Introduction

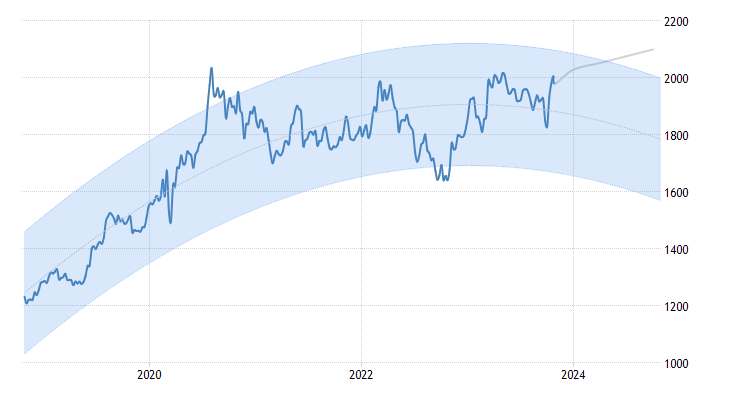

In the ever-evolving world of global finance, the glimmer of gold has always been a captivating beacon for investors seeking stability and prosperity. In recent times, the precious metal has been a center of attention, as it has steadfastly held its ground above $1,990 an ounce. However, this seemingly steady state is not without its complexities and nuances, and investors are positioning themselves cautiously as they prepare for the upcoming monetary policy meetings from major central banks.

The Federal Reserve, the behemoth of central banks, is poised to announce its interest rate decision this Wednesday. As investors await the outcome, the collective heartbeat of the financial world quickens. Simultaneously, across the Atlantic, the Bank of England is gearing up to reveal its own monetary policy decisions on Thursday. The expectations for both these central banks are clear – they are likely to leave interest rates unchanged. This cautious approach is a reflection of the intricate balance they must strike between combating inflation and managing the looming recessionary risks.

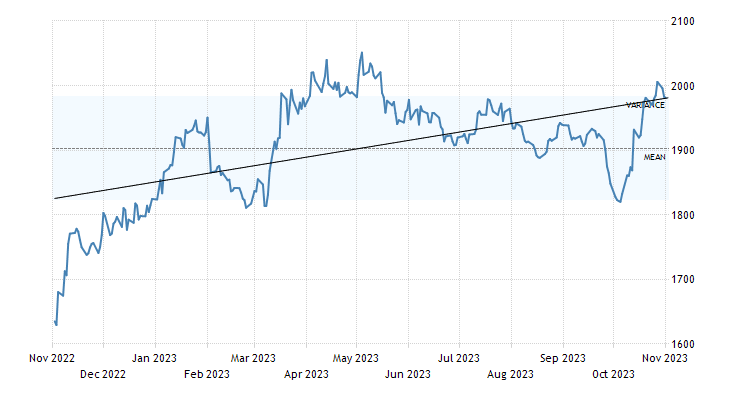

As we delve deeper into the intricacies of this dynamic financial landscape, it’s important to acknowledge the ripple effect of central bank decisions. These decisions are not isolated events; they send shockwaves through various financial instruments, including the gold market. Gold, often considered a safe-haven asset, reacts to shifts in interest rates, inflation expectations, and economic uncertainties. The meticulous investor keeps a close eye on the Gold Index Signals, a set of key indicators that offer insights into the precious metal’s performance.

One prominent factor in the current gold market equation is the Bank of Japan’s recent actions. While maintaining ultra-loose monetary settings, the Bank of Japan has made adjustments to its yield curve control policy. It expanded its target band on the 10-year JGB yield from 0.5% to +/- 1%. This move sends a subtle but meaningful signal to the global financial community. It indicates a commitment to a prolonged era of low interest rates, further fueling the attractiveness of non-interest-bearing assets like gold. The Gold Index Signals have registered this move as a noteworthy development.

Geopolitical tensions

October has been an eventful month for gold, with geopolitical tensions in the Middle East intensifying. These tensions have fueled a surge in safe-haven demand for the precious metal. Investors have been closely monitoring the Gold Index Signals throughout this period to gauge the impact of geopolitical events on gold prices. These signals provide a unique perspective on the dynamics of gold trading and help investors make informed decisions in the midst of global uncertainties.

Now, let’s shift our focus to the concept of gold as a hedge against inflation. Inflationary pressures have been a key concern for central banks, including the Federal Reserve and the Bank of England. Gold, historically, has proven to be an effective hedge against rising inflation. As the cost of living soars and paper currencies lose their value, gold tends to shine brighter. This is a fundamental aspect that investors must consider when interpreting the Gold Index Signals.

You see, gold is more than just a gleaming metal; it’s a refuge when the economic tempest rages. A stalwart asset that knows how to shine when everything else is dimmed by uncertainty. It’s like the North Star guiding you through the darkest nights of the financial world.

Gold Index Signals

Now, let me introduce you to the Gold Index Signals – the trusty navigators on this voyage. Picture them as the compass that always points you in the right direction. With their uncanny ability to keep you abreast of market movements, they’re your loyal first mates, helping you steer your portfolio towards the brightest horizon.

So, dear investors, remember that in the grand symphony of finance, gold is your golden note, and the Gold Index Signals are your chart-topping serenaders. Let’s harmonize your investments and sail through the financial seas with grace and confidence.

Transitioning to the role of an expert means using every tool at your disposal to make informed decisions. The Gold Index Signals offer a wealth of data and insights that can guide investors in the right direction. They act as a compass in the volatile seas of the financial world, helping investors navigate the treacherous waters of uncertainty.

In conclusion, the world of finance is an ever-evolving ecosystem, and gold stands as a stalwart amidst the shifting tides. The Gold Index Signals serve as an indispensable guide for investors, helping them make informed decisions in the face of complex economic and geopolitical factors. The careful analysis of these signals can be the key to unlocking the full potential of gold as an investment and risk management tool. In a world where change is the only constant, the Gold Index Signals provide stability, and as a financial expert, I recommend paying close attention to these signals to maximize investment success.