The May 2023 Non-Farm Payrolls (NFP) report took market participants by surprise, revealing an unexpected surge in job growth that surpassed market expectations. However, this unexpected employment report also brought about a contradictory increase in the unemployment rate, leading to questions and uncertainties. In this article, we will provide a comprehensive review of the May NFP report, analyzing job growth across various sectors, examining wage growth moderation, and assessing the implications for the stock market and the gold market. Additionally, we will explore potential future trends and consider the upcoming FOMC meeting, focusing on the impact of the NFP report on the subsequent release of the FOMC Minutes.

Table of Contents:

- Overview of May 2023 Non-Farm Payrolls Report

- Job Growth by Sector

- Unemployment Rate and Household Survey Discrepancy

- Wage Growth Moderation

- Market Expectations and FOMC Meeting

- Implications for the Stock Market

- Impact on the Gold Market

- Implications for FOMC Minutes:

- Future Possibilities and Outlook

- Comparison to Last Year’s Statistics

- Conclusion: Assessing the Economic Landscape

Overview of May 2023 Non-Farm Payrolls Report

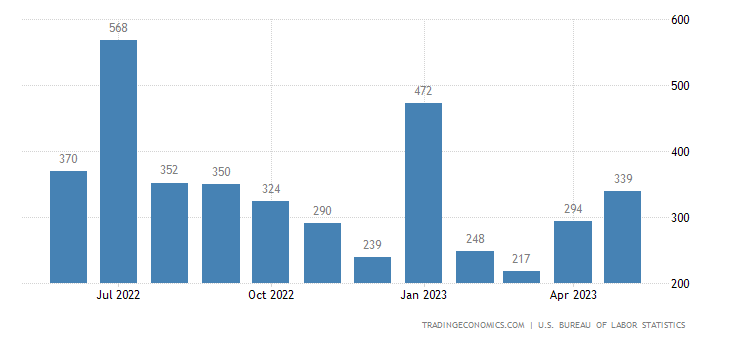

In May 2023, the US economy unexpectedly added 339,000 jobs, surpassing market forecasts of 190,000. This marked the highest job growth in four months, highlighting the strength of employment recovery. Notably, figures for March and April were revised upward, indicating an additional 93,000 jobs compared to previous reports. The average monthly employment gain so far in 2023 stands at 314,000, showcasing a tight labor market.

Job Growth by Sector

Numerous sectors received encouraging information from the May NFP report as they saw significant job gains. The professional and business services industry was in the lead, with an amazing 64, 000 job growth. The expansion of professional, medical, and technical services was a major factor in this growth. In addition, the medical field added 52, 000 jobs, reflecting the rising demand for healthcare professionals, while the government sector experienced a significant increase of 56,000. The luxury and hospitality industry also showed positive speed with an amazing gain of 48, 000 jobs, more solidifying its upward trend. Construction( 25,000 ), transportation and warehousing( 24,000 ), and social assistance( 22,000 ), are additional industries that contributed to job growth.

Although some major industries experienced little change in employment, including mining, manufacturing, retail trade, and financial activities, it is worth noting that the leisure and hospitality sector continued to shine. This sector showcased remarkable consistency, averaging 77,000 job additions per month over the previous year, highlighting its resilience and significance in job creation. These positive developments across various sectors demonstrate the dynamic nature of the job market and offer glimpses of economic growth and vitality in specific industries.

Unemployment Rate and Household Survey Discrepancy

Despite the robust job growth, the unemployment rate unexpectedly rose from 3.4% to 3.7%. This data is derived from a different survey—the household survey—which showed a decrease of 310,000 in household employment and an increase of 440,000 in the number of Americans classifying themselves as unemployed. The disparity between the employer survey and the household survey adds uncertainty to the overall employment situation.

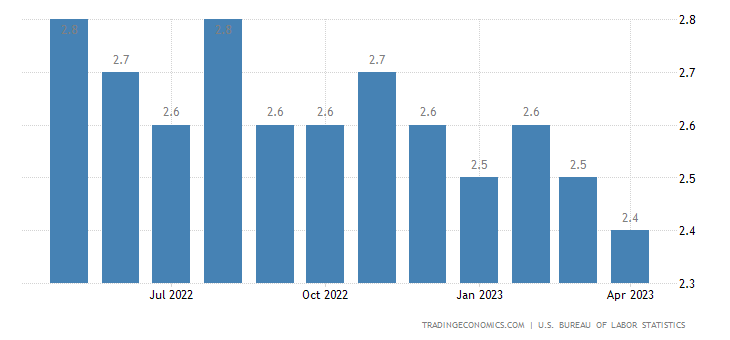

Wage Growth Moderation: Average hourly wage growth moderated as anticipated, with a month-on-month increase of 0.3% compared to the previous month’s revised 0.4%. This brought the annual rate of hourly earnings wage growth to 4.3%. The apparent contradiction of strong demand for workers alongside softening wage pressures poses an intriguing observation for the Federal Reserve.

