Dollar Index Declines: Probing the 11-Week Low

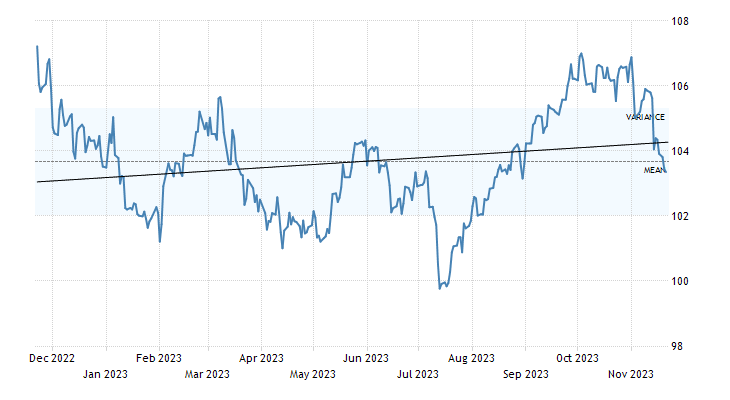

The dollar index, a crucial metric for assessing the dollar’s strength against major currencies, witnessed a notable weakening, sliding to approximately 103.6. This decline, observed on a Monday, marked its lowest position in 11 weeks. The catalyst behind this downward trajectory stemmed from recent data bolstering speculations that the Federal Reserve might have concluded its tightening cycle. Expectations are rife that the central bank will maintain interest rates at their current levels in December. Moreover, market sentiments project a 30% likelihood that the Fed might commence a rate decrease as early as March 2024. Investors keenly anticipate insights from the forthcoming FOMC minutes and a plethora of upcoming economic indicators in the United States for further directional cues.

Simultaneously, China’s central bank opted to retain its one and five-year loan prime rates at 3.45% and 4.2%, correspondingly, aligning with prevailing forecasts. Consequently, the dollar exhibited widespread depreciation, particularly evident in heightened selling activities vis-à-vis the antipodean currencies and the yuan. This trend signifies broader implications for global markets and trade dynamics.

Understanding the nuances of the dollar index movements becomes imperative for investors and stakeholders navigating the volatile financial landscape. With the index at its 11-week low, implications ripple across various sectors, influencing investment strategies, trade decisions, and policy outlooks. The Federal Reserve’s perceived conclusion of its tightening cycle amplifies the need for a comprehensive reevaluation of portfolios, considering potential shifts in interest rate dynamics. Market participants must diligently monitor forthcoming FOMC minutes and economic indicators, as these insights could provide pivotal guidance for future investment and trade positions. Moreover, the interplay between the dollar’s depreciation and China’s steadfast loan prime rates underscores the interconnectedness of global economies and the significance of policy decisions in shaping currency valuations.

Investment Strategies: Navigating Dollar Index Volatility

Advice on navigating these fluctuations encompasses a multifaceted approach. First and foremost, staying abreast of Federal Reserve communications and economic indicators stands pivotal. Secondly, diversification remains a fundamental principle in mitigating risks associated with currency fluctuations. Allocating investments across different currencies and asset classes can cushion against potential downsides stemming from a depreciating dollar. Additionally, a thorough understanding of geopolitical developments and their impact on currency markets aids in crafting resilient investment strategies. Collaborating with financial advisors or experts well-versed in currency markets can offer valuable insights and tailored approaches amid these volatile times.

Conclusion: Unveiling Complexities of Dollar Index Trends

In conclusion, the recent weakening of the dollar index unveils intricate market dynamics intertwined with Federal Reserve speculations and global economic policies. Its implications extend beyond mere currency valuations, influencing investment strategies, trade decisions, and policy outlooks. Staying vigilant, diversifying portfolios, and seeking expert guidance remain instrumental in navigating these fluctuations, thereby optimizing opportunities amidst evolving market conditions.