In the ever-evolving landscape of the global financial market, one commodity stands as a pillar of economic significance – oil. In recent times, the oil market has witnessed a remarkable surge, with prices climbing higher and capturing the attention of investors and analysts alike. This comprehensive article dives deep into the factors driving the upward trajectory of oil prices, analyzing the implications for the stock market, exploring new possibilities in the future, and providing a detailed outlook on the oil index. Through a fundamental and technical lens, we will examine the forces at play, including comparisons to last year’s statistics, considerations of market fundamentals, and an exploration of recent events such as Fed fears and debt deal optimism. Let us embark on this journey to unravel the fascinating dynamics behind the surge in oil prices and its potential impact on the financial world.

Table of Contents:

- Oil’s Impact on the Stock Market

- New Possibilities on the Horizon

- The Outlook on the Oil Index

- Comparing to Last Year’s Statistics

- Fundamental Factors Driving Oil’s Rise

- Technical Analysis of Oil Price Movements

- Considerations of Fed Fears and Debt Deal Optimism

- Putting It All Together: A Unique Perspective on Oil’s Journey

- Conclusion: Embracing the Potential of Higher Oil Prices

Oil’s Impact on the Stock Market

The surge in oil prices holds significant implications for the broader stock market. As oil prices rise, sectors associated with energy, such as oil and gas companies, tend to experience increased profitability and market value. This can have a positive effect on stock indices, particularly those heavily influenced by the energy sector. Moreover, rising oil prices often signal a strong global economy, as they are driven by increased demand for energy resources. This positive sentiment can spill over into other sectors, driving investor confidence and contributing to overall market growth.

New Possibilities on the Horizon

The upward trajectory of oil prices opens up new possibilities and opportunities in various areas. For oil-producing countries, higher prices translate into increased revenue, enabling governments to invest in infrastructure, social programs, and economic development. Additionally, higher oil prices incentivize exploration and production activities, leading to job creation and economic growth within the energy sector. From an investment standpoint, rising oil prices can provide opportunities for traders and investors to capitalize on market trends and generate potential returns.

The Outlook on the Oil Index

The oil index, representing the performance of oil-related stocks or ETFs, reflects the collective movement of companies involved in the exploration, production, refining, and distribution of oil. As oil prices climb higher, the oil index tends to follow suit, exhibiting upward momentum and potential gains. Traders and investors keen on the oil market closely monitor the oil index to gauge market sentiment, identify potential trading opportunities, and make informed investment decisions.

