Introduction

In the fast-paced and ever-evolving landscape of today’s global financial markets, the unwavering resilience of Equities has been a source of profound intrigue. Amid the perpetual flux of market dynamics, these equities continue to demonstrate their enduring strength. This comprehensive exploration, penned by a seasoned financial expert, delves into the intricate factors that underpin the steadfastness of European Equities, offering valuable guidance to investors navigating the complex realm of global finance.

The Perpetual Resilience of European Equities

In the context of contemporary global markets, Equities have emerged as a symbol of stability. As the financial world continues to spin, these equities stand as a beacon of dependability, anchoring investor portfolios with their consistent performance.

Unlike many asset classes that flounder in the face of economic turbulence, European Equities have displayed remarkable staying power. This unique quality is driven by a convergence of factors that render them exceptional in the world of investments.

The Cornerstones of European Equity Resilience

Economic Fortitude: At the heart of European Equities’ resilience lies the steadfast commitment of European economies to economic stability. These economies have erected robust frameworks to address financial crises and shocks, exemplifying proactive measures that reduce volatility and ensure a secure investment environment.

Diverse Investment Prospects: The European region offers a wide array of industries and sectors, providing investors with a rich tapestry of opportunities for diversification. This diversity inherently functions as a natural hedge against market fluctuations; when one sector falters, another may thrive, thus balancing the overall performance of Equities.

Stringent Regulatory Environment: Europe’s financial markets are governed by stringent regulations that advocate transparency and equity. Such regulatory rigor not only promotes investor confidence but also mitigates the likelihood of unscrupulous practices, further cementing the reputation of Equities as a dependable investment option.

Technological Ingenuity: European companies have harnessed innovation and embraced cutting-edge technologies in their operations. This technological prowess has not only enhanced their efficiency but has also positioned them to excel in an ever-evolving global marketplace.

The Role of European Equities in a Modern Investment Portfolio

Amid the ongoing quest for the ideal asset allocation, the place of European Equities within a global portfolio holds paramount significance. These equities play a pivotal role in achieving diversification, thereby offering a balancing act between risk management and growth prospects.

A well-rounded portfolio that incorporates European Equities can effectively mitigate the impact of market volatility. Their resilience serves as a counterweight to more volatile investments, providing a solid foundation for sustained growth over time.

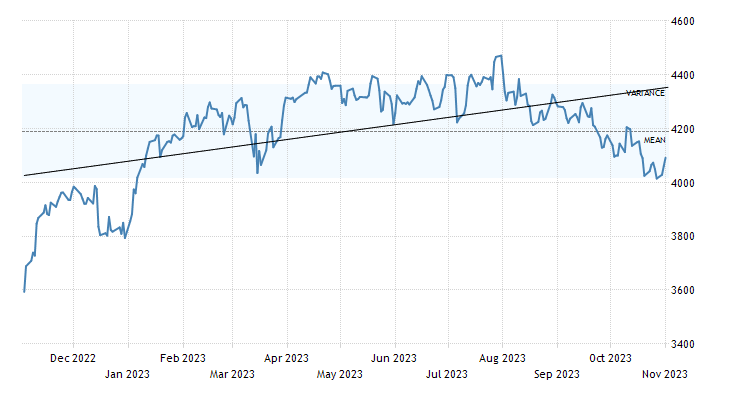

Analyzing Recent Performance

In evaluating the resilience of European Equities, it is essential to scrutinize their recent performance against the backdrop of contemporary global market uncertainties. Recent years have borne witness to a multitude of challenges, including geopolitical tensions, trade disputes, and the COVID-19 pandemic. However, European Equities have not only survived but often thrived in the face of these challenges.

Navigating the Pandemic Storm: The COVID-19 pandemic, which erupted in 2020, created worldwide market upheaval. Remarkably, European Equities exhibited formidable resilience in the face of this crisis. Swift government intervention, robust healthcare systems, and a commitment to social safety nets played pivotal roles in mitigating the economic fallout, allowing European Equities to rebound with remarkable alacrity.

Geopolitical Trials and Tribulations: Trade disputes between the United States and China, along with the United Kingdom’s departure from the European Union, introduced significant geopolitical instability. European Equities adeptly navigated these tumultuous waters through their diversified global market exposure and their ability to adapt to shifting trade dynamics.

Expert Advice for Investing in European Equities

Effectively harnessing the potential of European Equities necessitates a strategic approach. To optimize investments in this resolute asset class, consider the following expert counsel:

Embrace a Long-Term Outlook: European Equities are most aptly suited for investors with a long-term perspective. While they may exhibit short-term fluctuations, their enduring resilience shines through over extended periods. Remaining committed to your investment and resisting impulsive decisions based on transient market noise is advisable.

Diversify Within Europe: Diversification within the European region is a key strategy. Contemplate a balanced mix of large-cap, mid-cap, and small-cap stocks to efficiently spread risk.

Stay Informed and Adaptive: Global market uncertainties can emerge from multifarious sources. Staying informed about geopolitical developments, economic trends, and regulatory shifts is crucial for making informed investment decisions. Furthermore, adopting an adaptive approach to changing circumstances is invaluable.

Seek Professional Guidance: Consulting with a financial advisor well-versed in European Equities can provide a tailored strategy aligned with your specific financial objectives and risk tolerance. Their expertise can guide you through the intricacies of investing in European Equities.

Conclusion:

In a world rife with market uncertainties, European Equities continue to demonstrate their exceptional resilience. This enduring strength is underpinned by economic stability, diverse investment prospects, stringent regulations, and technological innovation. As a cornerstone of a diversified portfolio, Equities furnish a robust foundation for long-term growth and risk management.

For those seeking to harness the potential of Equities, adopting a long-term perspective, diversifying effectively within Europe, staying well-informed, and consulting with professional advisors are advisable strategies. By adhering to these principles, investors can confidently navigate the ever-evolving global financial landscape, secure in the knowledge that European Equities provide an unshakable pillar of their investment strategy.

One thought on “European Equities: A Beacon of Stability Amid Global Financial Uncertainties”