Introduction:

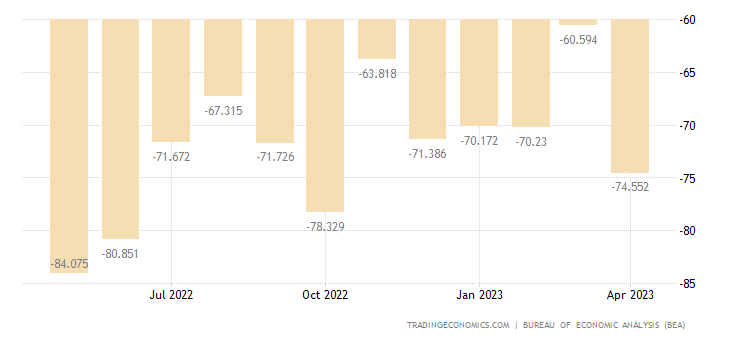

In the month of April 2023, the United States faced a formidable economic hurdle as its trade deficit widened significantly, reaching a six-month high of a staggering $74.6 billion. In this article, our aim is to go beyond the cold numbers and delve into the human side of this development, offering you a comprehensive analysis that uncovers the underlying factors driving this outcome. By diving into the latest data and incorporating insights from reputable economic indicators such as the PMI and IBD/TIPP, we embark on a journey to bring this story to life, providing you with a deeper understanding of the message conveyed by the US economy to the rest of the world.

Together, we will explore the intricate dance of export and import trends, but more than that, we will examining the stories of the people behind them. We will uncover the challenges faced by exporters and importers, the impact of shifting consumer preferences, and the ripple effects of geopolitical tensions. Through this lens, we aim to provide you with a more relatable and empathetic perspective on the complex web of trade dynamics.

Additionally, we will unravel the intricate relationships with trade partners, putting faces to the names of countries like China, the European Union, Mexico, and Vietnam. By doing so, we gain a deeper appreciation for the interconnectedness of our global economy and the people who drive it.

Trade Balance and Market Expectations:

Compared to the previous month’s trade gap of $60.6 billion, the trade deficit expanded by $14 billion. Market forecasts had predicted a slightly higher shortfall of $75.2 billion. While this widening deficit raises concerns about the US economy’s competitiveness, it is essential to examine the underlying export and import dynamics to gain a more nuanced perspective.

Export Performance and Contributing Factors:

As we delve into the export performance of the United States in April, we uncover a narrative that echoes the ebb and flow of global trade. The figures reveal a 3.6% decline in exports, amounting to $249 billion, signaling a potential loss of momentum in international trade.

Among the leading export categories, we witnessed a dip in various goods and services that have long been associated with the US economy’s prowess. Crude oil and fuel oil exports experienced a downturn, reflecting the ever-changing landscape of energy markets and global demand patterns. The decline in pharmaceutical preparations highlights the intricate dynamics of the healthcare industry and the impact of evolving regulations and market conditions. Similarly, the decrease in gem diamonds and jewelry exports reflects shifting consumer preferences and competition in the global luxury market.

However, amidst these declines, there was a silver lining in the form of travel-related goods. Despite the challenges faced by the travel industry during the ongoing pandemic, the sales of these goods showed a positive trajectory. This could be attributed to a pent-up desire for travel experiences and a gradual recovery in international tourism. It reminds us that even in the face of adversity, certain sectors can find their footing and provide a glimmer of hope.

Factors Contributing to the Decline in Exports:

The decline in US exports during April can be attributed to a multitude of factors that highlight the human stories behind the numbers. The global economic environment, characterized by ever-changing consumer preferences and geopolitical tensions, played a pivotal role in shaping export performance.

Consumer preferences, influenced by evolving trends and preferences, can have a profound impact on the demand for specific goods and services. As people’s tastes and preferences shift, industries must adapt to meet these changing demands. The decline in certain export categories, such as gem diamonds and jewelry, serves as a reminder of the dynamic nature of the global luxury market and the need for constant innovation and adaptation.

Geopolitical tensions and trade disputes can disrupt established trade relationships, impacting the flow of goods and services across borders. These tensions not only affect the businesses directly involved but also have broader implications for the overall export performance of nations. They highlight the interconnectedness of economies and the delicate balance required to maintain stable trade relationships in an ever-changing geopolitical landscape.