Market Expectations and FOMC Meeting

The divergent outcomes between the employer survey and the household survey have reinforced the belief in the June FOMC “skip” narrative, suggesting no interest rate hike. However, the upcoming core Consumer Price Index (CPI) report on June 13 could potentially influence market sentiment if it reveals unexpected strength. The Fed’s decision-making will closely consider this data.

Implications for the Stock Market: The mixed May NFP report has led to varied reactions in the market. While the job growth surge was seen as positive, the increase in the unemployment rate and wage growth moderation tempered enthusiasm. Market rate hike expectations have slightly risen, and the upcoming FOMC meeting will shed more light on the Fed’s stance.

Impact on the Gold Market: The May NFP report, with its strong job growth and positive economic indicators, can have implications for the gold market. Gold is often considered a safe-haven asset, and its value can be influenced by economic data. As the employment numbers signal a robust economy and potential inflationary pressures, it may impact investor sentiment and their demand for gold as a hedge against economic uncertainties. Therefore, monitoring the gold market and analyzing its reaction to the May NFP report becomes crucial for investors interested in precious metals.

Implications for FOMC Minutes

The May NFP report holds significant implications for the upcoming release of the FOMC Minutes. The unexpected surge in job growth and the contradictory increase in the unemployment rate will likely be subjects of discussion among Federal Reserve policymakers. The FOMC Minutes provide insights into the Federal Reserve’s thinking, shedding light on their assessment of the economy, inflation concerns, and potential monetary policy adjustments. Investors closely analyze the minutes for clues about future interest rate decisions and the Fed’s overall stance. Therefore, the unexpected employment report may influence the tone and direction of the FOMC Minutes, leading to potential market impacts and shifts in investor sentiment.

Ultimately, the May NFP report reveals a significant and unexpected increase in job growth, creating an uncertain economic environment. Uncertainty is brought on by the conflicting rise in unemployment and the restraint on wage growth, but we’ll keep a close eye on how it affects the stock market, gold markets, and later FOMC Minutes releases.

Future Possibilities and Outlook

As we gaze into the future, it becomes crucial to delve into the implications of the May NFP report and its potential impact on upcoming economic trends. The stark contrast between employer and household surveys serves as a reminder of the intricacies involved in accurately gauging the actual state of employment. This disparity calls for careful analysis and consideration, as it unveils the complexities of understanding the true dynamics of the job market.

Additionally, the report’s reasonable wage growth raises concerns and calls for more investigation. It suggests the need to keep an eye on the dynamics of labour supply and demand as well as the variables affecting wage pressures. Understanding the bigger picture and figuring out how these factors will affect the future economic landscape depend on this ongoing examination.

Uncertainties regarding the labor market will continue to exist as we proceed, necessitating our focus and attention. To understand probable trends and shifts in the future, it will be important to pay close attention to how employment figures, wage growth, and supply and demand interactions interact. We can better position ourselves to manage the changing job market and effectively respond to new challenges and opportunities by closely monitoring these indicators.

Comparison to Last Year’s Statistics

When comparing the May 2023 NFP report to the same period the previous year, the job growth demonstrates notable progress, reflecting a resilient recovery. Analyzing the specific sectors and comparing employment figures provides insights into the changes and trends over time.

Conclusion Assessing the Economic Landscape

The May 2023 Non-Farm Payrolls report exhibited strong job growth, exceeding expectations. However, the conflicting data between employer and household surveys introduce uncertainties. The moderation in wage growth and the rise in the unemployment rate add complexity to the overall assessment. As the Federal Reserve closely monitors these developments, market participants eagerly anticipate the upcoming core CPI report and the June FOMC meeting for further guidance.

Outlook for the Stock Market: The stock market is expected to reap the rewards of the positive job growth and the overall strength displayed in the May NFP report. The surge in employment brings a wave of optimism, signaling a thriving economy and a boost in consumer spending power. Such promising indicators have the potential to set the stage for a favorable environment in the stock market.

With more people finding employment, businesses are likely to experience an upswing in productivity and profitability. This, in turn, can translate into higher corporate earnings, a key driver for stock market performance. As investors witness companies thriving and generating solid financial results, their confidence in the market tends to grow, fostering a sense of optimism and attracting more investment.

While the outlook appears bright, it’s important to keep an eye on future economic indicators and market dynamics. The stock market is influenced by a multitude of factors, including geopolitical events, changes in interest rates, and global economic conditions. These external forces can introduce uncertainties and volatility, shaping the market’s direction. Staying attentive to these factors and monitoring market trends enables investors to make informed decisions and navigate potential challenges.

