

Analysts’ Expectations and Trading Economics Projections

We explore analysts’ expectations and Trading Economics projections in more detail. By examining the methodology and factors considered in these forecasts, we aim to provide readers with a well-rounded understanding of the factors influencing McDonald’s stock price in the future.

Implications for the Stock Market

The performance of a company as influential as McDonald’s can have broader implications for the stock market. This section analyzes the impact of McDonald’s stock performance on market indices, sector-specific stocks, and investor sentiment. Understanding these implications helps investors make informed decisions and evaluate potential market trends.

Exploring New Possibilities and Growth Factors

While analyzing past performance is essential, exploring new possibilities and growth factors is equally important. This section highlights potential drivers of growth for McDonald’s, including expansion plans, menu innovations, technology advancements, and consumer preferences. By identifying these opportunities, investors can assess the company’s future prospects.

Dividends and Shareholder Returns

McDonald’s has a history of providing dividends and delivering shareholder value. This section examines the company’s dividend policy, payout ratios, and historical returns to assess its attractiveness as an income-generating investment.

Conclusion

In conclusion, this comprehensive analysis of McDonald’s stock performance provides investors and stakeholders with valuable insights. By examining recent price movements, long-term trends, forecasts, and growth factors, we gain a comprehensive understanding of the stock’s performance. Understanding the implications for the stock

reputable mexican pharmacies online: cmq pharma mexican pharmacy – purple pharmacy mexico price list

https://foruspharma.com/# mexico pharmacies prescription drugs

best online canadian pharmacy: canadian pharmacy antibiotics – canadian drug pharmacy

https://indiapharmast.com/# best india pharmacy

purple pharmacy mexico price list medication from mexico pharmacy mexico drug stores pharmacies

online pharmacy india: indian pharmacy – online shopping pharmacy india

mexican mail order pharmacies mexico pharmacies prescription drugs mexican drugstore online

legal to buy prescription drugs from canada: canada rx pharmacy world – certified canadian international pharmacy

canadianpharmacymeds com: canada rx pharmacy world – canadian online pharmacy

http://indiapharmast.com/# top online pharmacy india

mexican drugstore online mexico drug stores pharmacies mexico drug stores pharmacies

https://indiapharmast.com/# reputable indian pharmacies

canada pharmacy online: ed meds online canada – canadian pharmacy mall

indianpharmacy com: online shopping pharmacy india – top online pharmacy india

best india pharmacy: online shopping pharmacy india – cheapest online pharmacy india

cheapest online pharmacy india: п»їlegitimate online pharmacies india – online pharmacy india

https://canadapharmast.online/# thecanadianpharmacy

legal canadian pharmacy online canadian pharmacy ed medications canadapharmacyonline

indian pharmacy online: indian pharmacy – indianpharmacy com

reputable indian pharmacies: best online pharmacy india – Online medicine order

https://indiapharmast.com/# Online medicine order

indian pharmacies safe Online medicine order reputable indian pharmacies

world pharmacy india: п»їlegitimate online pharmacies india – cheapest online pharmacy india

pharmacies in mexico that ship to usa: buying prescription drugs in mexico online – purple pharmacy mexico price list

buy prescription drugs from india: india online pharmacy – Online medicine order

https://foruspharma.com/# purple pharmacy mexico price list

my canadian pharmacy rx 77 canadian pharmacy canadian pharmacy king reviews

india pharmacy mail order: reputable indian online pharmacy – п»їlegitimate online pharmacies india

https://amoxildelivery.pro/# where can i get amoxicillin

amoxicillin tablets in india amoxicillin 500mg capsules uk amoxicillin 750 mg price

buy doxycycline 100mg tablets: buy doxycycline 100mg cheap – can you buy doxycycline over the counter in mexico

doxycycline gel in india: doxycycline 200mg price in india – doxycycline tablets for sale

https://ciprodelivery.pro/# cipro ciprofloxacin

https://paxloviddelivery.pro/# paxlovid for sale

https://doxycyclinedelivery.pro/# doxy 200

antibiotics cipro buy cipro online canada п»їcipro generic

how to get clomid without rx: can you get clomid for sale – where can i buy clomid without a prescription

http://ciprodelivery.pro/# purchase cipro

https://clomiddelivery.pro/# get clomid online

https://ciprodelivery.pro/# ciprofloxacin generic price

doxycycline cap tab 100mg doxycycline 100mg canada doxycycline 40 mg generic

https://doxycyclinedelivery.pro/# doxycycline canadian pharmacy

paxlovid generic: paxlovid cost without insurance – paxlovid pill

https://amoxildelivery.pro/# generic amoxil 500 mg

https://paxloviddelivery.pro/# paxlovid buy

ciprofloxacin mail online buy cipro online canada buy ciprofloxacin

http://amoxildelivery.pro/# medicine amoxicillin 500mg

Paxlovid over the counter: Paxlovid over the counter – Paxlovid over the counter

https://clomiddelivery.pro/# where can i get cheap clomid without a prescription

https://ciprodelivery.pro/# buy ciprofloxacin

http://clomiddelivery.pro/# where can i get generic clomid without insurance

how to get doxycycline online buy doxycycline 100mg online where can i buy doxycycline capsules