Introduction:

The unexpected and disconcerting economic contraction witnessed in the first quarter of 2023 by the Eurozone not only serves as a stark reminder of the formidable challenges that confront the region but also provides a poignant glimpse into the broader issues plaguing the global economy. This thought-provoking and insightful article delves into the intricate web of interrelated factors with meticulous precision, unraveling the pivotal role they played in contributing to the Eurozone’s economic recession. Simultaneously, it explores the far-reaching implications for critical indicators such as gold prices, consumer confidence, and the trade signal, allowing us to glean invaluable insights that shed light on the profound interconnectedness between the Eurozone and the vast tapestry of the global economic landscape. Armed with this deeper understanding, we are empowered to navigate the challenges and seize the opportunities that lie ahead, cultivating a more resilient, adaptive, and prosperous economic future.

Impact of Household Expenditure, Economy Recession, and Public Spending on Consumer Confidence:

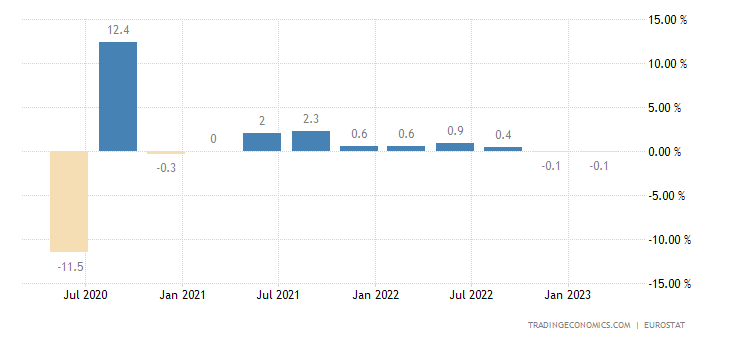

During the first quarter of 2023, families across the Eurozone faced some significant challenges with their spending. The steady rise in inflation and borrowing costs caused a slight 0.3% decline in household expenditure, making it harder for people to stretch their budgets and meet their needs. This decrease in spending directly affected the confidence and optimism that individuals had about the overall state of the economy. As a result, many families felt a sense of unease and uncertainty about their financial futures, which in turn had a detrimental impact on economic growth.

In addition to the struggles faced by households, governments in the Eurozone made the difficult decision to reduce public spending by 1.6%. This meant rolling back some of the stimulus measures that were initially implemented to support and uplift the economy. The aim behind this move was to address the mounting energy costs that were placing an additional burden on families. However, this reduction in public spending unintentionally added to the existing challenges faced by individuals, leading to a further decline in consumer confidence. With less financial support and assistance from the government, many families found themselves grappling with increased financial strain, exacerbating the overall contraction in the economy.

Rebound in Gross Fixed Capital Formation and Economy Recession:

A Positive Signal Amidst Economic Downturn While the Eurozone faced economic headwinds, there was a silver lining in the form of a rebound in gross fixed capital formation during Q1 2023. With a growth rate of 0.6%, businesses showcased resilience and confidence in investment. This positive signal suggests the potential for future economic stability and growth, both within the Eurozone and as a reflection of the global economy.

Trade Performance, Economy Recession, and Implications for Gold:

Trade dynamics play a vital role in the Eurozone’s economic performance. During Q1 2023, the region witnessed a marginal decline of 0.1% in exports, accompanied by a notable decrease of 1.3% in imports. This subdued trade activity reflects muted domestic demand and uncertainties surrounding global trade patterns. In this context, gold, often considered a safe-haven asset during economic uncertainties, may garner increased attention from investors seeking stability and hedging against market volatility.

Impact on Global Economy Recession and Trade Signal:

The Eurozone’s economic recession reverberates throughout the global economy, given its substantial role in international trade and commerce. As a major economic bloc, the performance of the Eurozone affects supply chains, demand for goods and services, and investor sentiment worldwide. The region’s economic downturn can trigger a trade signal, indicating potential shifts in global trade patterns and market dynamics. Investors and policymakers alike monitor these signals closely to make informed decisions about market positioning and economic policies.

Conclusion on Economy Recession:

The Eurozone’s unexpected economic recession in the first quarter of 2023 not only shows us the difficulties faced by the region’s economy but also sheds light on broader issues within the global economy. This downturn has had a direct impact on people’s lives, making it harder for them to cover their everyday expenses and putting a strain on public spending. Consequently, consumer confidence has been affected, further contributing to the overall economic decline. Nevertheless, amidst these challenges, there is a glimmer of hope for the future as we witness an increase in investments, which suggests that businesses are optimistic about better times ahead.

The Eurozone’s trade performance and its influence on the gold market remind us how the fluctuations of global trade can have an impact on regular investors like you and me. During times of uncertainty, when economies are struggling, it becomes crucial for policymakers and investors to carefully monitor trade signals. These signals serve as guides through market volatility, enabling informed decisions that contribute to economic recovery.

One thought on “Economic Recession and Eurozone Reflect Global Economic Challenges”