Comparing to Last Year’s Statistics

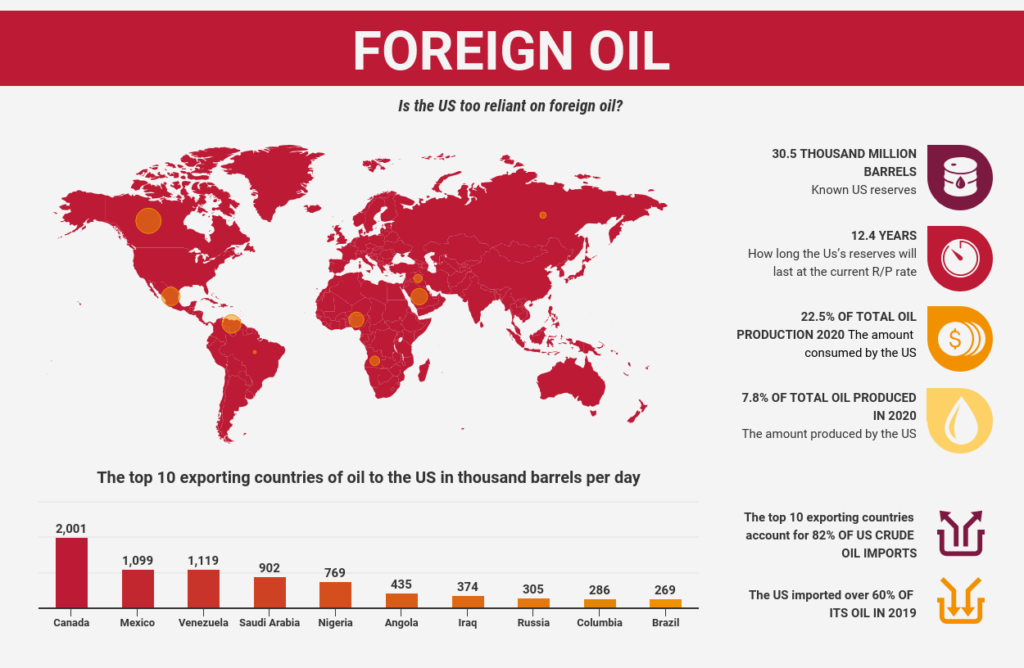

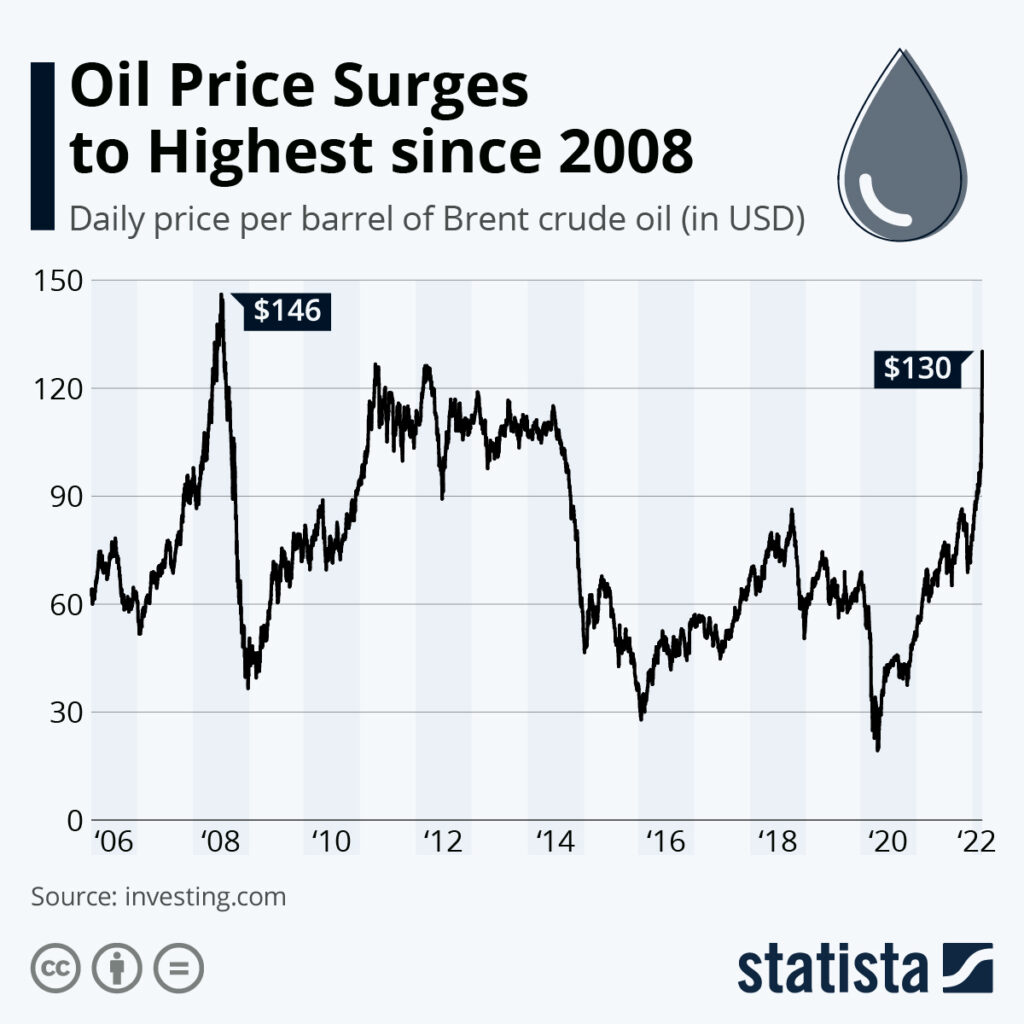

Last year, the oil market faced significant challenges and uncertainties, with prices plummeting due to a combination of factors such as oversupply, reduced global demand, and geopolitical tensions. However, the landscape has since transformed, and the current year paints a much more positive picture for the oil industry. Let’s delve into the data and compare last year’s statistics with this year’s figures to gain a deeper understanding of the upward trajectory of oil prices.