Import Performance and Contributing Factors:

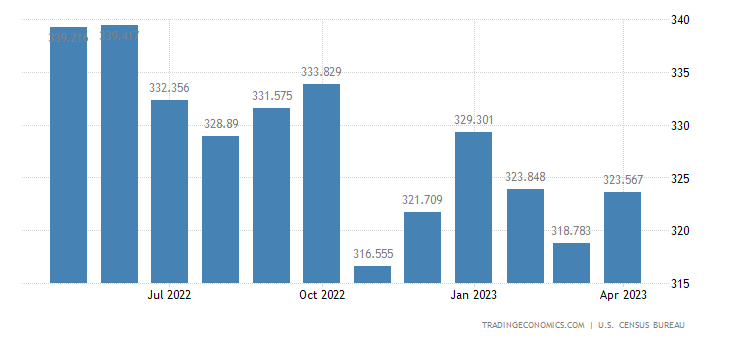

On the import side, April saw a 1.5% increase in imports to $323.6 billion, suggesting ongoing demand for foreign goods in the US market. Passenger cars, industrial supplies and materials, finished metal shapes, nonmonetary gold, organic chemicals, cell phones, and other household goods led the import growth. However, there was a decline in purchases of crude oil, natural gas, transport, and travel services.

This growth in imports reflects the resilience of the US consumer market and its appetite for a diverse range of products. The rise in passenger car imports can be attributed to the increased demand for automobiles as the economy recovers. Industrial supplies and materials signify a growing need for raw materials and intermediate goods in various sectors. However, the decrease in crude oil and natural gas purchases suggests progress in the US’s goal to achieve energy independence.

Trade Partners and Their Impact:

Analyzing the trade deficit by country provides insights into the US’s trade relationships and their impact on the overall deficit. In April 2023, the largest deficits were recorded with China ($24.2 billion), the European Union ($17.3 billion), Mexico ($13 billion), and Vietnam ($8.5 billion). On the other hand, the US enjoyed surpluses with the Netherlands ($4.2 billion), South and Central America ($4.1 billion), Belgium ($1.9 billion), and Hong Kong ($1.6 billion).

The significant trade deficit with China indicates the persistent trade imbalances between the two largest economies. Ongoing trade tensions, regulatory policies, and differences in manufacturing competitiveness contribute to this deficit. The deficit with the European Union can be attributed to various factors, including the impact of Brexit and fluctuations in exchange rates. Meanwhile, surpluses with the Netherlands, South and Central America, Belgium, and Hong Kong suggest opportunities for expanding trade cooperation.

Implications for the Global Economy:

The widening trade deficit in the United States carries significant implications for the global economic landscape, encompassing both challenges and opportunities. As the US continues to hold a prominent position as a major consumer market, fluctuations in its trade balance have far-reaching effects on international trade patterns, global supply chains, and the overall growth rates of economies worldwide.

A sustained trade deficit in the US may trigger a series of responses that impact the global economy. Increased protectionism, in the form of trade barriers and tariffs, could emerge as countries seek to safeguard their domestic industries and mitigate the impact of a widening trade imbalance. This, in turn, may escalate trade disputes and heighten tensions between nations.

Furthermore, policy adjustments may come into play as countries reassess their trade strategies in response to the US trade deficit. These adjustments could include changes in monetary policies, exchange rate manipulations, or the formulation of new trade agreements to rebalance trade flows. Such policy shifts have the potential to disrupt established trade relationships and create a ripple effect throughout the global economy.

Key Economic Indicators and Future Outlook:

To gain further insights into the trajectory of the US economy, it is crucial to examine renowned economic indicators. The Purchasing Managers’ Index (PMI) provides valuable information on manufacturing and service sector activities, which directly impact trade dynamics. The IBD/TIPP Economic Optimism Index gauges consumer sentiment, serving as a barometer of future consumption patterns.

By closely monitoring these indicators and tracking ongoing developments in international trade policies, market conditions, and global economic trends, policymakers, businesses, and investors can better navigate the evolving trade landscape.

Conclusion:

The widening trade deficit in the United States throughout April 2023 serves as a poignant reminder of the intricate nature of the global economic system. It underscores the challenges and opportunities that arise from the interconnectedness of nations and the ever-evolving dynamics of international trade. To navigate this complex landscape effectively, it is essential to delve into the contributing factors, examine export and import trends, and analyze the dynamics with trade partners.

By understanding the factors that contributed to the widening trade deficit, we gain valuable insights into the forces shaping the global economic stage. The fluctuations in export and import trends provide a glimpse into the shifting dynamics of industries, consumer preferences, and geopolitical tensions. These insights allow us to make informed decisions and adapt strategies accordingly, both at an individual and organizational level.

Incorporating insights from renowned economic indicators such as the PMI and IBD/TIPP adds depth to our understanding of the trade signal the United States sends to the rest of the world. These indicators offer valuable snapshots of economic conditions, providing a framework for assessing the health of the economy and predicting future trade patterns. By leveraging these insights, we can better anticipate market trends, identify emerging opportunities, and mitigate potential risks.

One thought on “Global Economic Trends and Trade Deficit: An In-depth Analysis of US Trade Performance in April 2023”