Introduction:

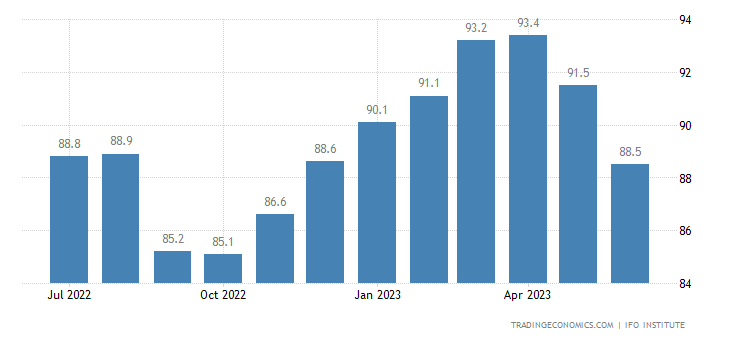

Germany stock signal and Germany’s economic outlook faces increasing uncertainty as the Ifo Business Climate indicator for June 2023 fell for the second consecutive month to 88.5. This decline, the lowest level since last December, came as a surprise to market analysts, who had anticipated a reading of 90.7. Such a downturn underscores the persistent challenges surrounding the recovery of Europe’s largest economy. Manufacturers, in particular, have witnessed a decline in new orders, primarily attributed to the dampening effect of global interest rate hikes on overall demand. Consequently, expectations for the upcoming months have become notably more pessimistic, with firms expressing a growing sense of concern. In this article, we delve deeper into the factors contributing to Germany’s business climate decline and explore the potential implications for stock signals, offering expert advice for investors seeking to navigate these challenging times.

Factors Influencing Germany’s Business Climate

Germany’s business climate is significantly impacted by several factors, contributing to the recent decline in the Ifo Business Climate indicator. One key element affecting sentiment is the tightening global monetary policy, characterized by interest rate hikes. These hikes have had a dampening effect on demand, particularly for manufactured goods, as consumers and businesses become more cautious in their spending. This trend is evident in the decreased volume of new orders reported by manufacturers, signaling a broader slowdown in economic activity.

Moreover, uncertainties surrounding international trade relations have further contributed to the downturn in Germany’s business climate. Ongoing trade disputes and the imposition of tariffs have disrupted global supply chains, leading to reduced export opportunities for German companies. These challenges have been particularly pronounced in sectors such as automotive manufacturing, where Germany holds a significant market share. The resulting decline in exports has created a ripple effect throughout the economy, dampening business confidence and investment.

Implications for Stock Signals and Investment Strategy

The weakening business climate in Germany has implications for stock signals and investment strategies, warranting careful consideration for investors. As sentiment turns increasingly negative, it is important to assess the potential impact on different sectors and adjust investment portfolios accordingly.

Manufacturing Sector:

Germany stock signal with manufacturers experiencing a sharp decline in new orders, investors should exercise caution when considering stocks within this sector. Companies heavily reliant on exports may face headwinds due to reduced global demand. It is advisable to focus on firms with diversified revenue streams, resilient supply chains, and strong competitive advantages to mitigate the risks associated with the current economic environment.

Service Providers:

While the decline in the business climate has also affected service providers, this sector has displayed relative resilience. Investors can explore opportunities within segments such as technology services, healthcare, and digital transformation. Companies offering innovative solutions and digitalization expertise are likely to fare better amidst challenging economic conditions.

Traders and Constructors:

Germany stock signal and the pessimistic sentiment among traders and constructors signal potential challenges ahead. Investors should exercise caution when considering investments in these sectors, given the anticipated downturn. It may be prudent to prioritize companies with strong balance sheets, efficient cost management, and a track record of successfully navigating market downturns.

Expert Advice for Investors

Diversification:

Spreading investments across different sectors and asset classes can help mitigate risk. Diversification ensures that any potential losses in one sector are balanced by gains in others. Investors should consider allocating their portfolios to sectors that demonstrate resilience or present new growth opportunities.

- First and foremost, let us direct our attention toward a company’s financial health. It is imperative to scrutinize their financial statements meticulously, including their balance sheets, income statements, and cash flow statements. By doing so, we can gain insights into their revenue growth, profit margins, and cash reserves. Companies that boast a robust financial foundation, marked by consistent growth and a healthy cash position, are better prepared to navigate the tumultuous seas of unpredictable economic conditions.

- Next, let us delve into the realm of a company’s competitive position. It is crucial to evaluate their market share, customer base, and brand strength. Do they stand as trailblazers within their industry? Do they possess a distinctive value proposition that sets them apart from their competitors? Companies armed with a formidable competitive advantage possess the resilience to weather storms and adapt to the ever-changing tides of the market.

- Lastly, let us ponder upon a company’s market prospects. Are they operating within a flourishing industry or encountering potential obstacles? It is essential to seek signs of future growth, such as expanding markets, innovative product offerings, or strategic alliances. Companies blessed with promising market prospects are poised to flourish, even amidst the most challenging economic landscapes.

- Long-Term Perspective: While short-term market fluctuations can be unsettling, it is important to maintain a long-term perspective when making investment decisions. History has shown that economies and markets go through cycles, and patient investors often benefit from recovery and growth phases.

Conclusion:

The declining business climate in Germany casts a shadow of challenges upon investors, my dear reader, necessitating a thoughtful and strategic approach to portfolio management. It is imperative to recognize the impact of factors like tightening global monetary policy and uncertainties surrounding international trade relations, which have played a role in the current economic downturn. In the face of these testing times, investors must embrace a multifaceted strategy that encompasses careful analysis, adaptation, and seeking expert advice.

2 thoughts on “Germany Stock Signal: Business Climate”