Introduction:

Well, folks, gather ’round and let’s dive into the captivating address delivered by none other than Fed Chair Chair Jerome Powell at the ECB Forum on Central Banking. Brace yourselves, because Powell had some real eye-opening things to say about the future of interest rates and the resilience of our beloved US economy. This article is your one-stop shop for unpacking Powell’s remarks and gaining insightful wisdom about how they might shake up the financial landscape. As a seasoned financial writer who’s seen it all, I’ll be your trusty guide, analyzing these developments and dishing out some savvy advice to help you navigate this ever-changing economic landscape with finesse. So, grab a seat and get ready for a wild ride!

Section 1: Fed Chair speaks

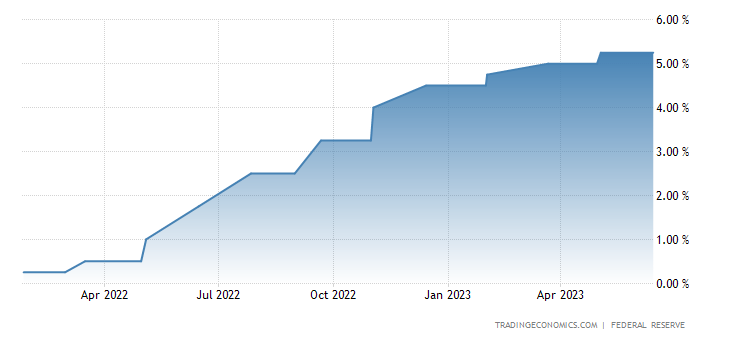

Fed Chair Powell came out swinging with some serious talk about the necessity for additional restrictions and made it clear that interest rates are set to climb once again within the current year. Brace yourselves, folks, because he hinted at the likelihood of not just one, but at least two more rate hikes on the horizon. And hey, don’t rule out the possibility of back-to-back increases in subsequent meetings, because everything’s still on the table. This cautious stance highlights the Federal Reserve’s unwavering dedication to ensuring steady economic growth and tackling any potential inflationary risks head-on. So, dear investors and market participants, buckle up and get ready for more tightening measures that could have an impact on borrowing costs and, of course, those all-important investment decisions. It’s time to stay alert and stay sharp!

Section 2:

The resilience of US Economy Chair Powell also expressed confidence in the resilience of the US economy, highlighting that while a recession remains a possibility, it is not the most probable outcome. This optimism stems from the positive indicators observed thus far, including strong employment figures, robust consumer spending, and a recovering labor market. However, it is crucial to acknowledge the presence of potential risks and uncertainties, such as geopolitical tensions or unforeseen external shocks. Therefore, a balanced approach to economic planning and risk management is advised to navigate these fluid conditions successfully.

Section 3:

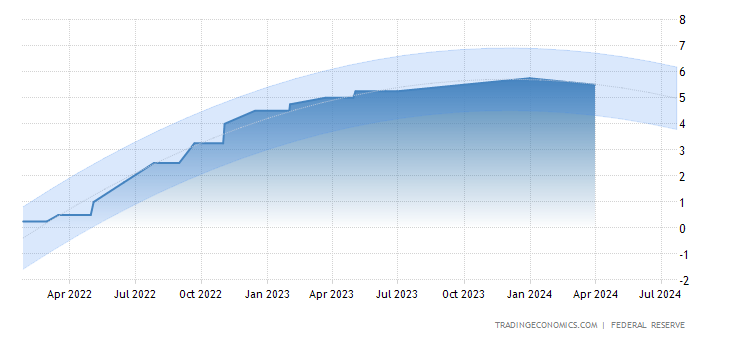

Federal Reserve’s Monetary Policy Stance The Federal Reserve opted to maintain the target range for the fund’s rate at 5%-5.25% during its June meeting. Nonetheless, they hinted at the possibility of a further increase to 5.6% by the end of the year if economic conditions and inflationary pressures persist. This decision marked a significant shift from the previously aggressive tightening campaign, which saw ten consecutive rate hikes, raising borrowing costs to their highest level since September 2007. The revised upward projections for 2023, 2024, and 2025 indicate the Federal Reserve’s cautious optimism and proactive stance in managing monetary policy to support sustainable economic growth.

Section 4:

Navigating the Changing Landscape Given the Federal Reserve’s announcements, it is crucial for investors, businesses, and individuals to reassess their financial strategies. Firstly, businesses should review their capital expenditure plans, considering potential higher borrowing costs in the future. A comprehensive assessment of financial stability, including stress testing and scenario analysis, is advisable for financial institutions to ensure robust risk management. Furthermore, individuals should evaluate their investment portfolios and consider diversification strategies to mitigate potential volatility. Seeking professional advice and staying updated with market developments will be key to making informed decisions amidst evolving economic conditions.

Conclusion:

Federal Reserve Chair Jerome Powell’s recent statements regarding upcoming restrictions and interest rate hikes have significant implications for the US economy and financial markets. While these measures aim to maintain stability and curb inflationary pressures, they necessitate a proactive approach to financial planning and risk management. As a professional financial writer, my advice is to remain vigilant, reassess investment strategies, and seek expert guidance to navigate the changing landscape successfully. By staying informed and prepared, individuals and businesses can position themselves for long-term financial resilience and growth.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?