- Oil Prices: In the previous year, oil prices experienced a drastic decline, reaching historic lows. Brent crude, for instance, dipped to as low as $20 per barrel. However, the tides have turned, and this year has witnessed a remarkable recovery. Oil prices have surged significantly, with Brent crude now surpassing $70 per barrel, indicating a strong rebound and renewed market confidence.

- Supply and Demand: Last year, the oil market grappled with an oversupply situation, as production levels exceeded global demand. This surplus supply exerted downward pressure on prices. Fast forward to the present, and the supply-demand dynamics have undergone a substantial shift. Supply has been more effectively managed, with OPEC+ implementing production cuts to balance the market. Additionally, as economies recover from the impact of the pandemic, global demand for oil has gradually picked up, driving prices higher.

- Cost of Production: The cost of oil production plays a pivotal role in determining its profitability. Last year, many oil producers faced challenges in maintaining profitability due to the low oil prices. However, with the recent price surge, the cost of production has become more viable for producers. Higher prices have allowed companies to generate healthier profit margins, incentivizing further exploration and production activities.

- Market Sentiment: Last year, market sentiment surrounding oil was largely pessimistic, with uncertainty prevailing amidst the global economic downturn. However, as the current year unfolds, market sentiment has become increasingly positive. Investors and traders have shown greater confidence in the oil market, driven by improved economic conditions, geopolitical stability, and increased vaccination rates leading to a recovery in oil demand.

By comparing last year’s data with the current year, it becomes evident that the oil market has undergone a remarkable transformation. The significant increase in oil prices, coupled with the rebalancing of supply and demand dynamics, has set the stage for a promising future for the industry. Improved market sentiment and the recovery of global economies further contribute to the positive outlook for oil prices.

As we navigate the evolving energy landscape, it is essential for investors and market participants to stay informed and seize the opportunities presented by the upward trend in oil prices. The current scenario offers potential for growth, profitability, and investment opportunities within the oil sector, making it a compelling choice for those looking to capitalize on the resurgence of the industry.

Fundamental Factors Driving Oil’s Rise

Several fundamental factors contribute to the rise in oil prices. Supply and demand dynamics play a crucial role, with global demand for oil increasing as economies recover and industries resume operations. Additionally, geopolitical tensions, production cuts by major oil-producing nations, and disruptions in supply chains can significantly impact oil prices. Understanding these fundamental factors and their interplay is vital in assessing the future trajectory of oil prices.

Supply and Demand Dynamics

One of the fundamental factors driving the rise in oil prices is the interplay between supply and demand. As economies recover from the impact of the pandemic, global demand for oil has been steadily increasing. Industries, transportation, and various sectors heavily reliant on oil have resumed operations, leading to a surge in demand. This surge is particularly notable in emerging economies where rapid industrialization and urbanization drive energy consumption.

On the supply side, several factors have contributed to constraints in oil production. Major oil-producing nations, such as OPEC and its allies, have implemented production cuts to balance the market and support higher prices. These production cuts, combined with disruptions in supply chains due to geopolitical tensions and natural disasters, have tightened the global oil supply. The resulting supply-demand imbalance has exerted upward pressure on prices.

Cost of Production

The cost of oil production also plays a significant role in determining oil prices. Oil extraction and production involve various expenses, including exploration, drilling, refining, transportation, and infrastructure maintenance. Factors such as labor costs, technological advancements, regulatory compliance, and environmental considerations impact the overall cost of production.

