Introduction: Japan stock signal

Today Japan stock signal, we’re going to embark on a captivating journey into the fascinating world of Japan’s economic prowess. Brace yourselves because what we’re about to discover is truly extraordinary – Japan’s exports have been soaring high, marking an astounding 28 consecutive months of growth! Can you believe it? It’s like they have the Midas touch!

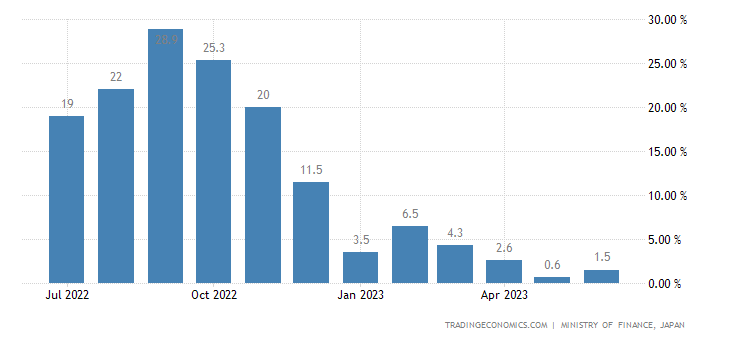

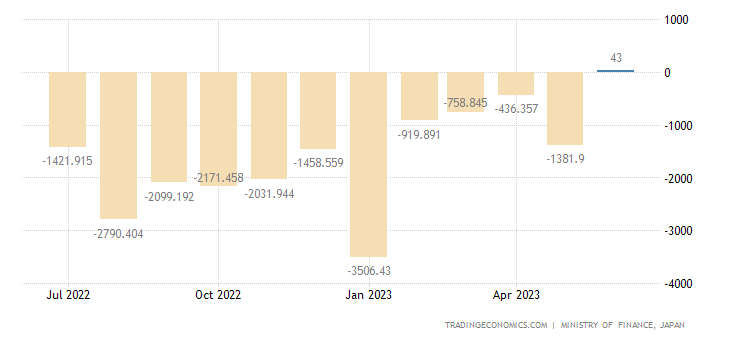

Now, we all know the pandemic has thrown some serious curveballs, but guess what? Japan has shown its mettle, recording a solid 1.5% year-on-year increase in exports, totaling an eye-popping JPY 8,744.06 billion! Not too shabby, right? Some might say it’s a tad lower than the market’s prediction of 2.2%, but don’t be fooled – this performance is sending a resounding signal to the Japan stock market.

And here’s the real kicker – the driving force behind this success is none other than the sustained foreign demand and remarkable growth across various sectors. It’s like a symphony of economic harmony! Investors, oh boy, you better keep a close eye on this because these factors are key to Japan’s economic melody.

Transport Equipment Leading the Way:

The backbone of Japan’s export success lies in its transport equipment sector, which witnessed an astounding 38.0% year-on-year surge. The remarkable growth was mainly driven by motor vehicles (49.7%) and cars (54.7%), showcasing the country’s competitive edge in the automotive industry. This sector’s resilience played a key role in Japan’s overall export growth, setting a positive tone for investors in the Japan stock market.

Divergent Trends in Machinery and Electrical Machinery:

Despite the overall export growth, there were areas of concern, as machinery shipments dipped by 1.5%. Semicon machinery, in particular, experienced a sharp decline of 17.7%, contributing to the sector’s downturn. Similarly, exports of electrical machinery fell by 6.3%, with semiconductors (-10.7%) and IC (-8.1%) being the primary culprits. Investors must closely assess these areas and factor in potential implications for related companies’ stock performance.

Mixed Performance in Manufactured Goods and Chemicals:

While the transport equipment sector shined, manufactured goods faced headwinds, with a notable decline of 10.2%. Iron & steel exports took a significant hit, dropping by 16.8%, signaling potential challenges for steel-producing industries. Additionally, chemical exports shrank by 13.0%, largely influenced by plastics (-12.6%) and organic chemicals (-15.9%). Investors should be mindful of the impact on relevant companies operating in these sectors when making their investment decisions.

Regional Export Destinations:

Understanding the geographical distribution of Japan’s exports is vital for investors gauging potential stock market implications. Japan’s exports increased to several key partners, including the US (11.7%), Hong Kong (9.3%), Indonesia (3.2%), Germany (7.6%), India (18.4%), Russia (29.3%), and the EU (15.0%). However, China experienced an 11.0% decline, along with Taiwan (-21.3%), South Korea (-9.2%), and Malaysia. This regional diversity implies varying impacts on different industries and highlights the significance of monitoring geopolitical developments.

Implications for the Japan Stock Market:

Given Japan’s strong export performance, investors are presented with promising opportunities in the Japan stock market. Companies in the transport equipment sector, particularly those excelling in motor vehicles and cars, are likely to attract considerable attention from investors. However, the challenges faced by the machinery and electrical machinery sectors demand a cautious approach. Investors should exercise prudence while assessing companies in these industries and consider potential risks before making investment decisions.

Conclusion: Japan stock signal

Japan’s continuous export growth serves as a compelling signal for investors in the Japan stock market. The 1.5% year-on-year increase in exports demonstrates Japan’s resilience in the face of adversity and highlights its economic strength on the global stage. The remarkable performance in the transport equipment sector and positive regional export trends offer valuable investment opportunities for astute investors. However, potential pitfalls in machinery, electrical machinery, manufactured goods, and chemicals warrant careful consideration. As a financial writer and expert, my advice to investors is to thoroughly analyze individual sectors, companies, and geopolitical factors to make informed and successful investment choices in Japan’s dynamic market landscape.

Source: tradingeconomics.com