Introduction:

In the realm of global finance, few commodities wield as much influence as WTI crude oil futures. However, recent developments have shaken the oil markets, compelling experts to analyze the implications for investors and traders. The market initially witnessed gains, but as the dollar surged and global commodity markets grappled with uncertainty, WTI crude oil futures plummeted below $80 per barrel. This article examines the factors behind this volatility, including the US Treasury’s unexpected debt issuance, which led to Fitch’s credit rating cut, prompting investors to flock to the greenback as risk appetite diminished. Moreover, concerns about commodity demand were intensified by China’s manufacturing sector experiencing further contractions following weak PMI data. Amidst this backdrop, even news of a significant drop in US crude oil inventories failed to stave off the downward pressure on prices, potentially amplifying the impact of Saudi Arabia’s potential production cut in the upcoming OPEC meeting. Crude oil signal

The Impact of US Debt Issuance:

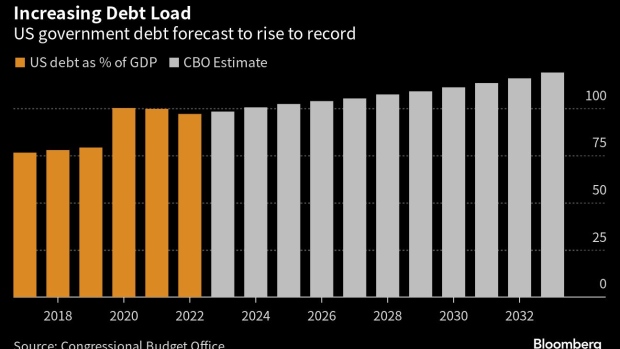

The US Treasury’s decision to exceed market expectations in debt issuance has sent ripples through the financial landscape. This move, while intended to address economic challenges, has underscored the nation’s growing dependency on running deficits. Fitch’s subsequent credit rating cut has triggered a flight to the greenback as investors seek refuge in a perceived safe haven. For traders in the oil market, the upswing of the dollar amid risk aversion has weighed heavily on WTI crude oil futures. As the greenback strengthens, oil becomes relatively more expensive for holders of other currencies, dampening demand and pressuring prices downwards.

China’s Manufacturing Sector Woes:

China’s manufacturing sector, being the world’s largest oil importer, plays a pivotal role in dictating global oil demand. However, persistent contractions in the sector, coupled with weak PMI data, have cast a shadow of uncertainty over the future of commodity demand. As China grapples with economic headwinds, investors and traders must monitor closely the country’s industrial activity, as it may further impact WTI crude oil futures. The interconnectedness of the global economy means that any developments in China’s manufacturing sector reverberate across international markets. In such times of uncertainty, traders may opt to closely follow “crude oil signal” indicators to navigate their investment decisions with greater precision and insight.

US Crude Oil Inventories and Saudi Arabia’s Potential Production Cut:

Amidst the complex web of market forces, fresh data revealing a significant 17.05 million barrel drop in US crude oil inventories would typically buoy market sentiment. Yet, the impact of this record reduction was overshadowed by the prevailing macroeconomic concerns. Traders and investors seeking signals in the turbulence must recognize that the supply dynamics are evolving. Speculations surrounding Saudi Arabia’s potential announcement of another production cut during the forthcoming OPEC meeting add further uncertainty to the mix. In this scenario, following credible “crude oil signal” sources can empower traders to make informed decisions, mitigating the risks inherent in such volatile market conditions.

Strategies to Navigate the Oil Market:

Given the heightened market volatility, traders and investors need to adopt a proactive approach to protect their portfolios and capitalize on opportunities. Monitoring “crude oil signal” indicators is critical, as it enables market participants to discern trends and make timely decisions. Additionally, diversification becomes paramount, spreading risks across different asset classes, such as equities and bonds, to hedge against oil market fluctuations. Implementing risk management strategies, like stop-loss orders, can also help protect investments in turbulent times. Furthermore, staying informed about geopolitical developments, technological advancements, and shifts in renewable energy trends will provide an edge in making informed decisions that align with the changing dynamics of the oil market.

Conclusion:

Navigating the turbulent waters of the global oil market demands keen insight, foresight, and a comprehensive understanding of the interconnected forces at play. The recent slump in WTI crude oil futures below $80 per barrel reflects a confluence of factors, from the US debt issuance to China’s manufacturing woes and impending OPEC meeting. As investors and traders seek to safeguard their interests and maximize returns, adopting a proactive and informed approach becomes imperative. Following credible “crude oil signal” indicators, diversifying portfolios, implementing risk management, and staying abreast of market dynamics are all critical components of a robust strategy. In a world where uncertainty looms large, strategic decision-making founded on reliable data and expert analysis will be the compass guiding successful ventures in the realm of crude oil trading.

Source: tradingeconomics.com

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.