Introduction: The Delicate Balance of Rate Hikes

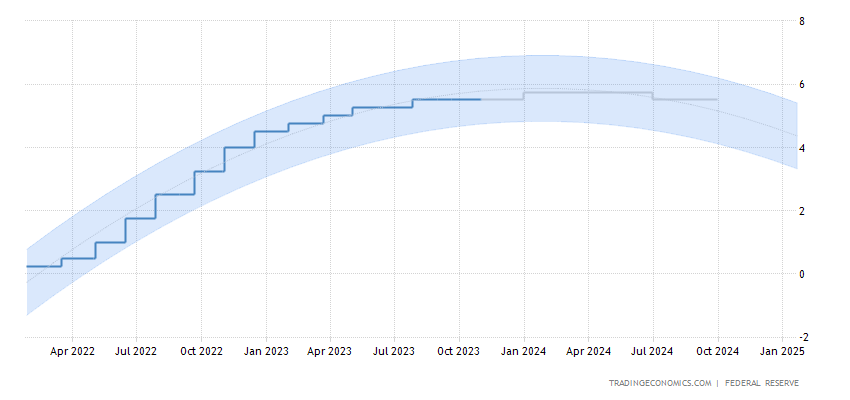

In November, the Federal Reserve upheld the federal funds rate at its 22-year high of 5.25%-5.5% for the second consecutive time. This decision highlights the Federal Reserve’s unwavering commitment to a dual mandate: reigniting inflation to reach the coveted 2% target while cautiously sidestepping the perils of excessive monetary tightening. In this article, we delve into the intricacies of this pivotal moment in monetary policy and discuss the implications for financial markets, economic activity, and investors.

Federal Reserve policymakers were keen to emphasize their meticulous approach to further policy tightening. Such a stance necessitates a thorough assessment of several critical factors, each with its unique implications for the rate hikes. In particular, the policymakers underscored their intention to gauge the cumulative repercussions of previous interest rate hikes. This prudence reflects a judicious recognition of the lag time associated with how monetary policy influences both economic activity and inflation. The Federal Reserve, in its wisdom, understands the intricacies of these dynamics and is poised to act accordingly.

Powell’s Verbal Cues and the Dot-Plot Conundrum

During the press conference, Chairman Jerome Powell’s statements sent ripples through the financial world. He hinted that the September dot-plot, which indicated that the majority of participants foresaw one more rate hike this year, might no longer be an accurate representation of the Federal Reserve’s thinking. Powell’s nuanced remarks left many investors and market observers pondering the central bank’s next move. While Powell categorically stated that the Federal Open Market Committee (FOMC) had not yet broached the topic of rate cuts, the primary focus remains on whether the central bank will need to implement additional rate hikes.

The Ongoing Saga of Rate Hikes: Implications for Investors

For investors, this decision by the Federal Reserve carries profound significance. The rate hikes have direct consequences for asset prices, particularly bonds and equities. As the central bank tightens its monetary policy, the yields on bonds can increase, which may lead to a decrease in bond prices. Similarly, equities may face headwinds as higher interest rates can curb corporate profitability and affect investor sentiment. Understanding these dynamics and their interplay is crucial for investors to make informed decisions in a shifting market environment.

Economic Indicators

The Federal Reserve’s stance on rate hikes is not made in a vacuum; it is intricately linked to a multitude of economic indicators. Observing these indicators provides valuable insights into the central bank’s decision-making process. Metrics such as employment figures, GDP growth, and inflation data are scrutinized meticulously. By staying attuned to these indicators, investors can better anticipate the Federal Reserve’s future moves and adjust their investment strategies accordingly.

The Global Context: Rate Hikes and International Markets

The implications of the Federal Reserve’s rate hikes extend far beyond U.S. borders. The global interconnectedness of financial markets means that in the United States can have ripple effects worldwide. Investors need to consider the impact on international markets, as capital flows, exchange rates, and trade dynamics can all be influenced by the Federal Reserve’s actions. A comprehensive understanding of these interconnected relationships is paramount for those looking to navigate the complexities of the global financial landscape.

Inflation: A Symbiotic Relationship

The Federal Reserve’s primary objective in implementing rate hikes is to tame inflation and steer it towards the 2% target. Inflation, when allowed to run rampant, erodes the purchasing power of a currency and disrupts economic stability. Rate hikes are the central bank’s tool to control inflation, but the relationship between the two is intricate. Investors must comprehend how it’s influence inflation and, conversely, how inflation affects the necessity for further rate hikes. This symbiotic relationship is a critical facet of modern monetary policy.

Forward Guidance

In an effort to provide clarity to financial markets and the public, central banks often employ forward guidance. This communication strategy informs the public about the future direction of monetary policy. For investors, forward guidance is a valuable tool for anticipating rate hikes and positioning their portfolios accordingly. By deciphering the central bank’s messaging, investors can gain insights into the timing and magnitude of future, helping them make informed investment decisions.

Balancing Risk and Reward in a Rate Hike Environment

Investors seeking to navigate the landscape of rate hikes must balance risk and reward effectively. While rate hikes may introduce uncertainty and potential volatility, they also present opportunities for savvy investors. Understanding how different asset classes, such as stocks, bonds, and alternative investments, respond to rate hikes can be instrumental in crafting a diversified and resilient investment portfolio. Finding the right equilibrium between risk and reward is essential in this ever-evolving financial environment.

Conclusion

The Federal Reserve’s decision to maintain the federal funds rate at its 22-year high underscores the central bank’s commitment to its dual mandate. Policymakers’ cautious approach, Chairman Powell’s nuanced statements, and the complex interplay of economic indicators all contribute to the evolving landscape of rate hikes. For investors, comprehending the implications of rate hikes is paramount. It requires a profound understanding of how these decisions affect various asset classes, the global financial ecosystem, and the delicate balance between risk and reward. As we move forward, it is the investors who are well-informed and adaptable that will thrive in this dynamic financial environment. Stay tuned and stay informed to navigate the ever-shifting world of rate hikes.

7 thoughts on “Global Market Impact: Federal Reserve Rate Hikes Unveiled”