In summary, the positive job growth highlighted in the May NFP report sets a promising tone for the stock market. It reflects a robust economy, increased consumer spending power, and the potential for improved corporate earnings. However, it is crucial to approach the market with vigilance, as external factors can sway its trajectory. By staying informed and adapting to evolving market conditions, investors can seize opportunities and position themselves for success in the stock market.

New Possibilities in the Future

The robust job growth in various sectors suggests opportunities for continued economic expansion and innovation. Industries such as professional and business services, health care, and leisure and hospitality are expected to witness further growth, creating new job opportunities and fostering economic development. As technological advancements and societal changes reshape the labor market, adapting to emerging trends will be crucial for both employers and job seekers.

mexican online pharmacies prescription drugs: cmqpharma.com – mexico pharmacies prescription drugs

canadian pharmacy in canada: reliable canadian online pharmacy – canada pharmacy

buying prescription drugs in mexico online: mexican online pharmacies prescription drugs – medication from mexico pharmacy

best canadian online pharmacy: canada drugs reviews – canadian pharmacy no scripts

https://indiapharmast.com/# india pharmacy mail order

india online pharmacy Online medicine home delivery п»їlegitimate online pharmacies india

mexico drug stores pharmacies mexican mail order pharmacies best online pharmacies in mexico

https://canadapharmast.online/# safe canadian pharmacy

india pharmacy mail order: Online medicine order – cheapest online pharmacy india

legitimate canadian mail order pharmacy: canadian pharmacy review – my canadian pharmacy rx

http://foruspharma.com/# mexican rx online

reputable indian online pharmacy online shopping pharmacy india top online pharmacy india

buying prescription drugs in mexico: mexican mail order pharmacies – reputable mexican pharmacies online

buying prescription drugs in mexico online mexico pharmacy mexico drug stores pharmacies

Online medicine home delivery: п»їlegitimate online pharmacies india – Online medicine order

india online pharmacy: reputable indian online pharmacy – indian pharmacy online

http://foruspharma.com/# mexico drug stores pharmacies

indian pharmacy paypal: indian pharmacies safe – reputable indian pharmacies

indian pharmacies safe Online medicine home delivery best india pharmacy

pharmacies in mexico that ship to usa: buying from online mexican pharmacy – mexican pharmaceuticals online

https://foruspharma.com/# buying prescription drugs in mexico

reputable mexican pharmacies online п»їbest mexican online pharmacies mexican pharmacy

best canadian online pharmacy: canadian pharmacy online reviews – buy canadian drugs

indianpharmacy com: best online pharmacy india – reputable indian online pharmacy

recommended canadian pharmacies: canadian drug – canadian pharmacy drugs online

world pharmacy india: india pharmacy – Online medicine home delivery

http://indiapharmast.com/# online shopping pharmacy india

canadian world pharmacy canadian online pharmacy canadapharmacyonline legit

http://indiapharmast.com/# best india pharmacy

paxlovid price: Paxlovid over the counter – paxlovid pharmacy

https://clomiddelivery.pro/# can you buy generic clomid without a prescription

http://clomiddelivery.pro/# how to buy clomid without prescription

Paxlovid over the counter paxlovid covid paxlovid india

http://ciprodelivery.pro/# buy cipro online

doxycycline 100 mg order online: doxycycline cream over the counter – doxycycline prescription online

http://clomiddelivery.pro/# where to buy generic clomid prices

http://paxloviddelivery.pro/# paxlovid cost without insurance

https://amoxildelivery.pro/# purchase amoxicillin online without prescription

buy cipro online ciprofloxacin generic cipro online no prescription in the usa

https://doxycyclinedelivery.pro/# how to get doxycycline

amoxicillin 500 mg price: amoxicillin order online – buy amoxicillin online cheap

https://paxloviddelivery.pro/# paxlovid buy

https://paxloviddelivery.pro/# buy paxlovid online

buy cipro online ciprofloxacin order online ciprofloxacin 500mg buy online

https://paxloviddelivery.pro/# paxlovid india

doxycycline over the counter australia: 3626 doxycycline – doxycycline buy online us

http://amoxildelivery.pro/# amoxicillin 500 mg tablets

https://ciprodelivery.pro/# ciprofloxacin order online

cipro pharmacy cipro online no prescription in the usa п»їcipro generic

http://doxycyclinedelivery.pro/# buy doxycycline over the counter

doxycycline 100mg capsules: buy doxycycline australia – doxycycline 100mg capsules buy

https://ciprodelivery.pro/# ciprofloxacin generic

https://ciprodelivery.pro/# ciprofloxacin 500mg buy online

can i purchase cheap clomid without a prescription how to get cheap clomid without insurance cost of cheap clomid pill