Introduction:

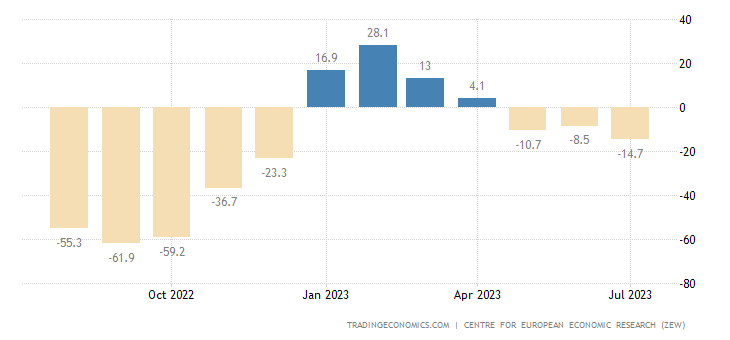

The atmosphere was somber in July 2023 as the ZEW Indicator of Economic Sentiment for Germany descended into a steep decline, plummeting from -8.5 to a jarring -14.7. This unforeseen blow not only shattered market expectations, initially set at -10.5 but also cast a shadow of despondency over investors, plunging their spirits to the lowest point since last December. Like ripples in a pond, murmurs of concern reverberated through the financial corridors, as investors pointed accusatory fingers at the looming specter of rising short-term interest rates in the Eurozone and the US. Moreover, lackluster performances in vital export markets, such as China, only added fuel to the fire of apprehension. As the dark clouds of an impending economic downturn gathered, it was the industrial sectors that stood precariously at the forefront, bracing themselves for the full impact. This article undertakes a comprehensive exploration of the implications of this decline, unraveling the potential consequences for export-oriented industries and illuminating the prevailing sentiment within Germany’s economic landscape. Dax stock signal

Factors Influencing the Economic Sentiment: Dax Stock Signal

The decline in the ZEW Indicator of Economic Sentiment can be attributed to several key factors. Firstly, the anticipation of rising short-term interest rates in both the Eurozone and the US has raised concerns among investors. As monetary policy tightens, it is expected to impact investment decisions and potentially slow down economic growth. Furthermore, the relative weakness in crucial export markets, such as China, has added to the apprehension surrounding Germany’s economic prospects. The interconnected nature of the global economy highlights the vulnerability of export-oriented industries to changes in international trade dynamics. These factors have collectively contributed to the dampened economic sentiment in Germany.

Implications for Export-Oriented Industries:

The decline in economic sentiment has significant implications, particularly for export-oriented industries in Germany. As the anticipation of an economic downturn looms, profit expectations for these sectors have experienced a substantial decline once again. The industrial sectors, heavily reliant on exports, are likely to face the brunt of the forthcoming economic challenges. Trade tensions and weakened demand in key markets can lead to reduced orders and lower profitability. In response, companies may be compelled to cut costs, potentially leading to layoffs or reduced investment. This can further exacerbate the economic slowdown and negatively impact consumer confidence. Export-oriented industries must proactively strategize to navigate these challenges, seeking diversification in markets and investing in innovation to maintain a competitive edge.

Assessing the Economic Situation:

The gauge measuring the assessment of the economic situation also experienced a decline, dropping to -59.5 in July from June’s reading of -56.5. This further confirms the prevailing pessimistic sentiment among market participants. A negative assessment of the economic situation indicates a lack of confidence in the current state of the economy, reflecting concerns about key indicators such as GDP growth, employment rates, and inflation. A decline in this gauge often precedes a slowdown or recessionary period. Policymakers and economic stakeholders must closely monitor this indicator to gauge the severity and duration of the economic challenges ahead. Timely intervention and effective policy measures can help alleviate the impact and mitigate the potential damage to the overall economy.

Conclusion: Dax stock signal

The decline in the ZEW Indicator of Economic Sentiment for Germany serves as a stark reminder of the mounting concerns gripping investors and market participants. The convergence of anticipated factors, such as the specter of rising short-term interest rates and lackluster export markets, has further fueled the prevailing air of pessimism. Amidst this uncertain climate, export-oriented industries, particularly the industrial sectors, find themselves standing at the precipice, bracing for significant challenges ahead and grappling with substantial declines in profit expectations.

Furthermore, the dwindling gauge measuring the assessment of the economic situation sends an unequivocal message—a lack of confidence in Germany’s present economic state. As this dimmer assessment permeates the minds of policymakers and economic stakeholders, it becomes imperative to closely monitor these indicators and take proactive measures to offset the potential negative consequences. The evolving global economic landscape demands that Germany embraces resilience, diversify its markets and nurtures a spirit of innovation to navigate the storm and emerge fortified in the post-downturn era. Dax stock signal

One thought on “Dax Stock Signal: Analyzing Germany’s Economic Sentiment and Its Implications”