Introduction

The recent warning from the Fitch credit rating agency regarding the mounting U.S. debt has brought renewed urgency to the ongoing talks between the White House and congressional Republicans. This article delves into the implications of Fitch’s warning, explores the potential impact on the American economy, and sheds light on the consequences that could arise if the U.S. debt were to default. As financial professionals, it is crucial to analyze these issues objectively and offer insights into the challenges and opportunities ahead.

The Fitch Warning: A Wake-Up Call

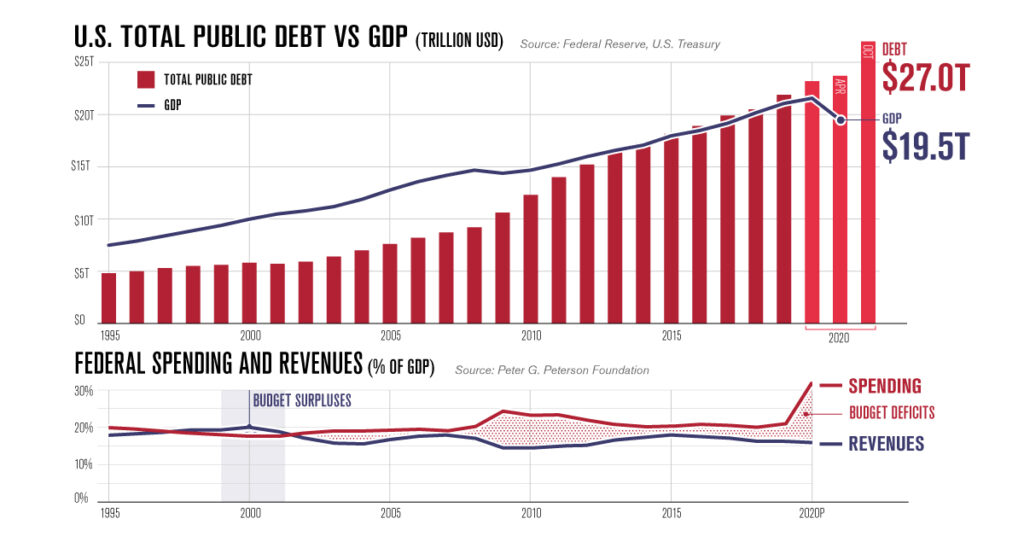

Fitch Credit Rating Agency has raised concerns about the escalating U.S. debt levels, emphasizing the need for immediate attention. The agency’s warning centers around the growing debt-to-GDP ratio and the potential risks it poses to the country’s financial stability and creditworthiness. This cautionary signal serves as a wake-up call for policymakers to address the underlying issues and develop sustainable solutions.

Talks between the White House and Congressional Republicans

The Fitch warning has injected a sense of urgency into the discussions between the White House and congressional Republicans. Both parties acknowledge the importance of tackling the debt crisis head-on and finding common ground on fiscal policies, budgetary adjustments, and potential reforms. The negotiations aim to strike a delicate balance between stimulating economic growth and ensuring responsible fiscal management.

Potential Impact on the American Economy

Borrowing Costs and Interest Rates: A downgrade in the U.S. credit rating could lead to higher borrowing costs and interest rates. This, in turn, may affect consumer loans, mortgages, and corporate borrowing, potentially dampening consumer spending and hindering business investments.

Investor Confidence and Financial Markets

The Fitch warning has the potential to shake investor confidence, resulting in volatility in financial markets. Investors may adopt a more risk-averse approach, leading to capital outflows and a decline in stock market performance. The value of the U.S. dollar and foreign investments may also be impacted.

Government Spending and Budgetary Decisions

Addressing the urgency surrounding the debt requires making tough decisions on government spending and budget cuts. Policymakers must carefully balance the need for economic stimulus with responsible fiscal management, which may entail debates on entitlement programs, defense spending, and tax policies.

Long-Term Economic Stability

Effectively managing the national debt is crucial for ensuring long-term economic stability. Failure to address the debt issue could result in rising interest costs, limited fiscal flexibility, and a reduced ability to invest in critical areas such as infrastructure, education, and healthcare.

International Perception and Influence

How the U.S. handles its debt situation can significantly impact global perception and influence. A downgrade in the credit rating may raise concerns among international investors and creditors, affecting borrowing capabilities and the nation’s standing in international financial matters.

The Implications of Debt Default

Financial Market Disruption: Debt default can trigger significant disruptions in financial markets. Bond prices may plummet, interest rates could spike, and a broader sell-off may occur, impacting stock prices, currency exchange rates, and investment flows.

Credit Crunch and Reduced Access to Capital

Defaulting on debt obligations can lead to a credit crunch, making it challenging for businesses and individuals to access capital. Lenders may become hesitant to extend credit, resulting in reduced investment, slowed economic growth, and potential job losses.

Economic Contraction and Recession

A debt default could potentially trigger an economic contraction and even a recession. Government spending may need to be drastically reduced, causing a decline in public services, job cuts, and reduced consumer spending. The overall economic activity would suffer, affecting businesses and households alike.

Loss of International Credibility

Defaulting on debt obligations would damage the United States’ reputation as a reliable borrower. This loss of international credibility could lead to higher borrowing costs in the future, reduced foreign investments, and potential challenges in negotiations with international partners.

Social and Political Unrest

The economic consequences of debt default could lead to social and political unrest. Austerity measures, reduced public services, and increased economic hardships can create dissatisfaction among the population, potentially fueling social and political tensions.

Conclusion

Addressing the Urgency for a Sustainable Future The warning from Fitch Credit Rating Agency about the U.S. debt has added a sense of urgency to the talks between the White House and congressional Republicans. The implications of an unchecked debt burden could have far-reaching consequences for the American economy, including increased borrowing costs, reduced investor confidence, and potential debt default consequences. It is imperative for policymakers to prioritize responsible fiscal management, implement effective reforms, and ensure a sustainable path forward to secure a prosperous future for the nation.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Readers are advised to consult with relevant professionals for guidance specific to their financial situation.”