Introduction

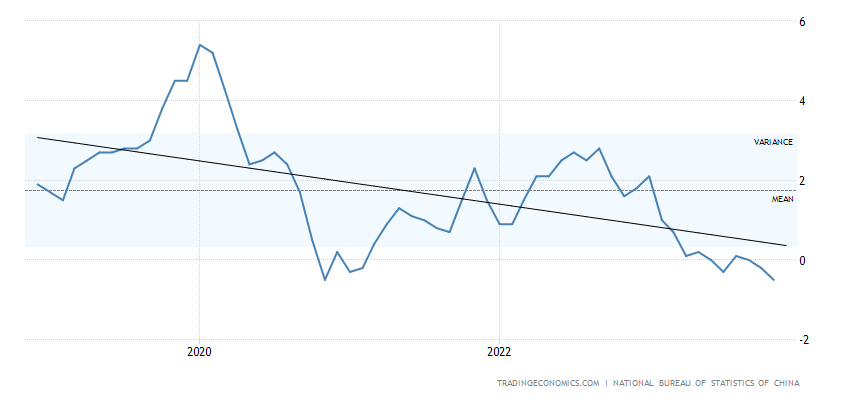

Amidst the economic landscape, China’s consumer prices made a notable descent, plunging by 0.5% year-on-year in November 2023. This decline, more pronounced than the prior month’s 0.2% drop, and beyond the anticipated 0.1% fall, signifies the swiftest dive in the Consumer Price Index (CPI) since November 2020. A pivotal contributor to this downward trajectory has been the conspicuous dip in food costs, marking the steepest descent in over two years, clocking in at -4.2% compared to October’s -4.0%. The core driver behind this nosedive has been the persistent fall in pork prices.

Concurrently, the non-food inflation track displayed a significant deceleration, slowing to 0.4% from the preceding 0.7%. This moderation owes itself to the tempering of education expenses, reducing from 2.3% to 1.8%, and a more rapid decline in transport prices, plummeting from -0.9% to -2.4%. In tandem, inflation levels remained unaltered for housing (at 0.3%) and health (at 1.3%), while marking an ascent for clothing (1.3% compared to 1.1%).

Core consumer prices, which meticulously exclude the volatile food and energy prices, mirrored October’s performance by surging 0.6% year-on-year in November. Further accentuating the landscape, the monthly CPI mirrored the annual trend, witnessing a 0.5% descent, straying from both market consensus and October’s 0.1% decrease.

Advice and Analysis on Hang Seng Stock:

Understanding the macroeconomic backdrop painted by China’s CPI trends is crucial for any analysis of the Hang Seng stock. The consumer price trends, notably the precipitous fall in food costs and the overall deceleration in non-food inflation, might indicate a broader economic slowdown. This could potentially influence investor sentiments and market dynamics concerning Hang Seng stocks, especially those sensitive to consumer spending and economic growth.

To navigate the implications effectively, investors should consider diversification and prudent risk management strategies. Diversifying across various sectors, such as technology, finance, and consumer goods, can help mitigate risks associated with specific market fluctuations. Moreover, closely monitoring ongoing developments in China’s economic policies and their impact on consumer spending patterns can offer crucial insights into the trajectory of Hang Seng stocks.

Conclusion:

In essence, comprehending the intricate interplay between China’s consumer price dynamics and the implications for the Hang Seng stock is paramount for investors. By incorporating a holistic view of macroeconomic indicators and staying abreast of evolving market trends, investors can make informed decisions to navigate the volatility and capitalize on potential opportunities.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?