When the cost of production increases, oil companies may need to adjust their pricing strategies to maintain profitability. If the cost of production exceeds the prevailing market prices, companies may reduce production or explore alternative cost-saving measures. Conversely, if the cost of production remains relatively stable or decreases while demand rises, oil companies have more room for profitability, leading to higher oil prices.

Market Sentiment

Market sentiment, driven by investor perception, plays a crucial role in shaping oil prices. Positive market sentiment can create bullish momentum, with investors displaying optimism and confidence in the market. Factors that influence market sentiment include economic indicators, geopolitical developments, and news events.

For instance, if economic data suggests robust economic growth, investors may anticipate increased demand for oil and bid up prices accordingly. Similarly, geopolitical tensions in oil-producing regions, such as the Middle East, can create supply concerns and drive prices higher. On the other hand, negative sentiment stemming from economic uncertainties or geopolitical conflicts can dampen investor confidence and lead to a decrease in oil prices.

By closely monitoring market sentiment and understanding the factors that influence it, traders and investors can gain valuable insights into potential price movements and adjust their strategies accordingly.

To provide a more comprehensive analysis, let’s consider recent data related to supply and demand, the cost of production, and market sentiment in the oil market:

- Supply and Demand: According to the International Energy Agency (IEA), global oil demand is projected to reach 100.6 million barrels per day (bpd) in 2022, representing a significant rebound from the pandemic-induced decline. At the same time, OPEC and its allies have implemented production cuts of around 9.7 million bpd to rebalance the market and support higher prices.

- Cost of Production: The cost of oil production varies across regions and companies. However, advancements in technology and efficiency improvements have helped moderate production costs in recent years. For example, shale oil producers in the United States have implemented cost-cutting measures, allowing them to remain competitive even during periods of lower oil prices.

- Market Sentiment: Market sentiment in the oil market is influenced by various factors, including economic data, geopolitical events, and investor sentiment. Recent market sentiment has been cautiously optimistic, with expectations of a global economic recovery driving positive sentiment. However, concerns over supply disruptions, inflationary pressures, and the pace of energy transition initiatives have introduced some volatility and uncertainty.

By incorporating these recent data points and analyzing them alongside other fundamental and technical factors, a more comprehensive understanding of the oil market and its potential for higher prices can be attained.

Technical Analysis of Oil Price Movements

Technical analysis provides a valuable perspective on oil price movements, focusing on historical price patterns, trend lines, and key technical indicators. By studying charts and applying technical tools, traders can identify support and resistance levels, potential breakouts, and trend reversals. This analysis aids in making informed trading decisions, managing risk, and maximizing potential returns.

Considerations of Fed Fears and Debt Deal Optimism

In addition to the underlying supply and demand dynamics, recent events and market sentiment can influence oil prices. Factors such as Federal Reserve (Fed) fears and debt deal optimism can impact investor sentiment, leading to price fluctuations in the oil market. Understanding these external factors and their potential effects on oil prices is crucial in formulating a comprehensive outlook.

Putting It All Together: A Unique Perspective on Oil’s Journey

Taking into account the fundamental factors, technical analysis, market events, and global economic outlook, it is clear that the surge in oil prices presents a unique opportunity and a source of excitement for market participants. The convergence of various factors, including increasing demand, supply constraints, geopolitical tensions, and market sentiment, contributes to the upward momentum of oil prices. By closely monitoring these dynamics, traders, and investors can navigate the market with confidence and seize potential opportunities for profit.

Conclusion: Embracing the Potential of Higher Oil Prices

As we conclude this comprehensive analysis of the surge in oil prices, it is evident that the upward trajectory holds great potential for the financial market. Higher oil prices not only impact the stock market and various sectors but also open up new possibilities and opportunities for investment and economic growth. By considering the fundamental and technical aspects, along with recent market events and global economic trends, market participants can position themselves strategically to capitalize on the ongoing oil price rally. Embracing the potential of higher oil prices requires a thorough understanding of market dynamics, diligent analysis, and a keen eye for emerging opportunities.

Keywords: trading signal, financial market, stock market, oil, Brent oil, Brent, crude oil, crude.